It's certainly obvious that something is changing in the overall market.

The price of oil plummeted 8.6% today to settle at $99.80 per barrel. Silver dove 7.9% to $36.30 per ounce, which means this precious metal has fallen more than 20% since last week. Commodities in general fell 4.9% today as measured in the CRB Commodity Index.

And if you hadn't noticed, the I fund slid 1.97% today, thanks in large measure to a dollar that suddenly found it's footing and advanced 1.4% against a basket of major foreign currencies.

And treasuries? The benchmark 10-year Note saw its yield fall to a fresh 2011 low at 3.15% today. Bonds have been seeing buying interest now since mid-April, and that includes our F fund.

And yet it seems that many traders are shrugging off the obvious. After all, the Fed has our backs, right? Is that why today's intra-day dip buying was met with more selling pressure late this afternoon?

We're those dip buyers simply buying fear? Are we now comfortable with obvious support levels?

This market has rallied for a long time on both good and bad news, but it didn't seem to take kindly to this morning's initial jobless claims number, which jumped to 474,000, the highest reading since last August and well above estimates of 400,000. That was the bad news. But the good news was that first quarter productivity increased by 1.6%, which was above economists expectation of a 1.0% increase. Unit labor costs declined by 1.0%, which was a positive given estimates looking for an increase of 0.8%.

Didn't matter though. The market seems to be on a mission at the moment.

Am I painting a bearish picture? You betcha. I don't know if the selling will continue, but sentiment has been largely bullish during this decline. That may be starting to shift, but it's not a good sign to see complacency when market character is showing obvious signs of change. And I'll repeat my concern that unless the Fed provides more clarity regarding it's plans after QE2, the bulls may have a tough time pushing this market higher during the market's historically weakest 6 month period.

But in spite of what sounds like a bearish rant, I think this market will find its footing once bullish levels have been sufficiently culled. And that may be soon, but we still haven't filled those gaps in the S&P and Nasdaq, so you may want to wait before you head to the punch bowl for the next round of kool-aid.

Here's today's charts:

NAMO and NYMO are now getting near a level where I may consider buying this market. The remain in a sell condition, but if we can fill that gap on the S&P, I'll be more inclined to pull the trigger.

Two sells for NAHL and NYHL, but they did tick higher just a bit, which could mean a bounce is coming.

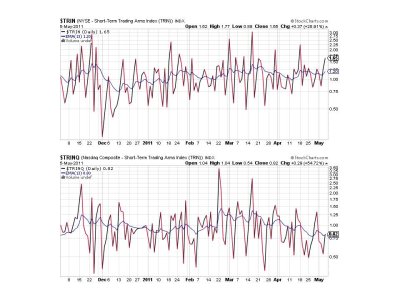

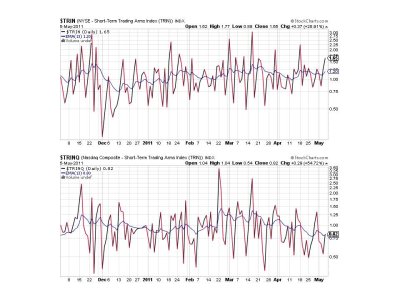

TRIN and TRINQ are both flashing sells.

