It was a quiet day today across the market, but the Greek financial tsunami continues to rise and that's been a focal point across the globe. But come Wednesday, all eyes will be on the Fed as they release their latest rate announcement with less than 2 weeks to go before QE2 expires. Perhaps it's expiration has already been priced in?

As for the market today, the major averages all posted moderate gains amid uninspiring action.

Let's go the charts:

NAMO and NYMO are moving back up and suggest higher prices in the short term. Both remain in a buy condition.

NAHL and NYHL showed little movement today and suggest that market internals are not strong. I consider NAMO and NYMO's movement today to be bullish, but these two signals are not on the same page.

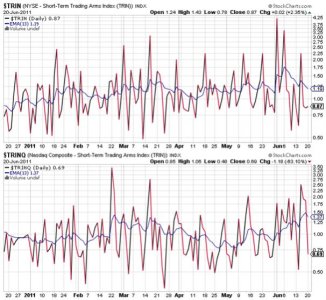

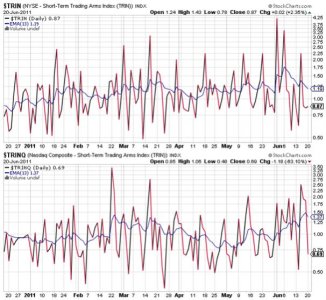

TRIN and TRINQ have often been opposite each other in the past few weeks, but not today. Both are flashing buys and could be portending a big move coming. My guess is it could be to the upside given NAMO and NYMO's readings. But again, NAHL and NYHL aren't on the same page. But NAHL and NYHL are also wallowing at low levels, which could mean the market may be about to springboard higher.

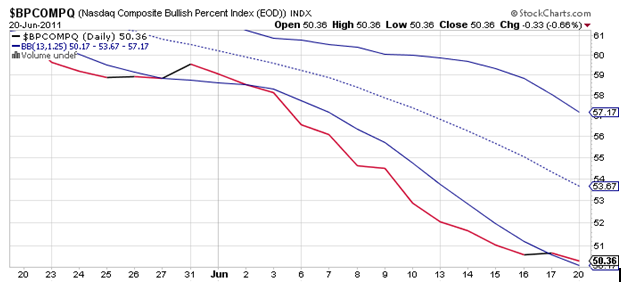

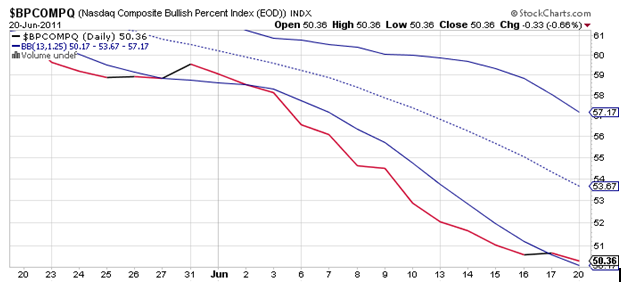

Here's where my bullish bias really gets challenged. BPCOMPQ, while still on a buy, tracked a bit lower today. And just like NAHL and NYHL it's not confirming a turn to the upside. This is problematic as this market cannot launch without this signal moving back to the upside.

So all signals are in a buy condition, which puts the Seven Sentinels in an "UNCONFIRMED" buy status, but NYMO is still well away from a 28 day trading high. I do not have a high confidence with this signal, especially with BPCOMPQ leaning negative, but there's still a chance that this market makes a surprise move higher in the short term.

As for the market today, the major averages all posted moderate gains amid uninspiring action.

Let's go the charts:

NAMO and NYMO are moving back up and suggest higher prices in the short term. Both remain in a buy condition.

NAHL and NYHL showed little movement today and suggest that market internals are not strong. I consider NAMO and NYMO's movement today to be bullish, but these two signals are not on the same page.

TRIN and TRINQ have often been opposite each other in the past few weeks, but not today. Both are flashing buys and could be portending a big move coming. My guess is it could be to the upside given NAMO and NYMO's readings. But again, NAHL and NYHL aren't on the same page. But NAHL and NYHL are also wallowing at low levels, which could mean the market may be about to springboard higher.

Here's where my bullish bias really gets challenged. BPCOMPQ, while still on a buy, tracked a bit lower today. And just like NAHL and NYHL it's not confirming a turn to the upside. This is problematic as this market cannot launch without this signal moving back to the upside.

So all signals are in a buy condition, which puts the Seven Sentinels in an "UNCONFIRMED" buy status, but NYMO is still well away from a 28 day trading high. I do not have a high confidence with this signal, especially with BPCOMPQ leaning negative, but there's still a chance that this market makes a surprise move higher in the short term.