JTH

TSP Legend

- Reaction score

- 1,158

Good morning (Post 1 of 2, January)

I apologize there's a lot to digest here, so I'll try to keep it brief.

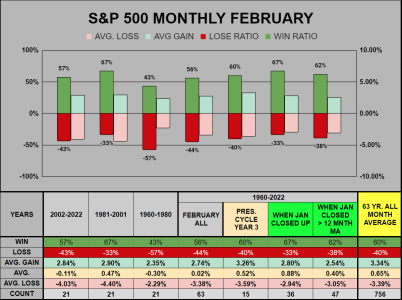

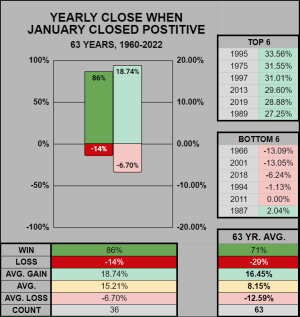

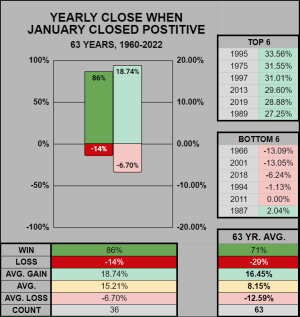

Going back to 1960, this January ranked as the 10th best of 64. When January closed positive, the previous year closed positive 31 of 36 times or 86% which is 15% more than the 63 year average 71% win ratio.

___

With a 6.18% gain, this January also closed above it's 4.50% average positive gain (only positive closes counted.)

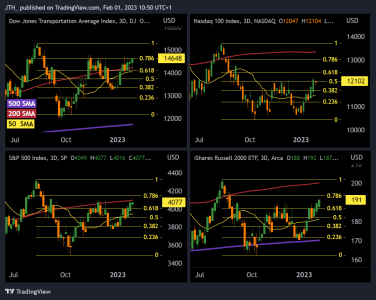

Lastly, the January Trifecta (as outlined in the video) has closed positive across all 3 indicators. I would encourage you to watch the video for the specifics, but for the time-constrained (historically speaking), it's bullish.

I apologize there's a lot to digest here, so I'll try to keep it brief.

Going back to 1960, this January ranked as the 10th best of 64. When January closed positive, the previous year closed positive 31 of 36 times or 86% which is 15% more than the 63 year average 71% win ratio.

___

With a 6.18% gain, this January also closed above it's 4.50% average positive gain (only positive closes counted.)

Discussion begins at 10:40, with the Editor of the Stock Trader's Almanac regarding the January "Trifecta" and the Presidential cycle.

Lastly, the January Trifecta (as outlined in the video) has closed positive across all 3 indicators. I would encourage you to watch the video for the specifics, but for the time-constrained (historically speaking), it's bullish.