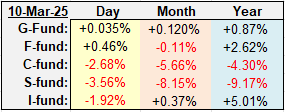

Stocks gapped down to start the new week, and it didn't get much better from there. We saw some crooked number percentage losses, something we don't see very often. The S&P 500 lost 156-points, or 2.7%. If we're looking for a positive, that was 50-points off the lows, but still, a 2.7% loss is a hard hit for an index to take. Small caps did even worse and at this point the market needs a Turnaround Tuesday. The Nasdaq is now down 10% and into correction territory. Yields were down helping the F-fund to a gain.

Pain levels are obviously on the rise, and for those who have been a round a while and have experienced this several times over the years, we know that things do eventually get better, and while extreme fear tends to be a good indication of the worst being over, that may not ease the pain.

Warren Buffett said, “Be fearful when others are greedy, and greedy when others are fearful”, and Nathan Rothschild is credited with saying, "The time to buy is when there's blood in the streets."

Again, does that ease your pain? probably not if you're in stocks, but if you have cash it may be tempting to start buying something.

The bulls are looking for a Turnaround Tuesday. You rarely get reversals on a Monday, and one of the reasons is because mom and pop investors get their weekend news and see that the stock market is plummeting, and so they are signing into their accounts and dumping stocks to ease the pain. Meanwhile institutional investors will be looking for the opportunity to buy their fear.

It doesn't mean we have seen a low in this new downgrading market, but short-term relief is likely on the way. Of course I thought this last week as well, but the market always seems to go further in one direction longer than we think is possible, reasonable, or as someone once said, "The market can remain irrational longer than you can remain solvent."

I saw this post on X.com from @LizThomasStrat: "The drawdown we're seeing in stocks has been purely sentiment based so far. The forward 12 month P/E has compressed from 22.5x to 20.5x (a 9% contraction), while forward 12 month EPS estimates have actually ticked *higher*.

So, valuations have improved.

A sign of a weak market isn't necessarily one that is going down. Markets always go up and down, but rather one that fails to bounce when it should, like when it is oversold or at key support levels, that's when it's dangerous, but even then, relief rallies can suck us in because they can be very strong, and we have to make the call if a relief rally is marking a low, or a selling opportunity.

So how do you know which is which? It will be the opposite of what you do. That's a joke, but unfortunately there's some truth to it that has to do with contrarian sentiment.

That's a joke, but unfortunately there's some truth to it that has to do with contrarian sentiment.

We've been through a lot in the last few years and the market may have needed this as a reset as it retests levels we saw last summer.

I don't want to do too much analysis because this really is a case of when, not if, the market rebounds, and then again, how long any relief rally can last. It's emotion running things for a little while, because no one knows exactly what all these tariffs, DOGE cuts, and possible government shutdown means for the economy. Even the Federal Reserve can't tell us for sure if this is going to cause a recession or not. It's a guessing game at this point, and we don't usually know until after the fact.

The S&P 500 (C-fund) fell through several layers of support yesterday, and that almost always brings out a little panic, along with algorithm selling kicking in, but it's likely a sign of an extreme. The concern for any rally is whether it can get back above the broken support as it tends to try to act as resistance once broken. Trading volume has been elevated but not to panic levels yet. (The volume spike in December was a quarterly expiration day so we see those once a quarter, so it's not a good comparison.)

The longer-term chart shows the nose-dive testing the old resistance area from the inverted head and shoulders pattern breakout level from back in September near 5600, which the S&P was able to close above yesterday. There's more support all the way down below 5500, although it is rising, but that could be the next target if 5600 fails to hold.

And here's a 12 year chart showing that the 200-week moving average, which is typically a place to be buying with both fists, but that's a long way down and not something we need to talk about yet, and hopefully we won't have to talk about it at all again this year.

The CNN Fear & Greed Index hit 15 yesterday, and I'm actually surprised it was even lower considering it tested this level last week as well.

Source: https://www.cnn.com/markets/fear-and-greed

I've been very wrong this month, and so far March hasn't been the bullish rebound month that I had expected based on seasonality, but the latter half of the month is typically stronger than the first half. There also an interesting pattern going on in the S&P 500 as we have seen alternating positive and negative months in the index since September. September was up, October was down, November was up, December was down, January was up, February was down, March ?

I'm looking (or hoping?) for a lower low today and an ugly morning that reverses upward by the close.

Admin note: The TSP offices do not see to observe daylight savings so, depending on which state you live in, the tsp.gov share prices may be getting updated an hour later then they have been this winter -- from about 8 PM ET to 9 PM ET. That means our site and AutoTracker will not update until after 9PM ET.

DWCPF (S-fund) has fallen into no-man's land as it is now down over 9% for the year. The prior lows may be the next test, and I would think there would be some orders to buy at 2000 if it gets that low.

