There was a media blitz today, that centered on a long awaited storyline. That being U.S. forces finally finding and killing Osama bin Laden. Early on it appeared the market would react very positively to the news as futures were up moderately. And while stocks did gap higher initially, they didn't rally into the day. In fact, before noon EST stocks began to drift lower, settling into listless trading above and below the neutral line. By the close the major averages posted modest to moderate losses, but nothing serious from a technical perspective.

Oil fell 0.4% to $113.50 per barrel, while the dollar fought back from another decline to finish the day flat.

The April ISM Manufacturing Index was released this morning and came in at 60.4, which was better than expected, while March construction spending increased 1.4%, which was much higher than the flat reading anticipated by economists.

Here's today's charts:

NAMO and NYMO fell back today, with both flipping to a sell condition in the process. It could the start of a bout of weakness, given the overbought condition of the market.

NAHL and NYHL remained in a buy condition, but their 6 day EMA suggests we could be in for some weakness.

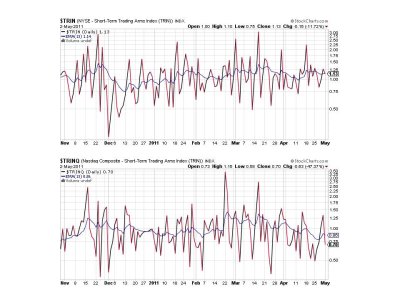

Both TRIN and TRINQ are flashing buys.

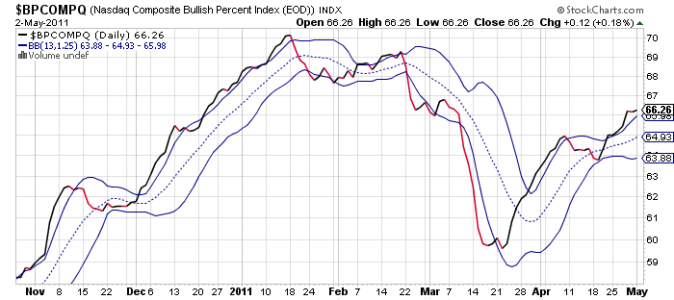

BPCOMPQ ticked just a tad higher today and remains on a buy.

So 5 of 7 signals remain on buys, which keeps the system in a buy condition.

Overall, some of the signals appear to be suggestive of some selling pressure coming into play soon. We still have that gap below in the S&P 500, which is certainly a target should any selling pressure find momentum. But it's difficult to predict when that may happen. And this is still a strong bull market, which has tended to find its footing quickly when weakness does present itself.

Oil fell 0.4% to $113.50 per barrel, while the dollar fought back from another decline to finish the day flat.

The April ISM Manufacturing Index was released this morning and came in at 60.4, which was better than expected, while March construction spending increased 1.4%, which was much higher than the flat reading anticipated by economists.

Here's today's charts:

NAMO and NYMO fell back today, with both flipping to a sell condition in the process. It could the start of a bout of weakness, given the overbought condition of the market.

NAHL and NYHL remained in a buy condition, but their 6 day EMA suggests we could be in for some weakness.

Both TRIN and TRINQ are flashing buys.

BPCOMPQ ticked just a tad higher today and remains on a buy.

So 5 of 7 signals remain on buys, which keeps the system in a buy condition.

Overall, some of the signals appear to be suggestive of some selling pressure coming into play soon. We still have that gap below in the S&P 500, which is certainly a target should any selling pressure find momentum. But it's difficult to predict when that may happen. And this is still a strong bull market, which has tended to find its footing quickly when weakness does present itself.