I've been reading a lot of posts by various TSPers the past couple of weeks and it's been somewhat entertaining to see what this market does to our emotions.

Some might have you believe (not necessarily on this MB) that this market is really no different than past markets. I would beg to differ.

I have been quite astonished to see the Seven Sentinels whipped around for over a year now. I'd never seen it so ineffective (relatively speaking) in the several years I'd been watching it. Sure, it's had some great calls during that time, but the whipsaws have more than neutralized any gains I might have realized. And now I find myself way down the tracker list wondering what's happening to both this system and this market.

Now, don't misunderstand me here. I don't really care where I am on the tracker, that doesn't bother me. But I do care about providing some good, proven technical analysis that each of us can use (if you're so inclined) as we see fit.

Sure, no system is perfect, I can accept that, but is this market really that different from past markets?

Since the June 7th low, the S&P 500 had dropped 13.7% from its April high during the course of trading last month. At the April apex this market was not showing any of the "classic" warning signs of an imminent large scale decline. The NYSE A/D line that the Seven Sentinels employs hit an all-time high on April 26th. You can go back more than 60 years and not find one case of the market collapsing greater than 20% without seeing internals flashing warning signs ahead of time. In this case the A/D line.

That April 26th high saw 674 stocks reach 52 week highs. Only 9 stocks that day hit 52 week lows. All told the market saw 20.7% of all stocks hit fresh 52 week highs. That's the largest percentage since 1986.

A market collapse does not begin after such incredible strength. Decades of data just doesn't support it.

So what does this mean?

Either we are witnessing something unprecedented, or the current decline is a normal (not sure that's the right word) market correction.

I also find it interesting that the Seven Sentinels have maintained a buy signal for much of the recent decline. No sell signal given. I even had 4 buys signals last Friday. Very odd indeed for this system given the depth of this decline.

Okay, the market did its usual gyration today, gapping up at the open, peaking, staging a decline, and then finishing mixed at the close.

So where do the Sentinels stand after today? Here's the charts:

NAMO and NYMO remain on sells, but in spite of new lows last week, the 6 day EMA remains well above the previous May decline level. This is a positive divergence.

NAHL flipped back to a sell, barely. NYHL remains on a buy, barely.

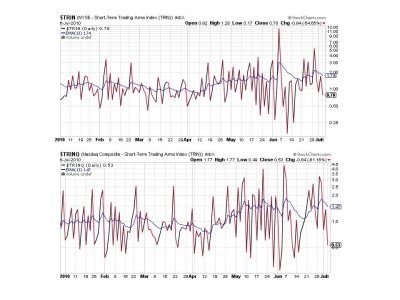

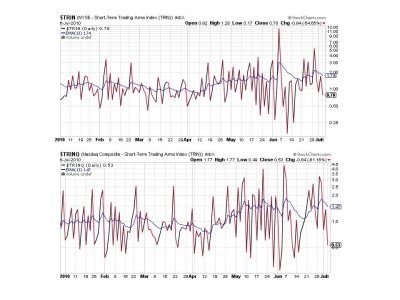

TRIN and TRINQ both remain on buys.

No turn yet for BPCOMPQ. It's a sell.

So we have 3 of 7 signals flashing buys, which keeps the system on a buy.

This is a big week for the market. The bulls can't wait much longer if they want to turn this market around and avoid bear market status.

Some might have you believe (not necessarily on this MB) that this market is really no different than past markets. I would beg to differ.

I have been quite astonished to see the Seven Sentinels whipped around for over a year now. I'd never seen it so ineffective (relatively speaking) in the several years I'd been watching it. Sure, it's had some great calls during that time, but the whipsaws have more than neutralized any gains I might have realized. And now I find myself way down the tracker list wondering what's happening to both this system and this market.

Now, don't misunderstand me here. I don't really care where I am on the tracker, that doesn't bother me. But I do care about providing some good, proven technical analysis that each of us can use (if you're so inclined) as we see fit.

Sure, no system is perfect, I can accept that, but is this market really that different from past markets?

Since the June 7th low, the S&P 500 had dropped 13.7% from its April high during the course of trading last month. At the April apex this market was not showing any of the "classic" warning signs of an imminent large scale decline. The NYSE A/D line that the Seven Sentinels employs hit an all-time high on April 26th. You can go back more than 60 years and not find one case of the market collapsing greater than 20% without seeing internals flashing warning signs ahead of time. In this case the A/D line.

That April 26th high saw 674 stocks reach 52 week highs. Only 9 stocks that day hit 52 week lows. All told the market saw 20.7% of all stocks hit fresh 52 week highs. That's the largest percentage since 1986.

A market collapse does not begin after such incredible strength. Decades of data just doesn't support it.

So what does this mean?

Either we are witnessing something unprecedented, or the current decline is a normal (not sure that's the right word) market correction.

I also find it interesting that the Seven Sentinels have maintained a buy signal for much of the recent decline. No sell signal given. I even had 4 buys signals last Friday. Very odd indeed for this system given the depth of this decline.

Okay, the market did its usual gyration today, gapping up at the open, peaking, staging a decline, and then finishing mixed at the close.

So where do the Sentinels stand after today? Here's the charts:

NAMO and NYMO remain on sells, but in spite of new lows last week, the 6 day EMA remains well above the previous May decline level. This is a positive divergence.

NAHL flipped back to a sell, barely. NYHL remains on a buy, barely.

TRIN and TRINQ both remain on buys.

No turn yet for BPCOMPQ. It's a sell.

So we have 3 of 7 signals flashing buys, which keeps the system on a buy.

This is a big week for the market. The bulls can't wait much longer if they want to turn this market around and avoid bear market status.