Another volatile, high-volume trading session and I would imagine that many traders are still unsure of where this market is going to go next. There were a ton of flat, neutral traders on Trader's Talk for today's action and I suspect their daily sentiment poll will show a sizable number for tomorrow too.

There's also still a lot of talk about last Thursday's fast meltdown and even quicker recovery. And no one is admitting to anything.

But it sure smacks of manipulation at the highest levels. Whether that's true or not this market is making it very difficult for folks like us to feel comfortable about making any trades. And it makes interpretation of any trading system much more difficult.

Still, the Seven Sentinels nailed the downward move well enough to allow me to sidestep some significant downside action. Whether we've seen the bottom yet remains to be seen. But this market has not had a true Intermediate Term downleg since the March lows of 2009, and that's very unusual.

Sentiment also continues to waver in the face of significant headwinds (the Eurozone debt crisis right now) and that could be blamed for this market's inability to drop for more than a week or two at a time.

There also seems to be a lot of friction between Central Banks and Politicians, which is a contributing factor. Those agendas are clashing big time.

For now all I can do is what I always do, and that's watch the SS for a clue on when to enter or exit the market. And right now I'm out and looking for another entry, although I'd like to think it's a few weeks off yet. Here's today's charts:

Still on a buy with modestly improved signals here.

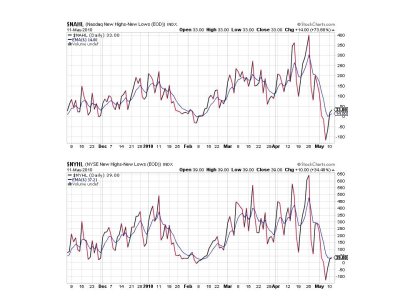

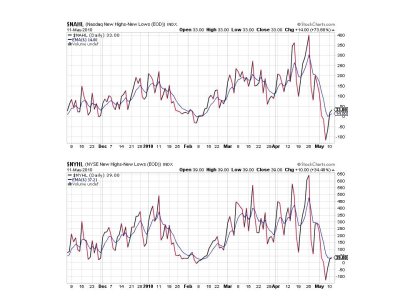

I think I'll call NYHL a buy today. That puts both of these signals on a buy now.

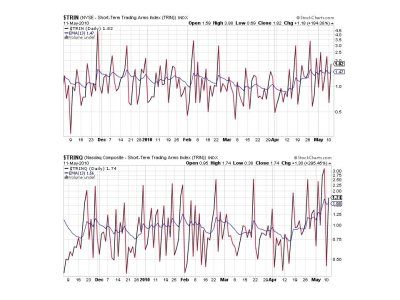

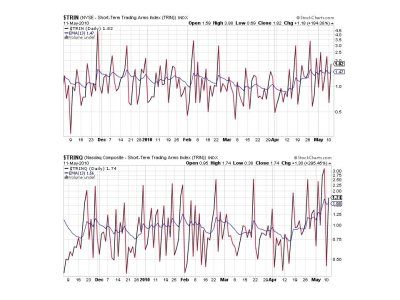

TRIN and TRINQ flipped back to sells.

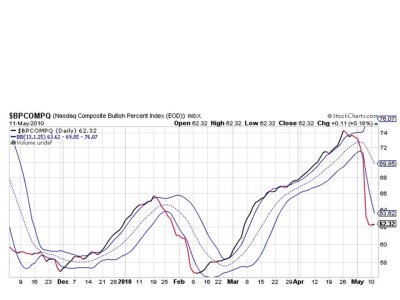

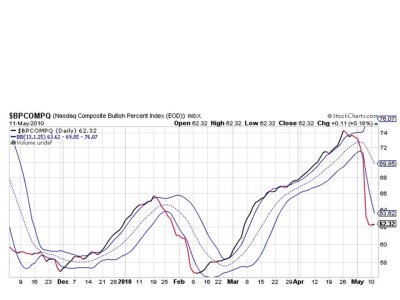

BPCOMPQ had a slight uptick, but remains on a sell. The lower bollinger band is dropping fast so if this market decides to go higher again we could see another buy signal this week.

So we have 4 of 7 signals on a buy, but we need all 7 to flip to buys to get buy at the system level. In other words, it remains on a sell.

I am not comfortable with this market. Too many indicators are being trampled by significant market intervention and that makes it almost impossible to look ahead for more than a few days at a time. The Seven Sentinels are designed to be an Intermediate Term system, which makes them very attractive for use in our limited TSP world. In a normal market I'd expect several weeks to months of weakness with a sell signal, but as I said earlier, we have not had one in over a year. And I can't be sure we'll get one now either. But I'm following the system regardless. See you tomorrow.

There's also still a lot of talk about last Thursday's fast meltdown and even quicker recovery. And no one is admitting to anything.

But it sure smacks of manipulation at the highest levels. Whether that's true or not this market is making it very difficult for folks like us to feel comfortable about making any trades. And it makes interpretation of any trading system much more difficult.

Still, the Seven Sentinels nailed the downward move well enough to allow me to sidestep some significant downside action. Whether we've seen the bottom yet remains to be seen. But this market has not had a true Intermediate Term downleg since the March lows of 2009, and that's very unusual.

Sentiment also continues to waver in the face of significant headwinds (the Eurozone debt crisis right now) and that could be blamed for this market's inability to drop for more than a week or two at a time.

There also seems to be a lot of friction between Central Banks and Politicians, which is a contributing factor. Those agendas are clashing big time.

For now all I can do is what I always do, and that's watch the SS for a clue on when to enter or exit the market. And right now I'm out and looking for another entry, although I'd like to think it's a few weeks off yet. Here's today's charts:

Still on a buy with modestly improved signals here.

I think I'll call NYHL a buy today. That puts both of these signals on a buy now.

TRIN and TRINQ flipped back to sells.

BPCOMPQ had a slight uptick, but remains on a sell. The lower bollinger band is dropping fast so if this market decides to go higher again we could see another buy signal this week.

So we have 4 of 7 signals on a buy, but we need all 7 to flip to buys to get buy at the system level. In other words, it remains on a sell.

I am not comfortable with this market. Too many indicators are being trampled by significant market intervention and that makes it almost impossible to look ahead for more than a few days at a time. The Seven Sentinels are designed to be an Intermediate Term system, which makes them very attractive for use in our limited TSP world. In a normal market I'd expect several weeks to months of weakness with a sell signal, but as I said earlier, we have not had one in over a year. And I can't be sure we'll get one now either. But I'm following the system regardless. See you tomorrow.