The S&P 500 found itself down more than 3% shortly after the market opened for trade today, but staged a long, volatile rally to close the session just above the flat line. It really was an impressive turn around considering how deep the market fell in that first 20 minutes of trade. I guess it must have been that great consumer confidence number that was announced at 1000. :laugh:

Of course fiscal concerns in Europe are still in play and now the market wants to worry about the geopolitical tensions between North Korea and South Korea too.

Yesterday, financials were the biggest losers posting a 2.9% loss, but found support after CNBC reported that Representative Barney Frank stated the financial reform bill's language regarding derivatives goes too far. That announcement was good for an almost 4% swing, from being down more than 3% to posting a gain at the close of 0.8%. And as of this writing, futures are up moderately.

This still looks like bottoming action to me, but I'm not confident enough to think the market is out of the woods just yet. Let's look at the charts:

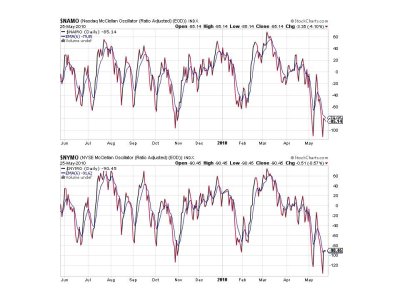

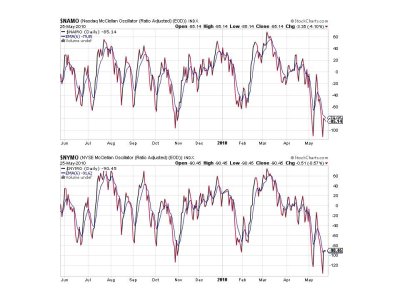

NAMO and NYMO continue to hold in a very tight range and are close to their 6 day EMA.

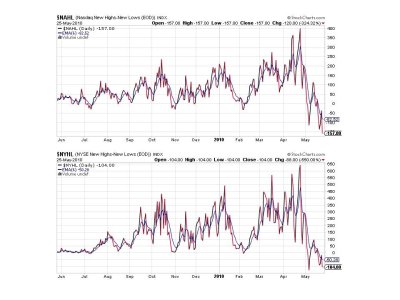

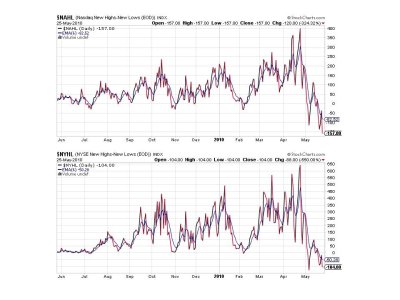

NAHL and NYHL flipped back to sells today, but also remain close to their 6 day EMA.

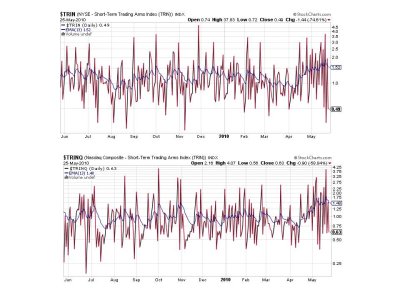

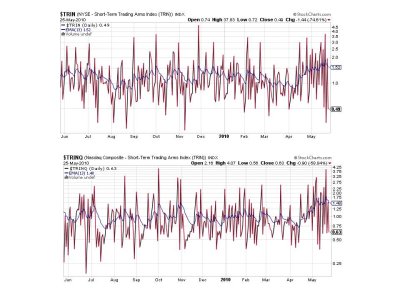

Back to buys here.

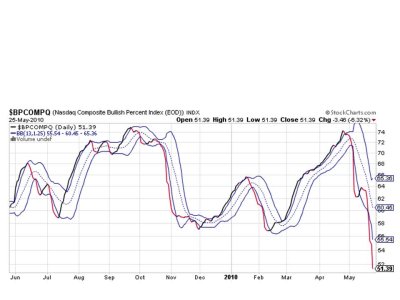

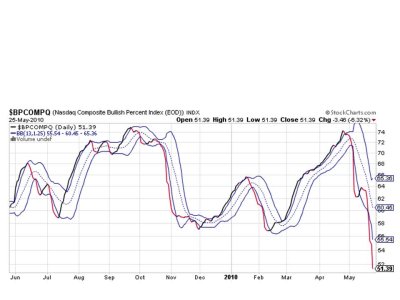

BPCOMPQ took another dive today and I find that the one troubling indicator of the seven. But the past two days seem to be suggesting the market is going through a bottoming process, so I don't want to get too bearish on this signal.

So we have 5 of seven signals flashing sells, with BPCOMPQ being the furthest away from turning. This keeps the system on a sell. It will take a good deal of buying pressure to flip it back to a buy too. But that could happen quickly given the oversold conditions and very bearish sentiment in some pockets.

The Top 50 are now holding over 83% cash and I'm not seeing too many froggy TSPers doing any dip buying. I'd like to think our sentiment survey is ready to make good on that buy signal for this week. I know I'm ready for a turn. That's it for this evening. See you tomorrow.

Of course fiscal concerns in Europe are still in play and now the market wants to worry about the geopolitical tensions between North Korea and South Korea too.

Yesterday, financials were the biggest losers posting a 2.9% loss, but found support after CNBC reported that Representative Barney Frank stated the financial reform bill's language regarding derivatives goes too far. That announcement was good for an almost 4% swing, from being down more than 3% to posting a gain at the close of 0.8%. And as of this writing, futures are up moderately.

This still looks like bottoming action to me, but I'm not confident enough to think the market is out of the woods just yet. Let's look at the charts:

NAMO and NYMO continue to hold in a very tight range and are close to their 6 day EMA.

NAHL and NYHL flipped back to sells today, but also remain close to their 6 day EMA.

Back to buys here.

BPCOMPQ took another dive today and I find that the one troubling indicator of the seven. But the past two days seem to be suggesting the market is going through a bottoming process, so I don't want to get too bearish on this signal.

So we have 5 of seven signals flashing sells, with BPCOMPQ being the furthest away from turning. This keeps the system on a sell. It will take a good deal of buying pressure to flip it back to a buy too. But that could happen quickly given the oversold conditions and very bearish sentiment in some pockets.

The Top 50 are now holding over 83% cash and I'm not seeing too many froggy TSPers doing any dip buying. I'd like to think our sentiment survey is ready to make good on that buy signal for this week. I know I'm ready for a turn. That's it for this evening. See you tomorrow.