Stocks extended their gains for the second day in row, which really gets September off to a bang. But the non-farm payrolls looms on the horizon. How will the market react to those numbers?

We remain very overbought, so some selling would seem to be in cards at this point, but I would not rule out another run to the upside tomorrow as we head into the Labor Day weekend. It's what happens next week that's of primary interest to me, but I am expecting to see stocks give some of their gains back tomorrow in any event.

The Seven Sentinels improved for the most part today, but there are signs we've come too far, too fast. Here's the charts:

Momentum moved higher today and NAMO and NYMO are now solidly in positive territory.

NAHL and NYHL remain on a buy, but NYHL suggests at least a pause in the short term as it declined today. Internals were not a strong as they were yesterday.

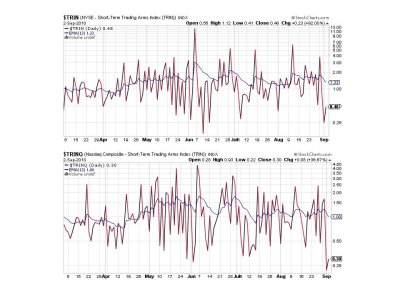

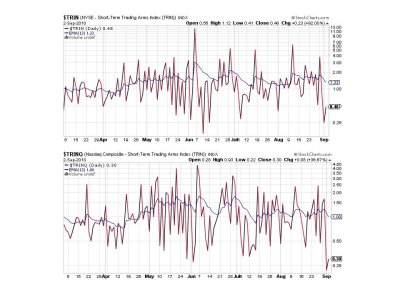

TRIN and TRINQ remain on a buy, but still show a very overbought market.

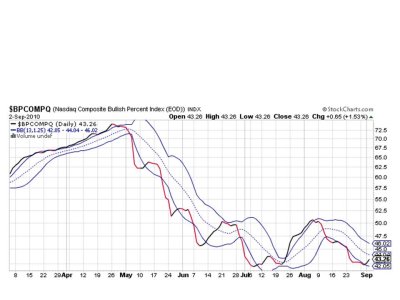

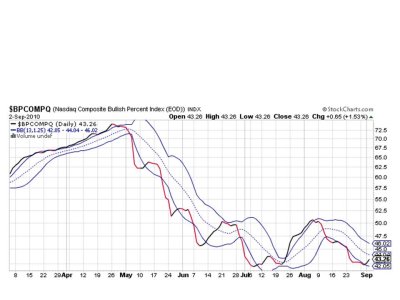

BPCOMPQ inched just a bit higher and remains on a buy.

All signals continue to flash buys, but a 28 day trading high has still not been triggered by NYMO, which now sits at 25.3. The 28 day trading high is a 76 today, so still no buy signal from the sentinels.

One of the concerns that I continue to have with this market is the fast, deep turns in both directions. Typically when the SS gets a signal, too much of the upside or downside has already passed by. Even with a 28 day signal this market cannot be taken for granted.

Still 100% G and just fine with that.

We remain very overbought, so some selling would seem to be in cards at this point, but I would not rule out another run to the upside tomorrow as we head into the Labor Day weekend. It's what happens next week that's of primary interest to me, but I am expecting to see stocks give some of their gains back tomorrow in any event.

The Seven Sentinels improved for the most part today, but there are signs we've come too far, too fast. Here's the charts:

Momentum moved higher today and NAMO and NYMO are now solidly in positive territory.

NAHL and NYHL remain on a buy, but NYHL suggests at least a pause in the short term as it declined today. Internals were not a strong as they were yesterday.

TRIN and TRINQ remain on a buy, but still show a very overbought market.

BPCOMPQ inched just a bit higher and remains on a buy.

All signals continue to flash buys, but a 28 day trading high has still not been triggered by NYMO, which now sits at 25.3. The 28 day trading high is a 76 today, so still no buy signal from the sentinels.

One of the concerns that I continue to have with this market is the fast, deep turns in both directions. Typically when the SS gets a signal, too much of the upside or downside has already passed by. Even with a 28 day signal this market cannot be taken for granted.

Still 100% G and just fine with that.