The biggest events of the week are now behind us and many held the expectation that the market would finally make a dramatic move in one direction or the other after an extended period of listless trading. Well, we did get a rally ahead of the elections and the FOMC announcement, and we also managed to tack on some modest gains late today, albeit in volatile fashion, but nothing all that dramatic really. So the question now is "has anything changed?" Certainly one thing that hasn't changed is that the rally remains intact.

But the real market action may be delayed. Often, the real market move happens post-fed, and we still have some unemployment numbers to deal with later in the week, so nothing is a given at this point.

As expected, the FOMC plans to implement further quantitative easing to the tune of $600B over time and kept the federal funds rate unchanged at 0.00% to 0.25%. This caused to dollar to end the day with a 0.4% loss, which is probably why the market managed a modest gain.

Treasuries were enjoying a moderate rally up until the Fed announcement. Our F fund, which we track using AGG, was up as much as about 0.3% prior to the announcement, but then sold off and ended the day relatively flat.

There were some economic reports released early in the day that didn't really seem to have much of an impact on trading. The ADP Employment Change for October showed that private payrolls were up by 43,000. The October ISM Service Index was 54.3, a bit higher than anticipated, while September factory orders increased 2.1%, which was also higher than expected.

Here's today's charts:

NAMO and NYMO remain on buys.

NAHL and NYHL also remain on buys.

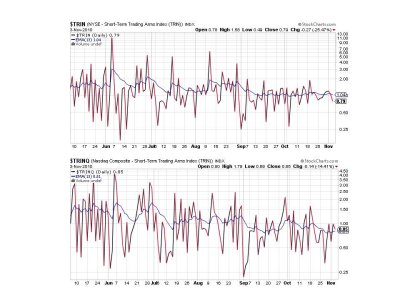

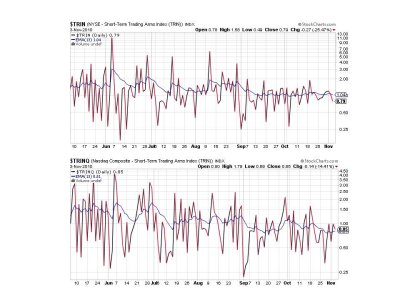

TRIN is on a buy, but TRINQ is flashing a weak sell.

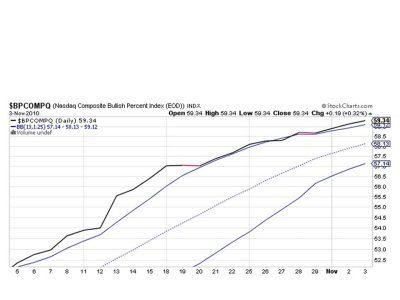

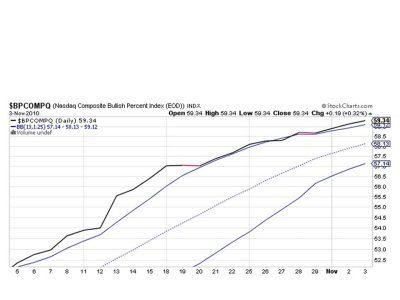

BPCOMPQ continued its slow ebb higher and also remains on a buy.

So 6 of 7 signals are flashing buys, which keeps the system on a buy. Sentiment continues to be mixed and every time the market gets some selling pressure, the dip buyers have usually stepped in to pick it back up. With the exception of a one day sell signal in early October, the Sentinels have been on a buy since the first week of September. So while they missed the initial move higher, they've caught the bulk of these gains up to this point. And it could continue, which is a big reason why I kept a small position in the market even when the Sentinels were flirting with a sell signal.

Next up, initial and continuing claims before the open tomorrow. And it's now post-fed. The fun never stops.

But the real market action may be delayed. Often, the real market move happens post-fed, and we still have some unemployment numbers to deal with later in the week, so nothing is a given at this point.

As expected, the FOMC plans to implement further quantitative easing to the tune of $600B over time and kept the federal funds rate unchanged at 0.00% to 0.25%. This caused to dollar to end the day with a 0.4% loss, which is probably why the market managed a modest gain.

Treasuries were enjoying a moderate rally up until the Fed announcement. Our F fund, which we track using AGG, was up as much as about 0.3% prior to the announcement, but then sold off and ended the day relatively flat.

There were some economic reports released early in the day that didn't really seem to have much of an impact on trading. The ADP Employment Change for October showed that private payrolls were up by 43,000. The October ISM Service Index was 54.3, a bit higher than anticipated, while September factory orders increased 2.1%, which was also higher than expected.

Here's today's charts:

NAMO and NYMO remain on buys.

NAHL and NYHL also remain on buys.

TRIN is on a buy, but TRINQ is flashing a weak sell.

BPCOMPQ continued its slow ebb higher and also remains on a buy.

So 6 of 7 signals are flashing buys, which keeps the system on a buy. Sentiment continues to be mixed and every time the market gets some selling pressure, the dip buyers have usually stepped in to pick it back up. With the exception of a one day sell signal in early October, the Sentinels have been on a buy since the first week of September. So while they missed the initial move higher, they've caught the bulk of these gains up to this point. And it could continue, which is a big reason why I kept a small position in the market even when the Sentinels were flirting with a sell signal.

Next up, initial and continuing claims before the open tomorrow. And it's now post-fed. The fun never stops.