Go short that is.

Yesterday I said that I was bullish, but I'm still a bit surprised at how the major indexes mounted a comeback from what looked to be a tough day for the bulls early on. Buying a red candle just isn't very easy to do anymore. But I don't think it matters. I suspect there's more upside to come. Maybe more than even some bulls think.

Let's look at the charts:

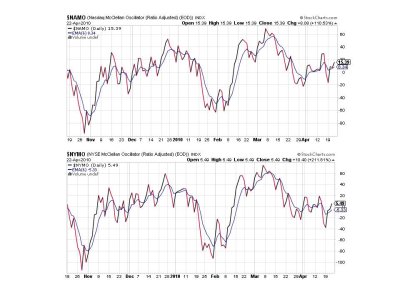

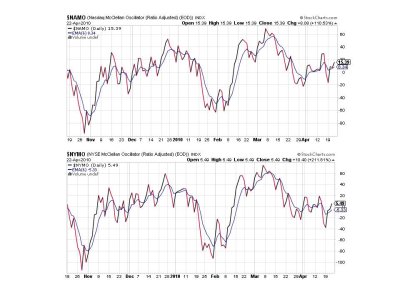

Still on a buy here with plenty of room to move higher should the market make another run.

NAHL and NYHL are still on buys too.

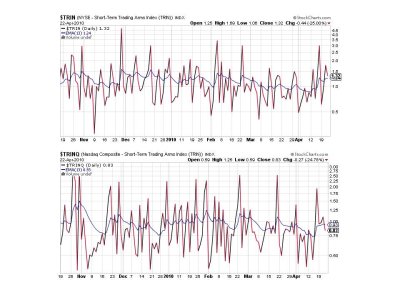

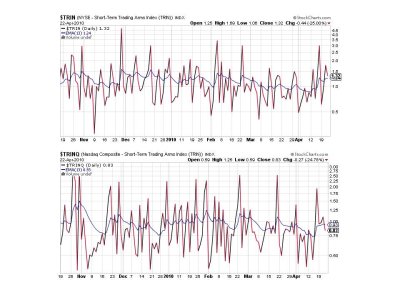

TRIN is just barely a sell, while TRINQ is a buy.

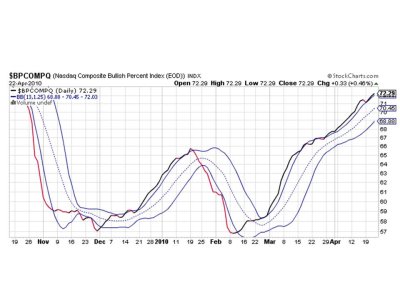

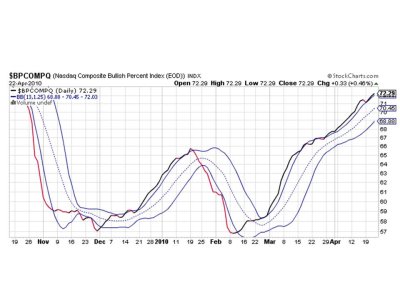

BPCOMPQ is still rising and looks strong.

So we have 6 of 7 signals on a buy and the one lone sell is very close to rolling over and making it unanimous. I have the feeling the market is about to make another run based on how quickly these signals recovered after last Friday's scare. They are getting stronger and I simply cannot be anything but bullish right now.

I'm now fully invested after putting my other 50% into C and S. I hope you are enjoying some gains. Let's hope it continues into May so we can remain in stocks going into the new month. See you tomorrow.

Yesterday I said that I was bullish, but I'm still a bit surprised at how the major indexes mounted a comeback from what looked to be a tough day for the bulls early on. Buying a red candle just isn't very easy to do anymore. But I don't think it matters. I suspect there's more upside to come. Maybe more than even some bulls think.

Let's look at the charts:

Still on a buy here with plenty of room to move higher should the market make another run.

NAHL and NYHL are still on buys too.

TRIN is just barely a sell, while TRINQ is a buy.

BPCOMPQ is still rising and looks strong.

So we have 6 of 7 signals on a buy and the one lone sell is very close to rolling over and making it unanimous. I have the feeling the market is about to make another run based on how quickly these signals recovered after last Friday's scare. They are getting stronger and I simply cannot be anything but bullish right now.

I'm now fully invested after putting my other 50% into C and S. I hope you are enjoying some gains. Let's hope it continues into May so we can remain in stocks going into the new month. See you tomorrow.