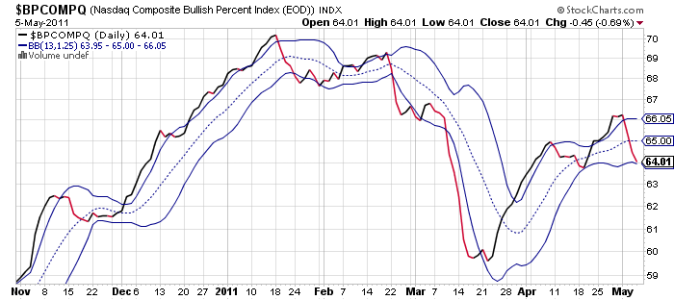

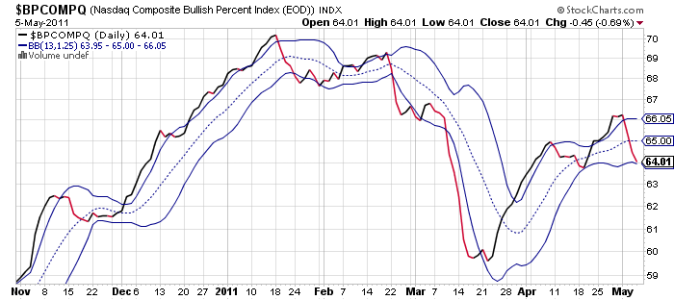

Lower still for BPCOMPQ, which also remains on a sell.

So all signals are in a sell condition, which could be an early warning sign as this sell signal is "unconfirmed" as NYMO has not hit a 28 day trading low. It will need to eclipse the -52 set on 12 April to do that.

So while I think the game is changing, I also think there is an opportunity developing to catch some nice gains. It'll be tricky picking an entry point given the volatile nature of the market, and I'm a bit concerned that a bounce may not last long as so many others have. But I'm not quite ready to pull the trigger anyway, so for now I'll continue to watch from the G fund.

The price of oil plummeted 8.6% today to settle at $99.80 per barrel. Silver dove 7.9% to $36.30 per ounce, which means this precious metal has fallen more than 20% since last week. Commodities in general fell 4.9% today as measured in the CRB Commodity Index.

And if you hadn't noticed, the I fund slid 1.97% today, thanks in large measure to a dollar that suddenly found it's footing and advanced 1.4% against a basket of major foreign currencies.

And treasuries? The benchmark 10-year Note saw its yield fall to a fresh 2011 low at 3.15% today. Bonds have been seeing buying interest now since mid-April, and that includes our F fund.

And yet it seems that many traders are shrugging off the obvious. After all, the Fed has our backs, right? Is that why today's intra-day dip buying was met with more selling pressure late this afternoon?

We're those dip buyers simply buying fear? Are we now comfortable with obvious support levels?

This market has rallied for a long time on both good and bad news, but it didn't seem to take kindly to this morning's initial jobless claims number, which jumped to 474,000, the highest reading since last August and well above estimates of 400,000. That was the bad news. But the good news was that first quarter productivity increased by 1.6%, which was above economists expectation of a 1.0% increase. Unit labor costs declined by 1.0%, which was a positive given estimates looking for an increase of 0.8%.

Didn't matter though. The market seems to be on a mission at the moment.

Am I painting a bearish picture? You betcha. I don't know if the selling will continue, but sentiment has been largely bullish during this decline. That may be starting to shift, but it's not a good sign to see complacency when market character is showing obvious signs of change. And I'll repeat my concern that unless the Fed provides more clarity regarding it's plans after QE2, the bulls may have a tough time pushing this market higher during the market's historically weakest 6 month period.

But in spite of what sounds like a bearish rant, I think this market will find its footing once bullish levels have been sufficiently culled. And that may be soon, but we still haven't filled those gaps in the S&P and Nasdaq, so you may want to wait before you head to the punch bowl for the next round of kool-aid.

Here's today's charts:

NAMO and NYMO are now getting near a level where I may consider buying this market. The remain in a sell condition, but if we can fill that gap on the S&P, I'll be more inclined to pull the trigger.

Two sells for NAHL and NYHL, but they did tick higher just a bit, which could mean a bounce is coming.

TRIN and TRINQ are both flashing sells.

Lower still for BPCOMPQ, which also remains on a sell.

So all signals are in a sell condition, which could be an early warning sign as this sell signal is "unconfirmed" as NYMO has not hit a 28 day trading low. It will need to eclipse the -52 set on 12 April to do that.

So while I think the game is changing, I also think there is an opportunity developing to catch some nice gains. It'll be tricky picking an entry point given the volatile nature of the market, and I'm a bit concerned that a bounce may not last long as so many others have. But I'm not quite ready to pull the trigger anyway, so for now I'll continue to watch from the G fund.