Last night I was watching the futures market ramp higher after news of Ireland's financial aid request hit the wires. I thought we'd see a sizable gap higher to start the trading day as a result of that revelation, but surprisingly the market gapped lower instead before quickly gaining its footing and reversing course. It didn't last long however, as the lows of the day came just before 1 pm EST. After that the market fought back to end the trading day mixed, with the Naz leading the way.

The I fund took a pounding relative to our domestic market, but dollar strength was only a partial contributing factor as it gained a modest 0.2% overall.

As if we needed more uncertainty about this market, a major probe into insider trading is well underway with Goldman Sachs being one of the hardest hit today (imagine that). Still, while the banking sector didn't fare well overall, this kind of news 2 years ago would have roiled the markets.

Here's today's charts:

NAMO and NYMO remain on buys, but also remain in negative territory.

NAHL and NYHL also remain on buys.

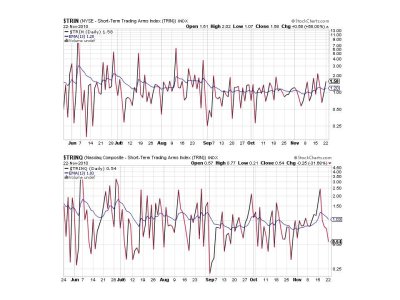

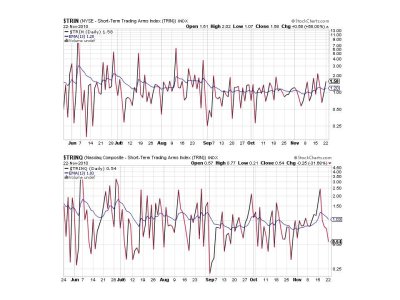

TRIN flipped to a sell, while TRINQ remains on a buy and overbought by this measure.

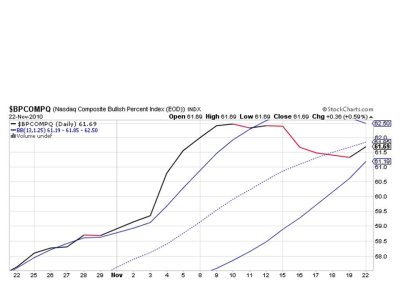

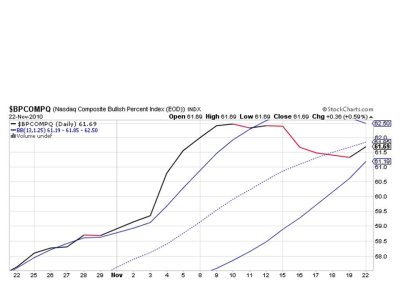

BPCOMPQ turned up today, but remains on a sell.

So 2 of 7 signals are flashing sells, which keeps the system on a sell.

Seasonality appears to be keeping the market buoyant and I suspect light volume helped. But as I stated earlier, not all of our funds did well as the I fund was down over 1%. Small caps are indeed the place to be if you're going to hold a stock fund allocation as the S fund posted yet another gain. But I don't think the selling is over and it may take more than this week to prove it. The Sentinels remain on a sell and that's what I have my eye on along with our sentiment survey's continued sell condition.

The I fund took a pounding relative to our domestic market, but dollar strength was only a partial contributing factor as it gained a modest 0.2% overall.

As if we needed more uncertainty about this market, a major probe into insider trading is well underway with Goldman Sachs being one of the hardest hit today (imagine that). Still, while the banking sector didn't fare well overall, this kind of news 2 years ago would have roiled the markets.

Here's today's charts:

NAMO and NYMO remain on buys, but also remain in negative territory.

NAHL and NYHL also remain on buys.

TRIN flipped to a sell, while TRINQ remains on a buy and overbought by this measure.

BPCOMPQ turned up today, but remains on a sell.

So 2 of 7 signals are flashing sells, which keeps the system on a sell.

Seasonality appears to be keeping the market buoyant and I suspect light volume helped. But as I stated earlier, not all of our funds did well as the I fund was down over 1%. Small caps are indeed the place to be if you're going to hold a stock fund allocation as the S fund posted yet another gain. But I don't think the selling is over and it may take more than this week to prove it. The Sentinels remain on a sell and that's what I have my eye on along with our sentiment survey's continued sell condition.