Well, that didn't long. Back to back weakness and a Seven Sentinels sell signal gets triggered.

Today's action is being blamed in part on some weak retail sales figures out of China, along with a dip in industrial production in July. Japan reported weak machinery orders issued a moderate economic outlook.

But I suspect the real blame is yesterday's FOMC announcement. How long can the market's rallies revolve around what the fed does when economic data continues to largely disappoint. I guessing here, but I suspect the market is finally succumbing to months of spin put out on how our economy is improving, when it clearly isn't. Fundamentals just aren't there.

I saw late this morning that the advance/decline line was overwhelmingly negative, so this sell-off was for real. Case in point, 495 of the 500 S&P 500 companies had a loss today. Broad-based selling? Check.

And the yield on 10 year note continues to drop, hitting 2.68% today.

It certainly appears most main street "investor's" are out of this market. That's partly why bonds and treasuries appear to be in a bubble. But if the economy falters for the long term, that bubble may be around for quite some time. After all, how long did the Tech bubble last? Or the Real Estate bubble. So don't hold your breath for the bond bubble to pop. It could be some time away yet.

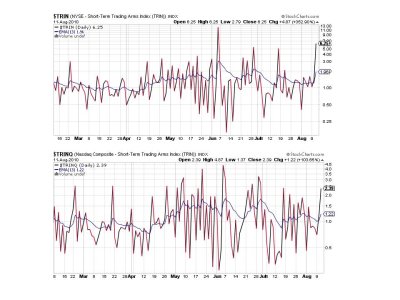

Let's take a look at the charts:

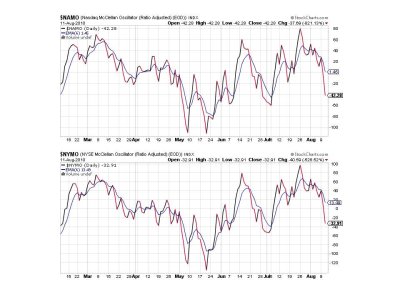

Decidedly down at this point.

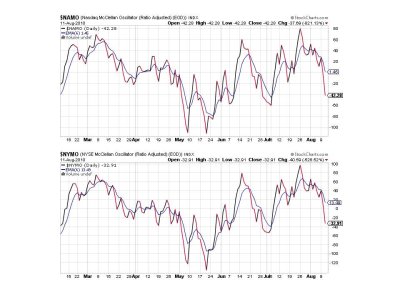

Same here.

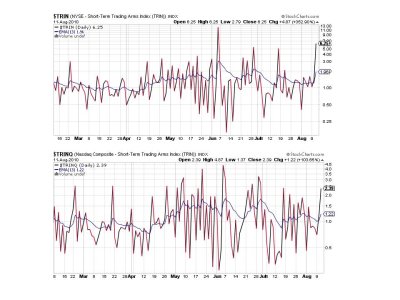

Big-time spikes higher, which usually means a snap-back rally in the next day or two, but I doubt it holds even if we get one.

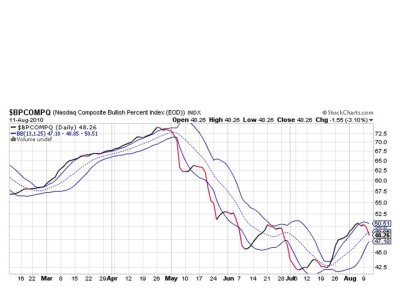

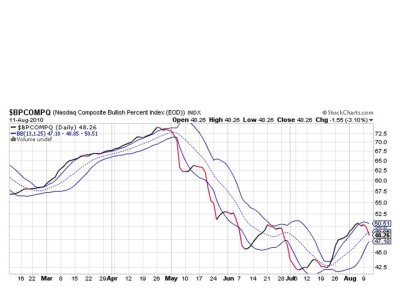

Yep. It looks like it's going down.

So all seven remain on a sell, and NYMO has hit its 28 trading day low. That confirms the sell signal for the system.

Once again the system worked well overall, but the volatility on the front and back ends (buys and sells) of these moves has been nullifying gains and low points in the market before we can either enter or exit. I'm going to be looking for a set of rules to follow that would deviate from waiting for sell/buy signals, but will hopefully allow better performance. It'll probably be based on a risk assessment. As long as this volatility remains, it's going to be tough to benefit from peaks and troughs.

Today's action is being blamed in part on some weak retail sales figures out of China, along with a dip in industrial production in July. Japan reported weak machinery orders issued a moderate economic outlook.

But I suspect the real blame is yesterday's FOMC announcement. How long can the market's rallies revolve around what the fed does when economic data continues to largely disappoint. I guessing here, but I suspect the market is finally succumbing to months of spin put out on how our economy is improving, when it clearly isn't. Fundamentals just aren't there.

I saw late this morning that the advance/decline line was overwhelmingly negative, so this sell-off was for real. Case in point, 495 of the 500 S&P 500 companies had a loss today. Broad-based selling? Check.

And the yield on 10 year note continues to drop, hitting 2.68% today.

It certainly appears most main street "investor's" are out of this market. That's partly why bonds and treasuries appear to be in a bubble. But if the economy falters for the long term, that bubble may be around for quite some time. After all, how long did the Tech bubble last? Or the Real Estate bubble. So don't hold your breath for the bond bubble to pop. It could be some time away yet.

Let's take a look at the charts:

Decidedly down at this point.

Same here.

Big-time spikes higher, which usually means a snap-back rally in the next day or two, but I doubt it holds even if we get one.

Yep. It looks like it's going down.

So all seven remain on a sell, and NYMO has hit its 28 trading day low. That confirms the sell signal for the system.

Once again the system worked well overall, but the volatility on the front and back ends (buys and sells) of these moves has been nullifying gains and low points in the market before we can either enter or exit. I'm going to be looking for a set of rules to follow that would deviate from waiting for sell/buy signals, but will hopefully allow better performance. It'll probably be based on a risk assessment. As long as this volatility remains, it's going to be tough to benefit from peaks and troughs.