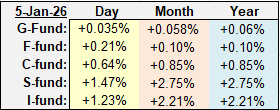

Despite the weekend turmoil, stocks rallied for a second straight day to start the new year, and the Dow was able to close at a new record high. Along with the Dow, small caps small caps and the ACWX (I-fund index we use to track the I-fund) were also up over 1%. Bonds were up with yields falling, and the dollar did a pop and drop, closing down moderately.

Since the close on December 23, the loss in the S&P 500 was only 0.11% for the S&P 500, but that is the 3rd consecutive loss for the official Santa Claus rally period of the final five days, and first two trading days of the year. It seems like the more people expecting the market to go one way, the less likely it happens. Next year everyone, including myself, will be talking about the 3-year losing streak for the Santa Claus rally, and we'll probably get a nice gain. We'll see. The loss was so modest that it may not be a factor, but I read that since the 1950's, when the Santa Claus rally was negative, the next three trading days were positive only 35% of the time, and a week later just 41% of the time.

I don't want to get too caught up in those seasonal tendencies since they haven't been very helpful going back to the late summer, but rather than focusing on getting a rally in the final two days of the Santa Claus rally, the trend in more recent years has been choppy action in the first week of January, meaning the two-day rally could do some giving back, if that tendency is going to continue. But again, it seems once we discover a pattern, that pattern is often near, or at the end of, its lifespan. So once again, we'll see.

That will be my theme this year in trying to predict market - we'll see. Helpful, huh? But in reality I have a sense that it could be a volatile year, which means taking it month by month, week by week, or day by day. And with President Trump in the White House, we know the next move could change everything. We saw it last April with the tariff Liberation Day, which turned out to be the best buying opportunity of the year. Bold moves in Washington beget bold moves in the stock market - good or bad. Wall Street is not generally a fan of changes, which is why stocks tend to do better in months when congress is not in session.

Now let's talk about what just happened. We had the major geopolitical event over the weekend, which likely put investors on alert that the stock market could fall on the shake up in the global oil markets, and while oil did eventually move up almost 2%, the stock market barely blinked, and the bullish start to January resumed.

The action was good yesterday, but not great, as the peak of the day came near noon ET, and from there sellers took over and the S&P 500 trended lower for the next four hours and into the close, as this intraday chart shows.

The daily S&P 500 (C-fund) chart shows where it found resistance, and it was right at the October peak. This chart is near the all time highs so it is undeniably bullish, but if resistance remains sticky and some support starts to give way, the story could change - but it hasn't yet. The bullish inverted head and shoulders pattern is still intact and that is still one of the more bullish patterns out there, so the bulls have the edge, but some investor and traders don't like to buy near the highs, and that could make things sticky for a minute.

According to @Bluekurtic on X, "When S&P 500 gains 15%+ in prior year, January returns tend to be muted. Since 1950, average Jan performance following strong years has been near flat with 48% positivity."

DWCPF (S-fund) rallied strongly, but like the S&P 500, it stalled near the October highs again, and the December peak is still considered a failed breakout. I don't see any reason to be fully bearish because of that big, beautiful inverted head and shoulders pattern, but small caps have lagged for so long that it wouldn't be unusual to see hesitation to buy up here.

The Dow Transportation Index, historically known as the market leader, made a new high yesterday. Not an all-time high, but an all-time closing high after that freakish pop and drop in 2021. Technically, it could still be considered a flat top and a failed breakout, so a little more upside on a closing basis would be better. With the Dow making a new closing high today as well, this is a Dow Theory confirmation.

The Yield on the 10-Year Treasury was down after backing off from the 200-day EMA again, but that resistance looks like the top of a large bull flag, which tend to break to the upside. However, the bullish flag in November did not break to the upside, so this could be a coin flip.

The dollar was up big early but it flipped over to close down on the day. The 50-day EMA did hold again so while the negative reversal may be bearish short-term, support is still intact.

We will get the December jobs report on Friday.

Mondays are normally lighter traffic days for these market commentaries, perhaps because of AWS schedules, so I will post these links again today to the AutoTracker and other contest winners another day.

2025 AutoTracker Winners | December AutoTracker Winners |

MRJ won with an impressive 41% gain in 2025! Several others had returns in the +30%'s. You can follow their moves in the daily Last Look Report.

To remain active and eligible for prizes, you will need to log into the AutoTracker at least once every two months, or every 60 days, whether you make an allocation change or not. We have a lot of idle accounts that appear abandoned and we are trying to keep the list more clean.

The 2025 Guess the Dow Contest Winner was Fltiger! Congrats! They came within 313 points of the Dow's closing price of 48,063.

We're starting the 2026 version of Guess the Dow contest for interested forum members. It's free, and a $100 Amazon eGift Card goes to the winner, so why not?

The ACWX (I-fund index) continued to move higher, leaving another open gap in its wake. I suspect some backing and filling, and even a test of the breakout line at some point -- probably this month, although betting against this fund has been a sucker bet for the last year.

