James48843

TSP Talk Royalty

- Reaction score

- 974

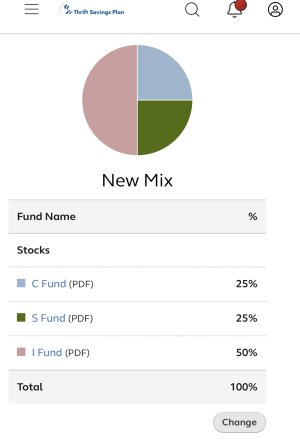

A new year, and new data- so it’s time to reassess where I am. I liked what I read about the “new” I fund being very different from the old I fund- enough that I decided I’m going to park more over in the new I.

Moving to:

C= 30%

S= 40%

I = 30%

Effective close of business tomorrow. I’m thinking , after reading more about the real reason we just took Venezuela out- I’m thinking that the world is where I am going to want to be. Hedge my bets against a U.S. crash by boosting the growing economies. Good luck.

(Seeing some wild stories about the dollar, and Muduro’s deal to sell to the Chinese in Yuan instead of dollars makes me think the dollar has much, much further to fall).

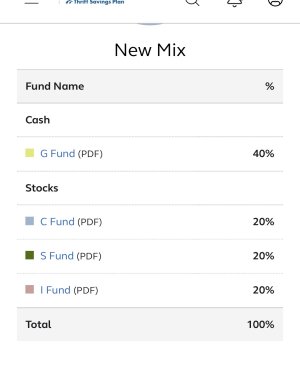

Moving to:

C= 30%

S= 40%

I = 30%

Effective close of business tomorrow. I’m thinking , after reading more about the real reason we just took Venezuela out- I’m thinking that the world is where I am going to want to be. Hedge my bets against a U.S. crash by boosting the growing economies. Good luck.

(Seeing some wild stories about the dollar, and Muduro’s deal to sell to the Chinese in Yuan instead of dollars makes me think the dollar has much, much further to fall).

Last edited: