Yesterday I said the market was giving mixed signals and we were poised to go either way. Well, the market made a move and in the process set off alarm bells everywhere.

The sell-off is being blamed on some of the countries in the EU whose fiscal health is in dire straits. Some negative jobless claims numbers didn't help. Tomorrow we have some more potential fuel for the fire as four economic reports will be released; Nonfarm payrolls, Unemployment rate, Average workweek, and Hourly earnings. The main event will be centered on nonfarm payrolls, which has been advertised to be ugly. I am inclined to think we'll rally off those numbers regardless of what they are simply based on fear after today's decline. But we shall see soon enough. Today's charts:

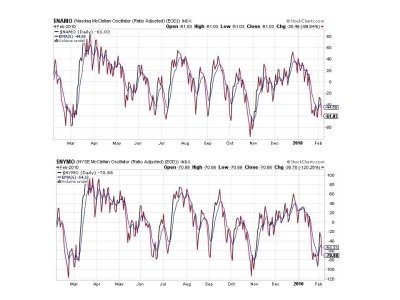

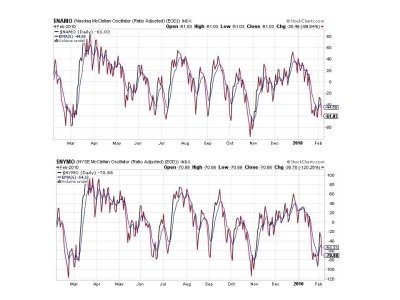

Sell

Sell

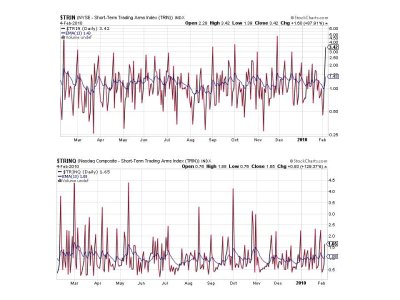

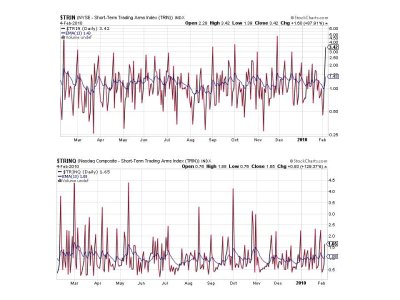

Sell

Sell

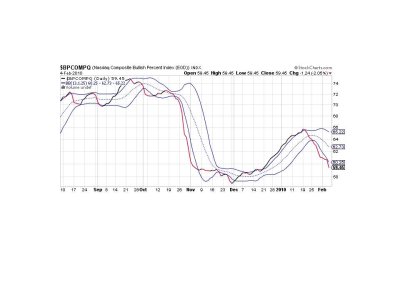

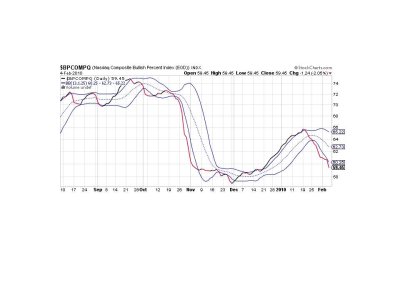

Any questions? Seriously though, we will bounce and maybe even rally at some point, but the question is from what level? It can be a very costly trade if the move is made too soon. And the Seven Sentinels are not going to issue a buy signal on short order at this point. Not unless we see the kind of rally we saw last summer, and I'm not so sure that's going to happen. I have to continue to be open to the idea that something has changed, so as tempting as these prices seem we could go much lower yet even with a bounce thrown in here and there.

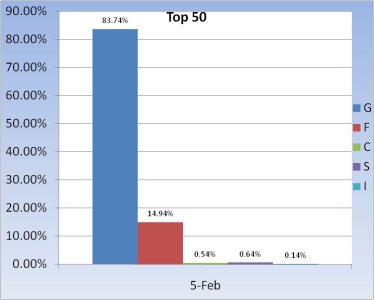

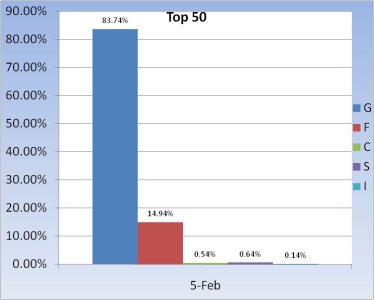

I only have room to post one more chart. The Top 15 didn't change so I opted to post how our Top 50 are positioned going into tomorrow's trading day. I think this chart speaks for itself so no further comment from me.

I didn't see as many dip buyers on the tracker today as I saw last week. At this point it would seem the market has our collective attention and risk is back in vogue. The Seven Sentinels remain in a sell condition and I don't see them flipping over quickly. Tomorrow should be very interesting to say the least. See you then.

The sell-off is being blamed on some of the countries in the EU whose fiscal health is in dire straits. Some negative jobless claims numbers didn't help. Tomorrow we have some more potential fuel for the fire as four economic reports will be released; Nonfarm payrolls, Unemployment rate, Average workweek, and Hourly earnings. The main event will be centered on nonfarm payrolls, which has been advertised to be ugly. I am inclined to think we'll rally off those numbers regardless of what they are simply based on fear after today's decline. But we shall see soon enough. Today's charts:

Sell

Sell

Sell

Sell

Any questions? Seriously though, we will bounce and maybe even rally at some point, but the question is from what level? It can be a very costly trade if the move is made too soon. And the Seven Sentinels are not going to issue a buy signal on short order at this point. Not unless we see the kind of rally we saw last summer, and I'm not so sure that's going to happen. I have to continue to be open to the idea that something has changed, so as tempting as these prices seem we could go much lower yet even with a bounce thrown in here and there.

I only have room to post one more chart. The Top 15 didn't change so I opted to post how our Top 50 are positioned going into tomorrow's trading day. I think this chart speaks for itself so no further comment from me.

I didn't see as many dip buyers on the tracker today as I saw last week. At this point it would seem the market has our collective attention and risk is back in vogue. The Seven Sentinels remain in a sell condition and I don't see them flipping over quickly. Tomorrow should be very interesting to say the least. See you then.