The market started out significantly lower at the open today, but once again found its footing near support at which time it fought back to neutral territory. At times the market even managed to trade with modest gains, but a late day selling surge took the major averages much lower in the final hour of trade. At the close the averages were at their lows of the day sporting significant losses.

Today's losses are being blamed in large measure on a report from Fitch, which indicated that domestic banks could still be subject to risk should the debt crisis in Europe deteriorate. That's not news, but it is an excuse to take profits.

Another ratings agency, Moody's, downgraded the credit ratings of ten German banks. Germany is the euro-zone's strongest economy, so the beat continues on that side of the pond. Or should I say beat down.

Oil continued its rally in spite of the selling pressure in most other market sectors. At the close, oil had rallied more than 3%, closing near $102.60/barrel.

We did have a bit market data today. The October Consumer Price Index dipped 0.1%, which was near estimates looking for a flat reading. Core prices were up 0.1%, which was also in-line with expectations. Finally, Industrial Production was up in October by 0.7%. A increase of 0.4% was expected.

Here's today's charts:

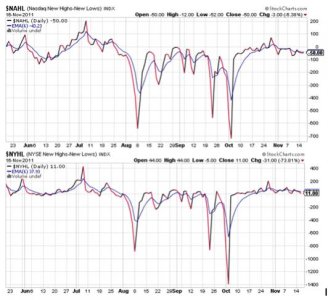

NAMO and NYMO are both flashing sells. NYMO has now dropped low enough after today's selling pressure to hit a fresh 28 day trading low.

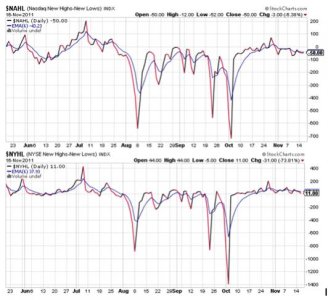

NAHL and NYHL are also on sells.

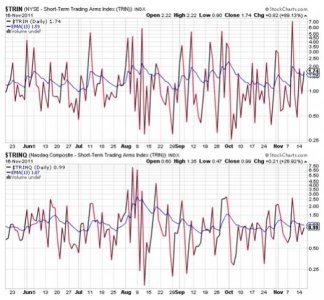

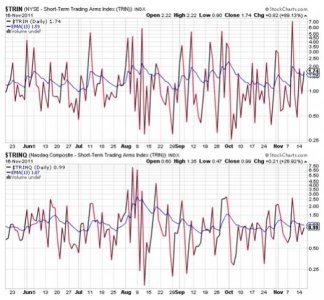

TRIN flipped back to a sell, while TRINQ remained on a buy.

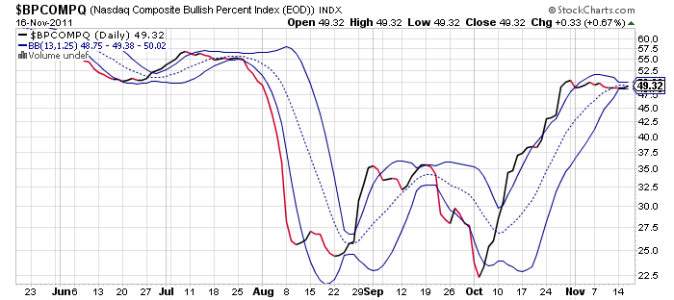

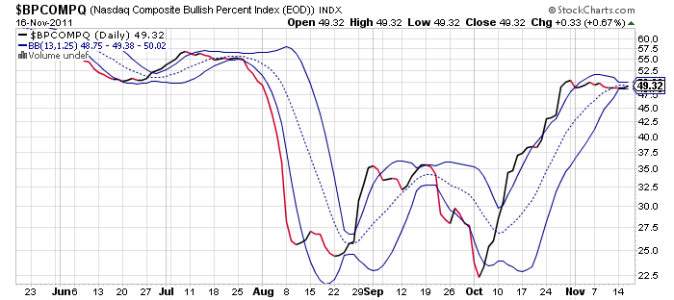

BPCOMPQ actually ebbed a bit higher today, but remains in a sell condition.

So the signals are mixed, but the important factor is that NYMO has tagged a new 28 day trading low. The unconfirmed sell signals of the past three weeks are now confirmed. That means the Seven Sentinels are now officially in an intermediate term sell condition.

This is a tricky signal, however, just like the buy signal was. I doubt this market will simply roll over as we move through the holiday period. We could see more weakness yet, but I'd not be surprised with another shot higher in the days/weeks ahead. My concern is that I really am expecting a sell signal between now and the end of the year that the market actually follows. It could also come sometime in January, but right now seasonality and headline risk are in the mix. And domestic economic reports have been on the positive side of late.

I did move 20% of my G fund holdings into the S fund yesterday, but that still leaves me with 80% in the G fund. I may push as much as another 30% into the the S fund on further weakness, but as I mentioned yesterday, I won't go beyond a 50% stock exposure, just in case this market really does fall apart in the days/weeks ahead. By that I mean before the new year.

Today's losses are being blamed in large measure on a report from Fitch, which indicated that domestic banks could still be subject to risk should the debt crisis in Europe deteriorate. That's not news, but it is an excuse to take profits.

Another ratings agency, Moody's, downgraded the credit ratings of ten German banks. Germany is the euro-zone's strongest economy, so the beat continues on that side of the pond. Or should I say beat down.

Oil continued its rally in spite of the selling pressure in most other market sectors. At the close, oil had rallied more than 3%, closing near $102.60/barrel.

We did have a bit market data today. The October Consumer Price Index dipped 0.1%, which was near estimates looking for a flat reading. Core prices were up 0.1%, which was also in-line with expectations. Finally, Industrial Production was up in October by 0.7%. A increase of 0.4% was expected.

Here's today's charts:

NAMO and NYMO are both flashing sells. NYMO has now dropped low enough after today's selling pressure to hit a fresh 28 day trading low.

NAHL and NYHL are also on sells.

TRIN flipped back to a sell, while TRINQ remained on a buy.

BPCOMPQ actually ebbed a bit higher today, but remains in a sell condition.

So the signals are mixed, but the important factor is that NYMO has tagged a new 28 day trading low. The unconfirmed sell signals of the past three weeks are now confirmed. That means the Seven Sentinels are now officially in an intermediate term sell condition.

This is a tricky signal, however, just like the buy signal was. I doubt this market will simply roll over as we move through the holiday period. We could see more weakness yet, but I'd not be surprised with another shot higher in the days/weeks ahead. My concern is that I really am expecting a sell signal between now and the end of the year that the market actually follows. It could also come sometime in January, but right now seasonality and headline risk are in the mix. And domestic economic reports have been on the positive side of late.

I did move 20% of my G fund holdings into the S fund yesterday, but that still leaves me with 80% in the G fund. I may push as much as another 30% into the the S fund on further weakness, but as I mentioned yesterday, I won't go beyond a 50% stock exposure, just in case this market really does fall apart in the days/weeks ahead. By that I mean before the new year.