JTH

TSP Legend

- Reaction score

- 1,158

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

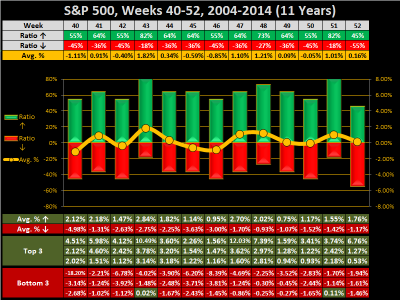

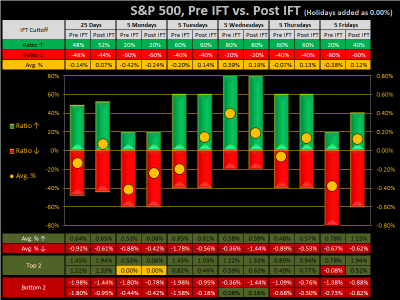

Covering the Pre-IFT vs. Post IFT deadline, for the last 25 cumulative days and last 5 Monday-Fridays each

Last 25 days show an unbiased winning/losing ratio, with weaker Pre-IFT gains (Hold)

Last 5 Mondays have very a weak 20% winning ratio and very weak gains (Best day to buy)

Last 5 Tuesdays have a decent 60% winning ratio with strong Post-IFT gains (Hold)

Last 5 Wednesdays have a very good 80% winning ratio with strong gains (Best day to sell)

Last 5 Thursdays have a decent 60% winning ratio with stronger Post-IFT average gains (Sell)

Last 5 Fridays have a very weak (combined) 30% winning ratio, with stronger Post-IFT gains (Buy)

Note: Buy on Monday, Sell on Wednesday

View attachment 35445

I feel like today or tomorrow is my day to get back onto the sidelines, but your Wednesday percentage may have me stay a while longer.Covering the Pre-IFT vs. Post IFT deadline, for the last 25 cumulative days and last 5 Monday-Fridays each

Last 25 days show an unbiased winning/losing ratio, with weaker Pre-IFT gains (Hold)

Last 5 Mondays have very a weak 20% winning ratio and very weak gains (Best day to buy)

Last 5 Tuesdays have a decent 60% winning ratio with strong Post-IFT gains (Hold)

Last 5 Wednesdays have a very good 80% winning ratio with strong gains (Best day to sell)

Last 5 Thursdays have a decent 60% winning ratio with stronger Post-IFT average gains (Sell)

Last 5 Fridays have a very weak (combined) 30% winning ratio, with stronger Post-IFT gains (Buy)

Note: Buy on Monday, Sell on Wednesday

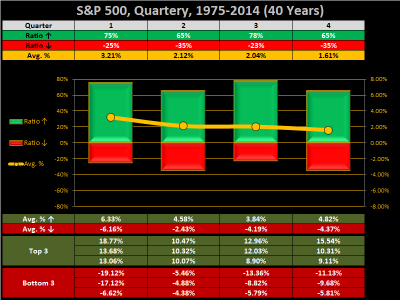

Thanks JTH. I would never have guessed that. I always thought the 4th Quarter was the best or second best performer. I guess thats why my performance needs improvement, I'm out when I should be in and in when I should be out..:laugh::laugh::laugh:FS

Thanks JTH - You've been a "Buy and Hold" for a while and I admire that strategy.

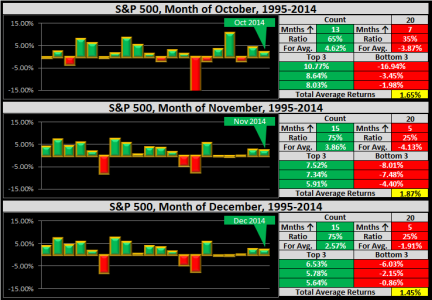

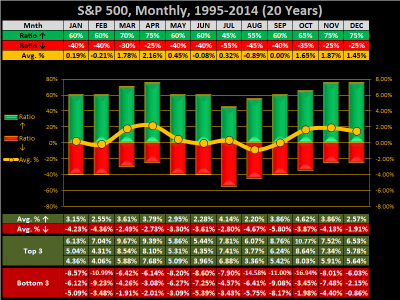

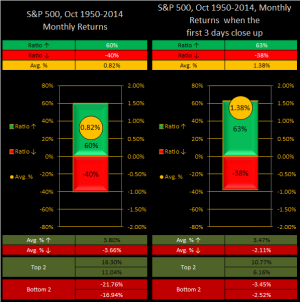

Serious question, do your charts indicate that this a good time of year for the buy and hold investor? I am a poor market timer, but if one were to stick with it, the last three months are in one's favor statistically, is that correct? One chart shows it's the worst performing quarter, but the monthly breakdown seems pretty good if you hang in there and don't panic.

Thanks JTH - You've been a "Buy and Hold" for a while and I admire that strategy.

Serious question, do your charts indicate that this a good time of year for the buy and hold investor? I am a poor market timer, but if one were to stick with it, the last three months are in one's favor statistically, is that correct? One chart shows it's the worst performing quarter, but the monthly breakdown seems pretty good if you hang in there and don't panic.

Over the past 65 Octobers, we have a 60% winning ratio with 1.11% average returns

Over those 65 Octobers, 16 closed positive on trading days 1, 2, & 3 with a 63% winning ratio with 1.38% average returns

Have you done any analysis of returns based on presidential election cycle? A 4 year cycle. Say this October vs October 2011, 2007, 2003 etc