It would seem the train has built quite a head of steam since leaving the station the first week of September. And at its current speed it would seem foolhardy to step in front of it.

Good earnings reports along with a slide in the dollar kept the momentum going to the upside today as we gapped at the open, maintaining strong gains most of the day until a bit of selling took the averages down moderately below their highs going into the close. But make no mistake, the market made another statement today and that being the intermediate term is up until it's not.

Of particular note today was that advancing issues outnumbered decliners by 4-to-1 in the S&P 500. Volume was also strong.

The Seven Sentinels look decidedly bullish after today. Let's take a look at the charts:

NAMO and NYMO both moved higher today and remain on buys.

NAHL and NYHL both show how strong the underlying internals of the market are as they spiked higher today to levels not seen since early May.

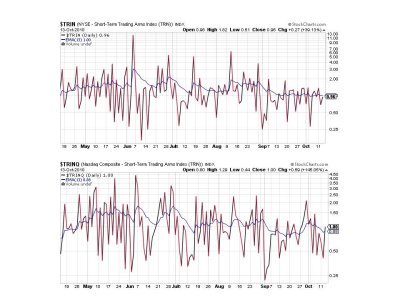

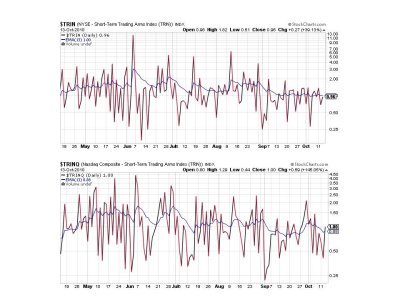

TRIN remained on a buy, while TRINQ actually flipped to a sell, which I found to be a bit odd. Oddity aside we are not overbought by these measures.

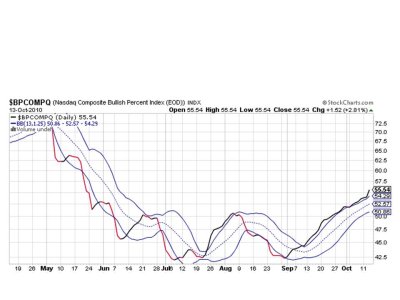

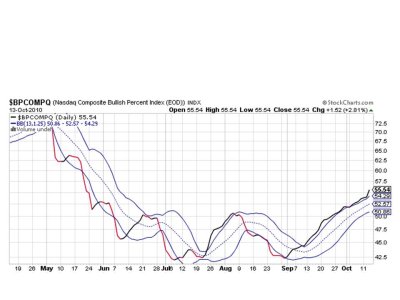

BPCOMPQ made a decided upturn today and remains on a buy.

So we have 6 of 7 signals flashing buys, which keeps the system on a buy. These charts look darn bullish right now and give me the impression of more upside to come. I took 12% off the table today, but I don't intend on getting too aggressive moving to cash just yet. Bullishness is moving higher, but the momentum of this market should offset that sentiment for a little while longer yet.

Good earnings reports along with a slide in the dollar kept the momentum going to the upside today as we gapped at the open, maintaining strong gains most of the day until a bit of selling took the averages down moderately below their highs going into the close. But make no mistake, the market made another statement today and that being the intermediate term is up until it's not.

Of particular note today was that advancing issues outnumbered decliners by 4-to-1 in the S&P 500. Volume was also strong.

The Seven Sentinels look decidedly bullish after today. Let's take a look at the charts:

NAMO and NYMO both moved higher today and remain on buys.

NAHL and NYHL both show how strong the underlying internals of the market are as they spiked higher today to levels not seen since early May.

TRIN remained on a buy, while TRINQ actually flipped to a sell, which I found to be a bit odd. Oddity aside we are not overbought by these measures.

BPCOMPQ made a decided upturn today and remains on a buy.

So we have 6 of 7 signals flashing buys, which keeps the system on a buy. These charts look darn bullish right now and give me the impression of more upside to come. I took 12% off the table today, but I don't intend on getting too aggressive moving to cash just yet. Bullishness is moving higher, but the momentum of this market should offset that sentiment for a little while longer yet.