ACWX (the I-fund tracking index) took a hit and it is now below some rising support so that's a warning sign, but it retested the 55 area and closed above it again.

BND (F-fund) was up as yields slipped and bonds seems to be the safety trade, as is often the case. It closed well off the highs however, so we may have to be on the look out for a possible reversal.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We may use additional methods and strategies to determine fund positions.

| Daily TSP Funds Return More returns |

Pain levels are obviously on the rise, and for those who have been a round a while and have experienced this several times over the years, we know that things do eventually get better, and while extreme fear tends to be a good indication of the worst being over, that may not ease the pain.

Warren Buffett said, “Be fearful when others are greedy, and greedy when others are fearful”, and Nathan Rothschild is credited with saying, "The time to buy is when there's blood in the streets."

Again, does that ease your pain? probably not if you're in stocks, but if you have cash it may be tempting to start buying something.

The bulls are looking for a Turnaround Tuesday. You rarely get reversals on a Monday, and one of the reasons is because mom and pop investors get their weekend news and see that the stock market is plummeting, and so they are signing into their accounts and dumping stocks to ease the pain. Meanwhile institutional investors will be looking for the opportunity to buy their fear.

It doesn't mean we have seen a low in this new downgrading market, but short-term relief is likely on the way. Of course I thought this last week as well, but the market always seems to go further in one direction longer than we think is possible, reasonable, or as someone once said, "The market can remain irrational longer than you can remain solvent."

I saw this post on X.com from @LizThomasStrat: "The drawdown we're seeing in stocks has been purely sentiment based so far. The forward 12 month P/E has compressed from 22.5x to 20.5x (a 9% contraction), while forward 12 month EPS estimates have actually ticked *higher*.

So, valuations have improved.

A sign of a weak market isn't necessarily one that is going down. Markets always go up and down, but rather one that fails to bounce when it should, like when it is oversold or at key support levels, that's when it's dangerous, but even then, relief rallies can suck us in because they can be very strong, and we have to make the call if a relief rally is marking a low, or a selling opportunity.

So how do you know which is which? It will be the opposite of what you do.

We've been through a lot in the last few years and the market may have needed this as a reset as it retests levels we saw last summer.

I don't want to do too much analysis because this really is a case of when, not if, the market rebounds, and then again, how long any relief rally can last. It's emotion running things for a little while, because no one knows exactly what all these tariffs, DOGE cuts, and possible government shutdown means for the economy. Even the Federal Reserve can't tell us for sure if this is going to cause a recession or not. It's a guessing game at this point, and we don't usually know until after the fact.

The S&P 500 (C-fund) fell through several layers of support yesterday, and that almost always brings out a little panic, along with algorithm selling kicking in, but it's likely a sign of an extreme. The concern for any rally is whether it can get back above the broken support as it tends to try to act as resistance once broken. Trading volume has been elevated but not to panic levels yet. (The volume spike in December was a quarterly expiration day so we see those once a quarter, so it's not a good comparison.)

The longer-term chart shows the nose-dive testing the old resistance area from the inverted head and shoulders pattern breakout level from back in September near 5600, which the S&P was able to close above yesterday. There's more support all the way down below 5500, although it is rising, but that could be the next target if 5600 fails to hold.

And here's a 12 year chart showing that the 200-week moving average, which is typically a place to be buying with both fists, but that's a long way down and not something we need to talk about yet, and hopefully we won't have to talk about it at all again this year.

The CNN Fear & Greed Index hit 15 yesterday, and I'm actually surprised it was even lower considering it tested this level last week as well.

Source: https://www.cnn.com/markets/fear-and-greed

I've been very wrong this month, and so far March hasn't been the bullish rebound month that I had expected based on seasonality, but the latter half of the month is typically stronger than the first half. There also an interesting pattern going on in the S&P 500 as we have seen alternating positive and negative months in the index since September. September was up, October was down, November was up, December was down, January was up, February was down, March ?

I'm looking (or hoping?) for a lower low today and an ugly morning that reverses upward by the close.

Admin note: The TSP offices do not see to observe daylight savings so, depending on which state you live in, the tsp.gov share prices may be getting updated an hour later then they have been this winter -- from about 8 PM ET to 9 PM ET. That means our site and AutoTracker will not update until after 9PM ET.

DWCPF (S-fund) has fallen into no-man's land as it is now down over 9% for the year. The prior lows may be the next test, and I would think there would be some orders to buy at 2000 if it gets that low.

ACWX (the I-fund tracking index) took a hit and it is now below some rising support so that's a warning sign, but it retested the 55 area and closed above it again.

BND (F-fund) was up as yields slipped and bonds seems to be the safety trade, as is often the case. It closed well off the highs however, so we may have to be on the look out for a possible reversal.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We may use additional methods and strategies to determine fund positions.

Last edited: