In late 2024 some of my statistical studies concluded 2026 was going to be a tough year. Problem is I can't remember why, but I'm sure some of it had to do with the 2nd Year of the Presidential Cycle.

But for 2026 we have 2 basic choices, either you think the economy is tanking or the the loose regulations will unleash the Kraken.

Then some folks might guesstimate, since we've had 3-Solid years of gains, it's time to take profits.

I wonder what they thought back in the mid 90s.

- 1995 gained 33.56%

- 1996 gained 20.26%

- 1997 gained 31.01%

- 1998 gained 26.67%

- 1999 gained 19.53%

The 1962-2024 Historical Average Chart is impressive.

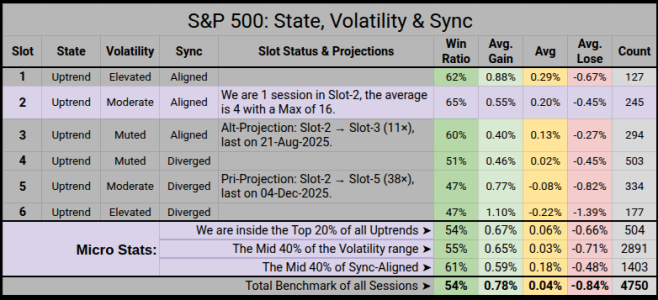

On the SVS Chart, Sync has realigned, and as was expected, the 5-Sessions in Slot-5 shifted back up to Slot-2.

On the Micro Stats, we can see the Sync-Alignment is in the Mid-40% (the mushy middle) so while we are in Slot-2, it's on the lower end of the range, meaning the weakest, but also still has a good bullish statistics.

This is our 4th sequential Slot-5 to Slot-2 transition over the past 44 sessions, and with the Uptrend in the Top-20%, I expect we'll fluctuate here until Volatility gains or loses traction.