Bullitt

Market Veteran

- Reaction score

- 75

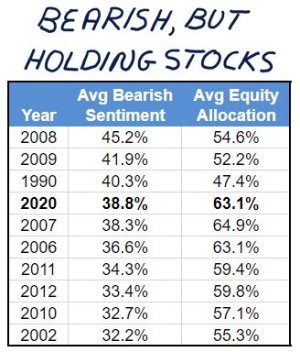

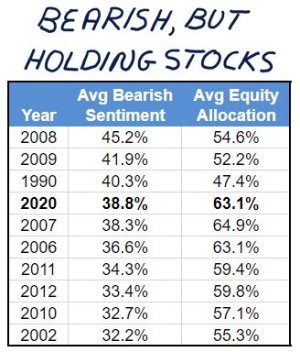

It's all about the extremes on both ends. March to May 2020 saw multiple weeks with bears over 50, a number not seen with such consistency in many years.

AAII members have often kept more than half of their portfolios in stocks even when their collective pessimism about the short-term direction of the S&P 500 index has been comparatively high.

This is not paradoxical. Disciplined investors prevent their short-term outlooks from interfering with their long-term strategies.