I don't know if I mentioned it previously, but I would have been surprised if the market didn't rally out the gate today. And while anyone can make a case that sentiment is flashing warning signs just about everywhere one looks, it's still a bull market and the trend is up. Breadth was very good today to boot.

Not that I think the market needed any reason to continue higher, but we did have some market data to support higher prices.

Construction spending in November was up 0.4%, which was double the expected number and the December ISM Manufacturing Index ticked higher to 57.0 from 56.6. That was a tad below estimates, but who cares when there's a party going on.

Here's today's charts:

Amazing what a big rally can do for momentum. Both signals here are back to flashing buys.

NAHL and NYHL are also flashing buys.

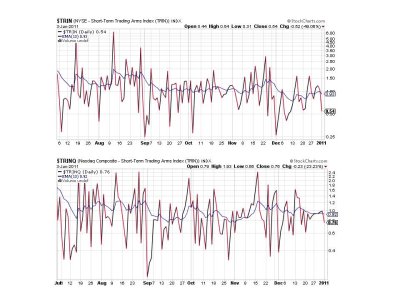

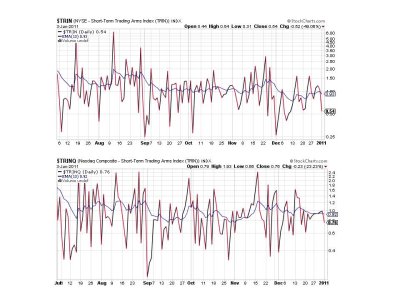

Ditto for TRIN and TRINQ.

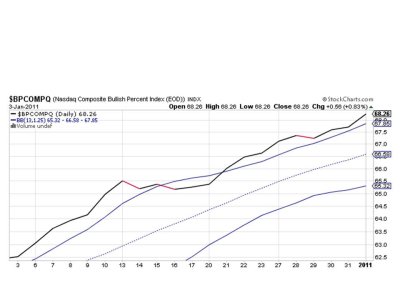

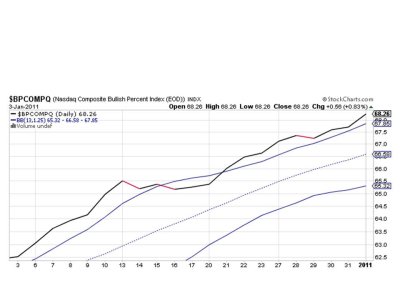

Of course BPCOMPQ can only get more bullish after a day like today. That means all seven signals are flashing buys again, which keeps the system on a buy.

I have no reason not to expect higher prices from here outside the overly bullish sentiment, although a short decline at the very least is always a possibility. I suspect any weakness will be bought quickly, but I would be remiss to suggest there is no risk in this market. The same global economic concerns are still out there, but are largely being ignored as the Fed has spiked the punch bowl. Enjoy it, one never really knows how long it will last, and it could be awhile yet.

Not that I think the market needed any reason to continue higher, but we did have some market data to support higher prices.

Construction spending in November was up 0.4%, which was double the expected number and the December ISM Manufacturing Index ticked higher to 57.0 from 56.6. That was a tad below estimates, but who cares when there's a party going on.

Here's today's charts:

Amazing what a big rally can do for momentum. Both signals here are back to flashing buys.

NAHL and NYHL are also flashing buys.

Ditto for TRIN and TRINQ.

Of course BPCOMPQ can only get more bullish after a day like today. That means all seven signals are flashing buys again, which keeps the system on a buy.

I have no reason not to expect higher prices from here outside the overly bullish sentiment, although a short decline at the very least is always a possibility. I suspect any weakness will be bought quickly, but I would be remiss to suggest there is no risk in this market. The same global economic concerns are still out there, but are largely being ignored as the Fed has spiked the punch bowl. Enjoy it, one never really knows how long it will last, and it could be awhile yet.