It was a relatively benign trading day on Wall Street with the major averages closing mixed on this quadruple witching options expiration day.

The Tax package was finally signed, but that didn't seem to mean a whole lot to the market as it was already priced in. Earlier in the day, the Leading Economic Indicators data was released and showed a 1.1% increase , which was close to estimates.

In spite of what seemed like a good week for the bulls, the S&P only closed up 0.3%.

The next two weeks should see diminished trading activity as the holiday's are now upon us. Unless something happens to really shake things up my blogging may be limited during this time.

Here's today's charts:

Not much change today, but they do remain on a buy.

NAHL and NYHL managed to creep a bit higher and both triggered buys.

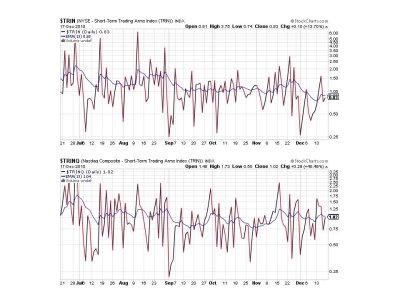

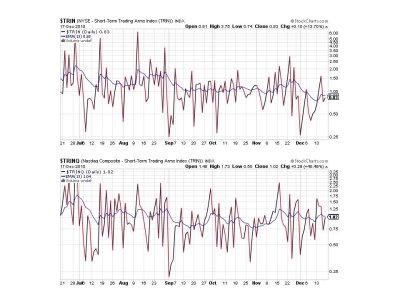

TRIN and TRINQ are pretty much neutral, but are also flashing buys.

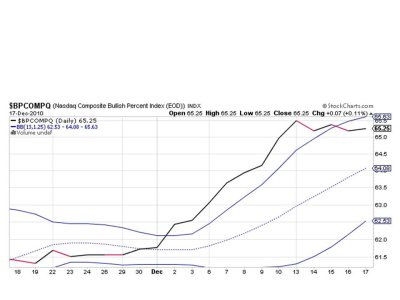

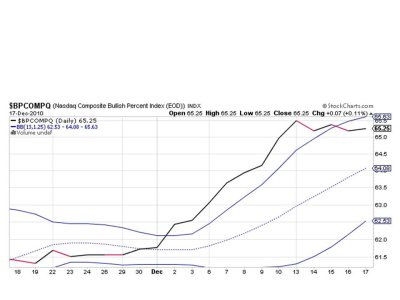

BPCOMPQ remains the lone sell today.

The system remains on a sell, but the overall sense I get from these charts is a market that's moving sideways. And I suppose it is, although with a slight upward bias.

That's it for this week, but I'll be posting the Tracker charts later this weekend. See you then.

The Tax package was finally signed, but that didn't seem to mean a whole lot to the market as it was already priced in. Earlier in the day, the Leading Economic Indicators data was released and showed a 1.1% increase , which was close to estimates.

In spite of what seemed like a good week for the bulls, the S&P only closed up 0.3%.

The next two weeks should see diminished trading activity as the holiday's are now upon us. Unless something happens to really shake things up my blogging may be limited during this time.

Here's today's charts:

Not much change today, but they do remain on a buy.

NAHL and NYHL managed to creep a bit higher and both triggered buys.

TRIN and TRINQ are pretty much neutral, but are also flashing buys.

BPCOMPQ remains the lone sell today.

The system remains on a sell, but the overall sense I get from these charts is a market that's moving sideways. And I suppose it is, although with a slight upward bias.

That's it for this week, but I'll be posting the Tracker charts later this weekend. See you then.