Today's market action, while certainly weak overall, didn't give many clues as far as what we might expect when Friday's non-farm payrolls data is released. After opening higher the market fell and remained in the red a good part of the day, but did manage to close mixed overall. Let's take a look at today's market data.

Initial claims came in at 445,000, which was a little below the forcast of 455,000 claims. Continuing claims fell 48,000 to 4.46 million, just a tad higher than the expected 4.45 million claims.

Earnings season is upon us, but I think the main event at the moment is tomorrow's non-farm payrolls. That will probably set the tone for Friday's trading activity.

My short term system remains on a buy, but it's more neutral than anything at the moment. The Sentinels remain on buy as well. Here's the charts:

NAMO and NYMO are both flashing sells, and are very near their neutral line.

NAHL flipped to a sell, while NYHL is neutral.

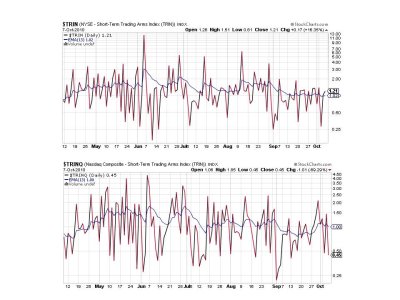

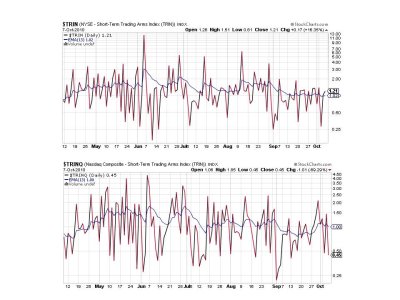

TRIN is just barely on a sell, but TRINQ is solidly in buy territory and perhaps a bit overbought.

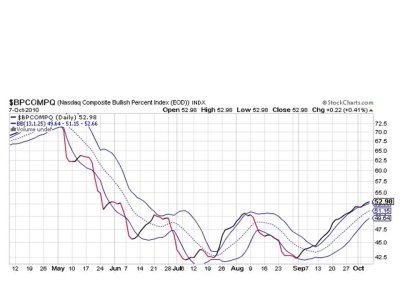

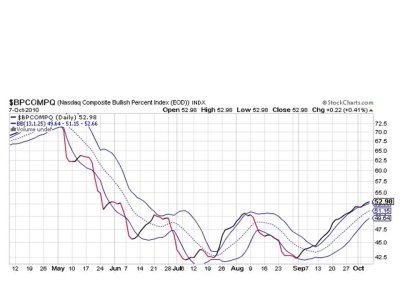

BPCOMPQ remains on a buy, which seems to indicate the intermediate term advance is still intact even if we are seeing neutral readings elsewhere.

So we have two buys, one neutral, and four sell readings, which keeps the system on a buy.

It's a tough call in the short term, but even if we see selling pressure I'm expecting it to be somewhat contained. Of course we could rally tomorrow too based on the non-farms payrolls data. Sentiment is mixed and own sentiment survey for next week is more bullish than last week, but if the numbers don't change much when the survey closes I'm expecting it to remain on a buy for next week in spite of the higher bullish reading.

For now though, it's all about jobs.

Initial claims came in at 445,000, which was a little below the forcast of 455,000 claims. Continuing claims fell 48,000 to 4.46 million, just a tad higher than the expected 4.45 million claims.

Earnings season is upon us, but I think the main event at the moment is tomorrow's non-farm payrolls. That will probably set the tone for Friday's trading activity.

My short term system remains on a buy, but it's more neutral than anything at the moment. The Sentinels remain on buy as well. Here's the charts:

NAMO and NYMO are both flashing sells, and are very near their neutral line.

NAHL flipped to a sell, while NYHL is neutral.

TRIN is just barely on a sell, but TRINQ is solidly in buy territory and perhaps a bit overbought.

BPCOMPQ remains on a buy, which seems to indicate the intermediate term advance is still intact even if we are seeing neutral readings elsewhere.

So we have two buys, one neutral, and four sell readings, which keeps the system on a buy.

It's a tough call in the short term, but even if we see selling pressure I'm expecting it to be somewhat contained. Of course we could rally tomorrow too based on the non-farms payrolls data. Sentiment is mixed and own sentiment survey for next week is more bullish than last week, but if the numbers don't change much when the survey closes I'm expecting it to remain on a buy for next week in spite of the higher bullish reading.

For now though, it's all about jobs.