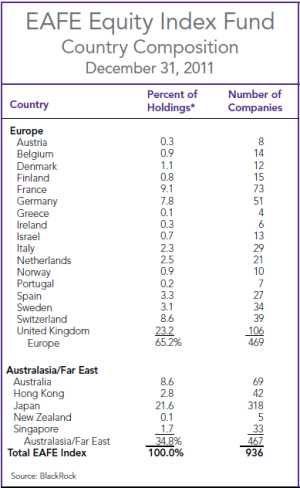

Thanks JTH. Great Britain, EU, and Japan are basically it. Those are the currencies you need to watch.

[TABLE="class: yfnc_mod_table_title1, width: 100%"]

[TR]

[TH="align: left"]Top 10 Holdings (13.2% of Total Assets)[/TH]

[TH="align: right"] [/TH]

[/TR]

[/TABLE]

[TABLE="class: yfnc_tableout1, width: 100%"]

[TR]

[TD][TABLE="width: 100%"]

[TR]

[TH="class: yfnc_tablehead1, bgcolor: #EEEEEE, align: left"]Company[/TH]

[TH="class: yfnc_tablehead1, bgcolor: #EEEEEE, align: left"]Symbol[/TH]

[TH="class: yfnc_tablehead1, bgcolor: #EEEEEE, align: right"]% Assets[/TH]

[/TR]

[TR]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF"]NESTLE SA CHAM ET VE[/TD]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF"]

NSRGF[/TD]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF, align: right"]1.96[/TD]

[/TR]

[TR]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF"]HSBC Holdings PLC[/TD]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF"]HBCYF.L[/TD]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF, align: right"]1.79[/TD]

[/TR]

[TR]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF"]NOVARTIS AG BASL[/TD]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF"]

NVSEF[/TD]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF, align: right"]1.36[/TD]

[/TR]

[TR]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF"]ROCHE HLDG AG DIV RT[/TD]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF"]

RHHVF[/TD]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF, align: right"]1.34[/TD]

[/TR]

[TR]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF"]BP PLC[/TD]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF"]BPAQF.L[/TD]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF, align: right"]1.22[/TD]

[/TR]

[TR]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF"]Vodafone Group PLC[/TD]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF"]VODPF.L[/TD]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF, align: right"]1.16[/TD]

[/TR]

[TR]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF"]Royal Dutch Shell PLC Class A[/TD]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF"]RYDAF.L[/TD]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF, align: right"]1.14[/TD]

[/TR]

[TR]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF"]Toyota Motor Corp[/TD]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF"]7203[/TD]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF, align: right"]1.13[/TD]

[/TR]

[TR]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF"]BHP Billiton Ltd[/TD]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF"]BHPLF.AX[/TD]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF, align: right"]1.09[/TD]

[/TR]

[TR]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF"]SANOFI[/TD]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF"]

SAN.PA[/TD]

[TD="class: yfnc_tabledata1, bgcolor: #FFFFFF, align: right"]1.01[/TD]

[/TR]

[/TABLE]

[/TD]

[/TR]

[/TABLE]