Aside from dollar strength being a drag on the I fund, the indicies held their ground fairly well today given yesterday's broad-based rally. We could see more selling kick in at this point, which would be consistent with what this market has been doing in its slow grind upward to higher prices. I suppose some profit taking now could be justified, but we are still two weeks from December, which is a lot of time to be out of the market. After making a new high yesterday, the S&P may not be done on the current up-trend, so additional gains might be missed going to cash now.

But I doubt we rally another two weeks without a pullback, so raising cash at this point might be a good idea (assuming one is looking shorter term).

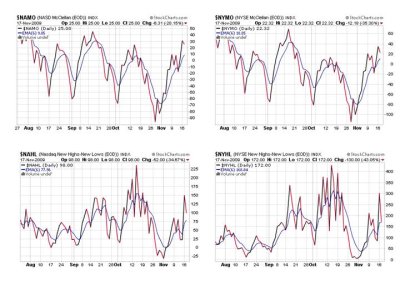

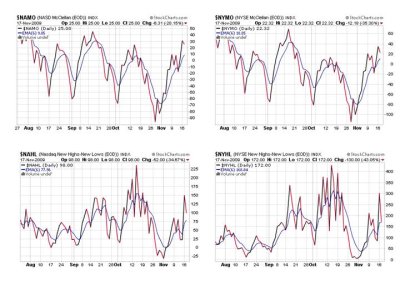

I've not had much of a chance to watch the action as I'm on the road this week and unable to react in a timely manner. But looking at the charts, we still look to be in good shape. But the reversals have been just as brutal to the bulls as they have been to the bears. Here's the charts:

We're still flashing four buy signals here, but the 6 day ema is moving back up quickly. Some sideways action would help to level off the signals while the market consolidates gains, but any broad-based selling could trigger sell signals in all four of these charts very quickly.

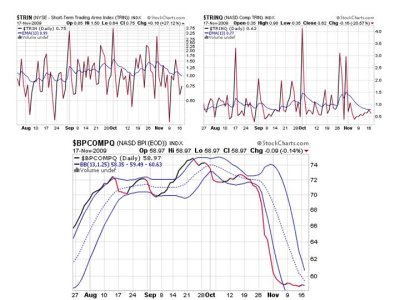

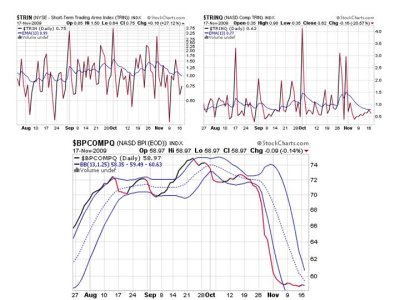

TRIN and TRINQ are still on a buy as is BPCOMPQ (which continues to track sideways). These three signals can flip quickly in volatile trading too.

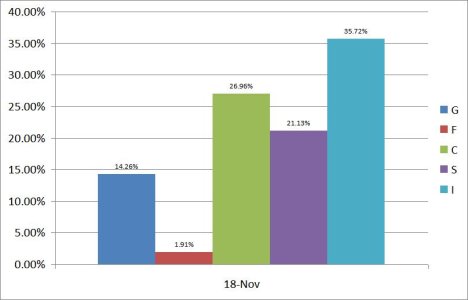

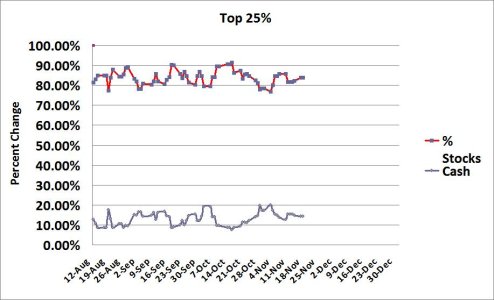

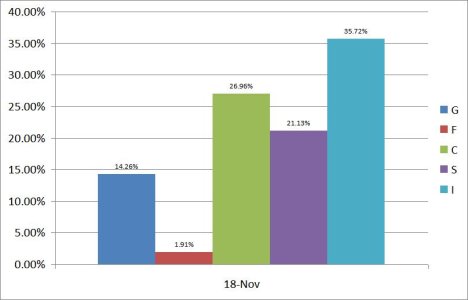

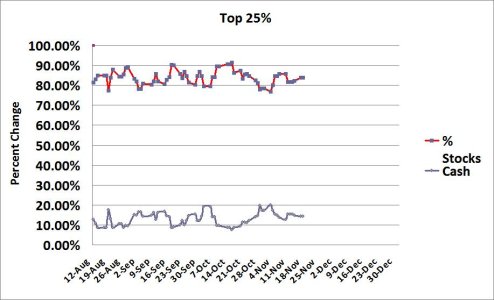

Here is how our top 25% were positioned going into today's trading.

So profit taking at this point may be a good way to front-run anticipated weakness, but one has to realize that with new highs established yesterday additional gains might be in the cards. Also, two weeks to go until the end of the month is a lot of time to sit on the sidelines if one has already used one or more IFTs. Weakness could come and go by the time we get to December.

So there is no clear path on how to play this short term. For the moment though, I'm still long, but getting antsy.

But I doubt we rally another two weeks without a pullback, so raising cash at this point might be a good idea (assuming one is looking shorter term).

I've not had much of a chance to watch the action as I'm on the road this week and unable to react in a timely manner. But looking at the charts, we still look to be in good shape. But the reversals have been just as brutal to the bulls as they have been to the bears. Here's the charts:

We're still flashing four buy signals here, but the 6 day ema is moving back up quickly. Some sideways action would help to level off the signals while the market consolidates gains, but any broad-based selling could trigger sell signals in all four of these charts very quickly.

TRIN and TRINQ are still on a buy as is BPCOMPQ (which continues to track sideways). These three signals can flip quickly in volatile trading too.

Here is how our top 25% were positioned going into today's trading.

So profit taking at this point may be a good way to front-run anticipated weakness, but one has to realize that with new highs established yesterday additional gains might be in the cards. Also, two weeks to go until the end of the month is a lot of time to sit on the sidelines if one has already used one or more IFTs. Weakness could come and go by the time we get to December.

So there is no clear path on how to play this short term. For the moment though, I'm still long, but getting antsy.