It hasn't been by leaps and bounds, but stocks ended April in bullish fashion nonetheless.

What's interesting, is that overall volume for most of April was lackluster. The NYSE never had a day that saw volume exceed 1 billion shares. This is a manufactured advance in my mind, but who cares as long as one is invested as it moves along.

Earnings have been overwhelmingly positive since reports began to come out and today was no different, but there were some surprises. Here's that latest batch of companies and how they fared:

Caterpillar (CAT 115.41, +2.77), Merck (MRK 35.95, +0.18), Microsoft (MSFT 25.92, -0.79), Research In Motion (RIMM 48.65, -7.94), Occidental Petroleum (OXY 114.29, +9.16), and Chevron (CVX 109.44, +0.63).

As the dollar has dropped, oil has risen. Today, a barrel of oil hit more than $114 at one point, but it fell back modestly before the close to settle at $113.84 per barrel.

And can you believe gold? The precious metal hit a record high of almost $1570 an ounce before closing at $1556.30. Silver is sitting at $48.54 per ounce.

It certainly seems as though that last dip we had allowed the market re-energize for a push up and through the highs from February. The S&P 500 is now well above its February high, but I'm not going to forget about that gap below. And while it's hard to be bearish here, with volume so lackluster how much can possibly be left in the tank before another dip? And if that gap is a target, it'll be a hard drop.

Here's today's charts:

Both NAMO and NYMO keep pushing higher, but NYMO is now approaching 50, and given this latest advance was over a very short period, I'd not be surprised with a drop soon. Perhaps next week.

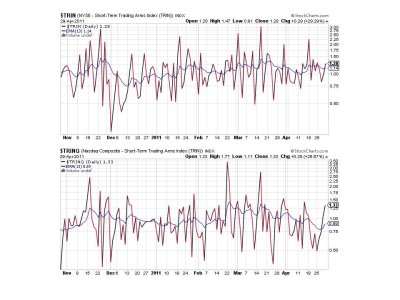

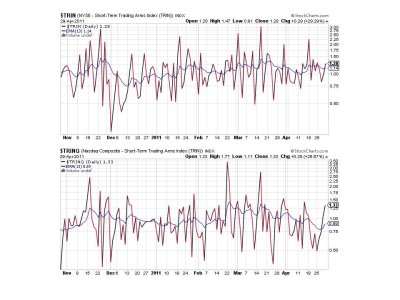

TRIN and TRINQ are both flashing sells now.

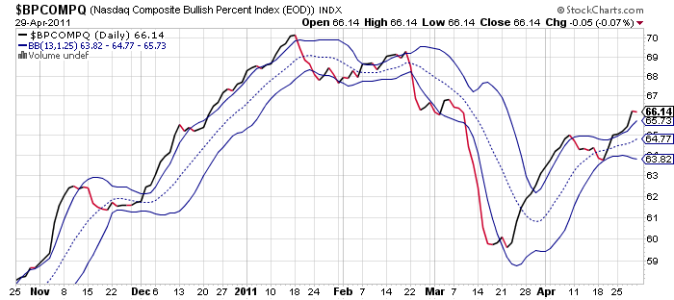

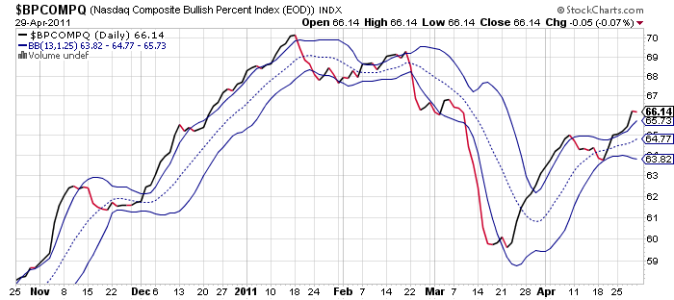

BPCOMPQ ticked just a bit lower today. It's too early to be sure, but it could be a subtle sign of weakness on the horizon. But it's not nearly enough to bet on it.

You may have noticed I didn't post NAHL and NYHL. Those charts aren't being updated on Stockcharts.com this evening for some reason, so I'm just going to post what I can. But regardless of those charts the Seven Sentinels remain on a buy. Monday is May 2nd and IFTs will be available again for all TSP participants. I'll be posting the tracker charts Sunday evening. See you then.

What's interesting, is that overall volume for most of April was lackluster. The NYSE never had a day that saw volume exceed 1 billion shares. This is a manufactured advance in my mind, but who cares as long as one is invested as it moves along.

Earnings have been overwhelmingly positive since reports began to come out and today was no different, but there were some surprises. Here's that latest batch of companies and how they fared:

Caterpillar (CAT 115.41, +2.77), Merck (MRK 35.95, +0.18), Microsoft (MSFT 25.92, -0.79), Research In Motion (RIMM 48.65, -7.94), Occidental Petroleum (OXY 114.29, +9.16), and Chevron (CVX 109.44, +0.63).

As the dollar has dropped, oil has risen. Today, a barrel of oil hit more than $114 at one point, but it fell back modestly before the close to settle at $113.84 per barrel.

And can you believe gold? The precious metal hit a record high of almost $1570 an ounce before closing at $1556.30. Silver is sitting at $48.54 per ounce.

It certainly seems as though that last dip we had allowed the market re-energize for a push up and through the highs from February. The S&P 500 is now well above its February high, but I'm not going to forget about that gap below. And while it's hard to be bearish here, with volume so lackluster how much can possibly be left in the tank before another dip? And if that gap is a target, it'll be a hard drop.

Here's today's charts:

Both NAMO and NYMO keep pushing higher, but NYMO is now approaching 50, and given this latest advance was over a very short period, I'd not be surprised with a drop soon. Perhaps next week.

TRIN and TRINQ are both flashing sells now.

BPCOMPQ ticked just a bit lower today. It's too early to be sure, but it could be a subtle sign of weakness on the horizon. But it's not nearly enough to bet on it.

You may have noticed I didn't post NAHL and NYHL. Those charts aren't being updated on Stockcharts.com this evening for some reason, so I'm just going to post what I can. But regardless of those charts the Seven Sentinels remain on a buy. Monday is May 2nd and IFTs will be available again for all TSP participants. I'll be posting the tracker charts Sunday evening. See you then.