JTH

TSP Legend

- Reaction score

- 1,158

Thank you kind sir.

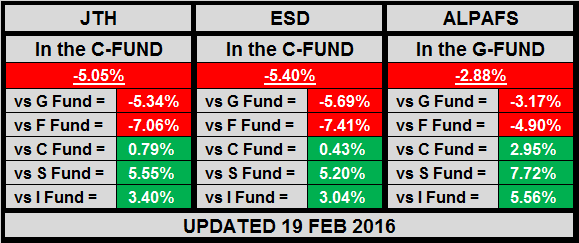

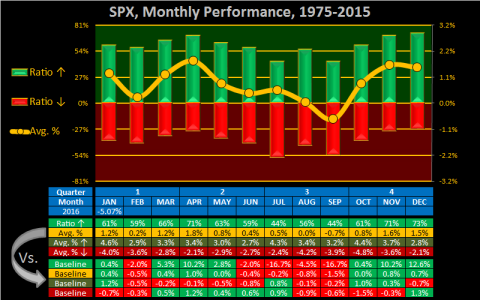

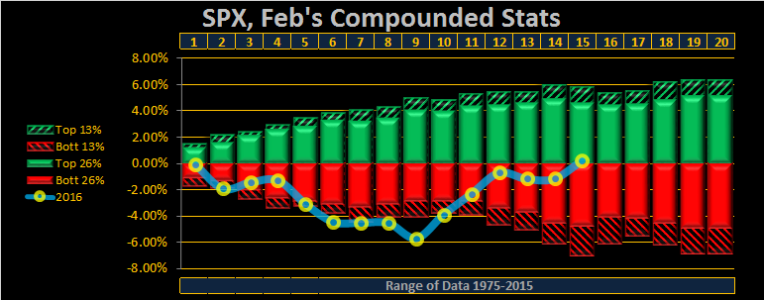

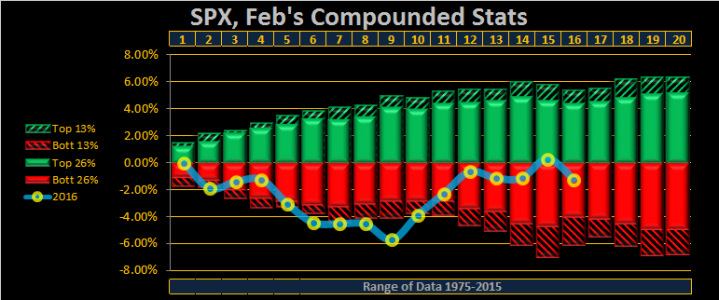

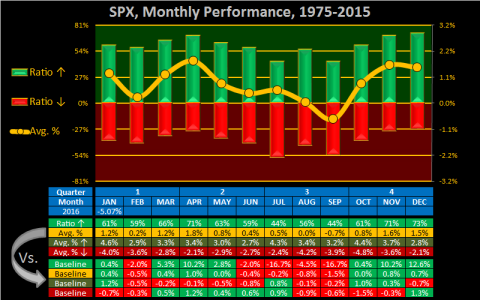

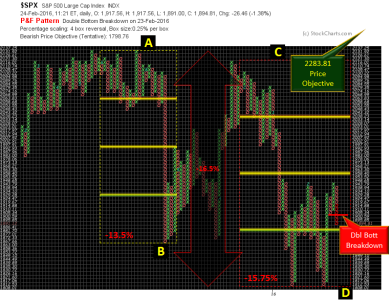

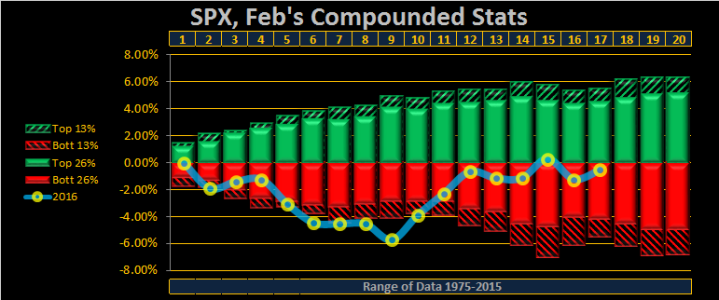

If we close in the green today, then I've met about 2/3rds of the price objective, meaning the plan executed precisely as I had hoped. IMHO, looking at my statistical data and the current charts, when we close out the month, I do not believe we will close above the Feb highs. Thus, with the risk to reward ratio (as I see it), I felt it was in my best interest to take the exit. We'll see how that decision looks at the end of the month.

I am still in SPX and pleased to hear your analysis!

Hope you are not full of it! :cheesy:

I had it pegged at Tuesday, but I can do Monday...Thanks!!!

I still don't believe we will close above the Feb highs, but hey it doesn't matter what I think, only how I react.

An encouraging sign, is the tweezers bottom on the hourly chart, I find this to be a good buy signal on this timeframe. For today, I'd guesstimate we'll close flat to down, because I'd find it hard to believe investors would want to stay in over the weekend. But all we have to do today is survive, and let the news prop up the markets for us over the weekend.