I'm going to make this quick this evening and go right to the charts:

On Friday I said that I believed both NAMO and NYMO had more upside potential, which was primarily a function of momentum, and today we got more upside in spades. Now they're looking toppy, but I'm loath to be too bearish here because these signals can work their way lower without the market giving back substantial gains and today's action put an exclamation point on last week's gains.

NAHL and NYHL didn't seem to be in agreement with NAMO and NYMO last week, but that problem went away today as both pushed higher.

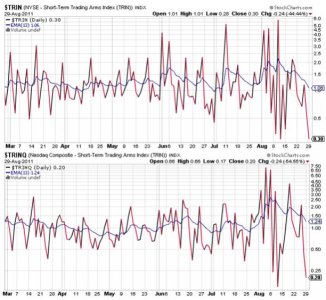

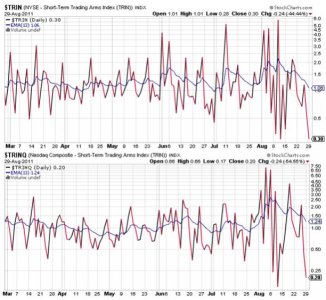

TRIN and TRINQ both spiked lower and are highly suggestive of an overbought market, which usually translates into selling pressure coming into play very soon. Usually the follow day. But the S&P 500 broke out to the upside and that's bullish, so the downside may now be limited.

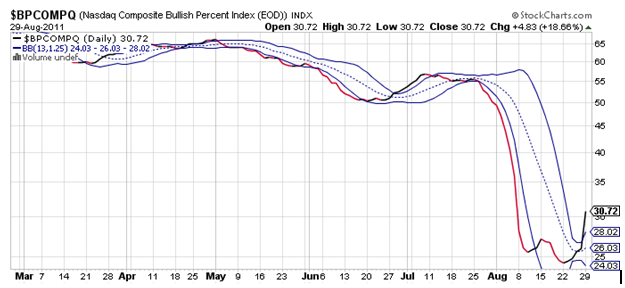

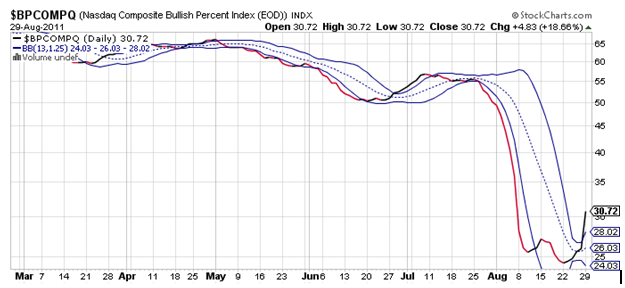

Today's spike in BPCOMPQ makes believing this rally a lot easier. It looks poised to run higher from here.

So all Seven Sentinels remain in buy mode and NYMO blew past its 28 day trading high by a wide margin, which now puts the Seven Sentinels into an intermediate term buy condition.

It's hard to argue with a market that runs in one direction with very little selling pressure in evidence. And the charts now look super bullish. I'd like to tell you that sentiment is probably getting too bulled up now to sustain this up-leg, but that's not a given. Our sentiment survey remains on a hold too. Aside from any short term weakness to work off the current overbought condition, I have to say that it appears this market is heading higher in the weeks to come. It's not a comfortable trade to go long here knowing that global economic issues remain fully intact, but it is what is. I myself still think we could reverse these gains with the right catalyst (excuse).

I will be entering an IFT to put the Seven Sentinels back in a buy condition by the close of business tomorrow. It should go without saying that this market is still not without risk, but each of us has to be weigh our risk tolerance for ourselves. Momentum appears to heavily favor the market right now and pullbacks should probably be bought. Assuming we get one soon.

On Friday I said that I believed both NAMO and NYMO had more upside potential, which was primarily a function of momentum, and today we got more upside in spades. Now they're looking toppy, but I'm loath to be too bearish here because these signals can work their way lower without the market giving back substantial gains and today's action put an exclamation point on last week's gains.

NAHL and NYHL didn't seem to be in agreement with NAMO and NYMO last week, but that problem went away today as both pushed higher.

TRIN and TRINQ both spiked lower and are highly suggestive of an overbought market, which usually translates into selling pressure coming into play very soon. Usually the follow day. But the S&P 500 broke out to the upside and that's bullish, so the downside may now be limited.

Today's spike in BPCOMPQ makes believing this rally a lot easier. It looks poised to run higher from here.

So all Seven Sentinels remain in buy mode and NYMO blew past its 28 day trading high by a wide margin, which now puts the Seven Sentinels into an intermediate term buy condition.

It's hard to argue with a market that runs in one direction with very little selling pressure in evidence. And the charts now look super bullish. I'd like to tell you that sentiment is probably getting too bulled up now to sustain this up-leg, but that's not a given. Our sentiment survey remains on a hold too. Aside from any short term weakness to work off the current overbought condition, I have to say that it appears this market is heading higher in the weeks to come. It's not a comfortable trade to go long here knowing that global economic issues remain fully intact, but it is what is. I myself still think we could reverse these gains with the right catalyst (excuse).

I will be entering an IFT to put the Seven Sentinels back in a buy condition by the close of business tomorrow. It should go without saying that this market is still not without risk, but each of us has to be weigh our risk tolerance for ourselves. Momentum appears to heavily favor the market right now and pullbacks should probably be bought. Assuming we get one soon.