JTH

TSP Legend

- Reaction score

- 1,154

Good morning

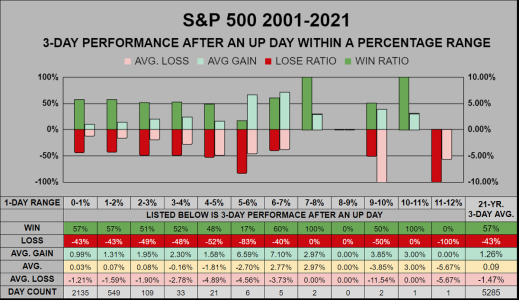

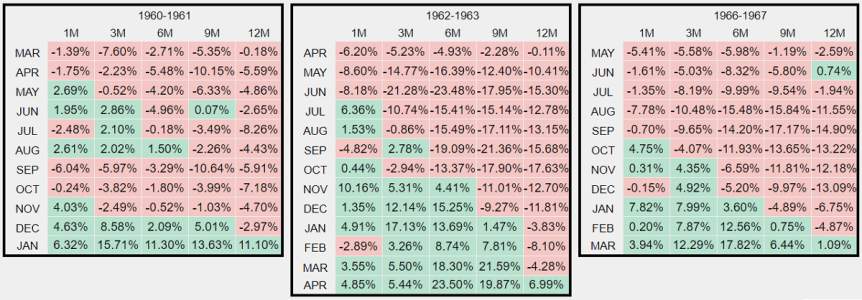

After a strong up day, do we get to hold onto those gains or should we exit?

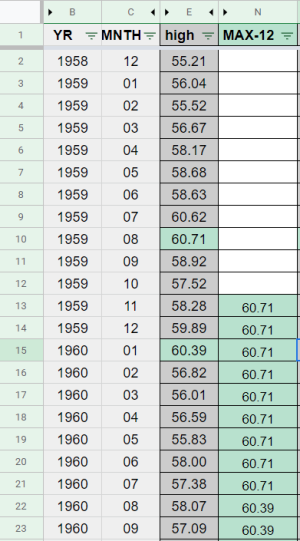

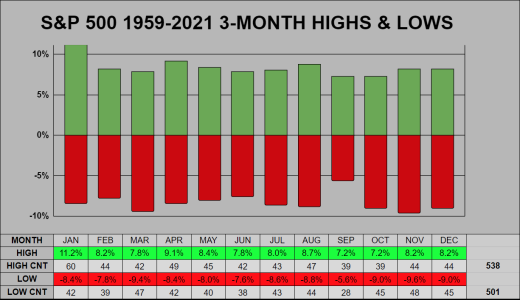

Here's a part 2 for "How often the index closed up within a percentage range." This time we've measured the 3-day cumulative performance after those single up days.

Listed in the bottom right corner are the 21-year 3-Day averages, where we have a 57% win ratio (the benchmark for this chart). For the 0-1% & 1-2% column, we can see we are inline with the 3-day benchmark. However, from 2-6% the win ratio dips significantly, (but there is also significantly less days counted). My guess would be the smaller up days keep sellers at bay, while the larger up days, make them take some gains off the table.