BND (bonds / F-fund) was up after a 3-day pullback, and I'm watching that 10-year yield for signs of which way it wants to break. It appears to be coiling for another move up, which would be bearish on this chart, and this head and shoulders pattern is considered bearish.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

| Daily TSP Funds Return More returns |

Since the close on December 23, the loss in the S&P 500 was only 0.11% for the S&P 500, but that is the 3rd consecutive loss for the official Santa Claus rally period of the final five days, and first two trading days of the year. It seems like the more people expecting the market to go one way, the less likely it happens. Next year everyone, including myself, will be talking about the 3-year losing streak for the Santa Claus rally, and we'll probably get a nice gain. We'll see. The loss was so modest that it may not be a factor, but I read that since the 1950's, when the Santa Claus rally was negative, the next three trading days were positive only 35% of the time, and a week later just 41% of the time.

I don't want to get too caught up in those seasonal tendencies since they haven't been very helpful going back to the late summer, but rather than focusing on getting a rally in the final two days of the Santa Claus rally, the trend in more recent years has been choppy action in the first week of January, meaning the two-day rally could do some giving back, if that tendency is going to continue. But again, it seems once we discover a pattern, that pattern is often near, or at the end of, its lifespan. So once again, we'll see.

That will be my theme this year in trying to predict market - we'll see. Helpful, huh? But in reality I have a sense that it could be a volatile year, which means taking it month by month, week by week, or day by day. And with President Trump in the White House, we know the next move could change everything. We saw it last April with the tariff Liberation Day, which turned out to be the best buying opportunity of the year. Bold moves in Washington beget bold moves in the stock market - good or bad. Wall Street is not generally a fan of changes, which is why stocks tend to do better in months when congress is not in session.

Now let's talk about what just happened. We had the major geopolitical event over the weekend, which likely put investors on alert that the stock market could fall on the shake up in the global oil markets, and while oil did eventually move up almost 2%, the stock market barely blinked, and the bullish start to January resumed.

The action was good yesterday, but not great, as the peak of the day came near noon ET, and from there sellers took over and the S&P 500 trended lower for the next four hours and into the close, as this intraday chart shows.

The daily S&P 500 (C-fund) chart shows where it found resistance, and it was right at the October peak. This chart is near the all time highs so it is undeniably bullish, but if resistance remains sticky and some support starts to give way, the story could change - but it hasn't yet. The bullish inverted head and shoulders pattern is still intact and that is still one of the more bullish patterns out there, so the bulls have the edge, but some investor and traders don't like to buy near the highs, and that could make things sticky for a minute.

According to @Bluekurtic on X, "When S&P 500 gains 15%+ in prior year, January returns tend to be muted. Since 1950, average Jan performance following strong years has been near flat with 48% positivity."

DWCPF (S-fund) rallied strongly, but like the S&P 500, it stalled near the October highs again, and the December peak is still considered a failed breakout. I don't see any reason to be fully bearish because of that big, beautiful inverted head and shoulders pattern, but small caps have lagged for so long that it wouldn't be unusual to see hesitation to buy up here.

The Dow Transportation Index, historically known as the market leader, made a new high yesterday. Not an all-time high, but an all-time closing high after that freakish pop and drop in 2021. Technically, it could still be considered a flat top and a failed breakout, so a little more upside on a closing basis would be better. With the Dow making a new closing high today as well, this is a Dow Theory confirmation.

The Yield on the 10-Year Treasury was down after backing off from the 200-day EMA again, but that resistance looks like the top of a large bull flag, which tend to break to the upside. However, the bullish flag in November did not break to the upside, so this could be a coin flip.

The dollar was up big early but it flipped over to close down on the day. The 50-day EMA did hold again so while the negative reversal may be bearish short-term, support is still intact.

We will get the December jobs report on Friday.

Mondays are normally lighter traffic days for these market commentaries, perhaps because of AWS schedules, so I will post these links again today to the AutoTracker and other contest winners another day.

2025 AutoTracker Winners | December AutoTracker Winners |

MRJ won with an impressive 41% gain in 2025! Several others had returns in the +30%'s. You can follow their moves in the daily Last Look Report.

To remain active and eligible for prizes, you will need to log into the AutoTracker at least once every two months, or every 60 days, whether you make an allocation change or not. We have a lot of idle accounts that appear abandoned and we are trying to keep the list more clean.

The 2025 Guess the Dow Contest Winner was Fltiger! Congrats! They came within 313 points of the Dow's closing price of 48,063.

We're starting the 2026 version of Guess the Dow contest for interested forum members. It's free, and a $100 Amazon eGift Card goes to the winner, so why not?

The ACWX (I-fund index) continued to move higher, leaving another open gap in its wake. I suspect some backing and filling, and even a test of the breakout line at some point -- probably this month, although betting against this fund has been a sucker bet for the last year.

BND (bonds / F-fund) was up after a 3-day pullback, and I'm watching that 10-year yield for signs of which way it wants to break. It appears to be coiling for another move up, which would be bearish on this chart, and this head and shoulders pattern is considered bearish.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.