I'm surprised. I expected the seven sentinels to issue a sell signal Friday and much to my astonishment they did not. They're still hanging on. And once again internals seem odd to me. Perhaps some of the signal action is a direct reflection of the underlying bullishness we've seen for so long. A bull this strong is not going down without a fight.

Distribution is evident too. IBD has indicated as much the past couple of days. Buy even IBD was fooled not to long ago when it issued a market in a downtrend decree, only to get whipsawed like the seven sentinels with a blast back to the upside.

I've mentioned that volatility was probably going to increase in the days ahead, and that has certainly been coming to pass. I suspect that the big money is indeed selling into strength, but that doesn't mean they won't use those profits to trick the bears at least one more time. But it's like playing musical chairs at this point. Sooner or later there won't be a chair to sit on and one could find themselves on the wrong side of the market in a big way.

There seems to be more risk right now in maintaining market exposure as we move forward. After all we've come a long way since the March lows and fundamentally I don't see this market continuing to paint a rosy picture of economic health. So timing is everything right now. A more conservative person might take their chips off the table now and not worry about any more upside. They might be more interested in ensuring they've got cash to move back into the market after a large correction has taken place. There's wisdom in that. But one has to be willing to forgo potential gains and not second guess their position.

Then there are those investors who either do not believe this rally is going to end soon, or are willing to take more risk to eke out as much upside as possible.

So think about your investing strategy right now. How much risk are you willing to take? I am not advocating anyone do anything in particular, that's a personal decision. But I can't help but think this market is coming to a crossroad in the next few weeks. I'm feeling the emotion, and I know others are too. Is it the wall of worry? Or is the wall of worry soon to become the slope of hope?

Let's go to the charts:

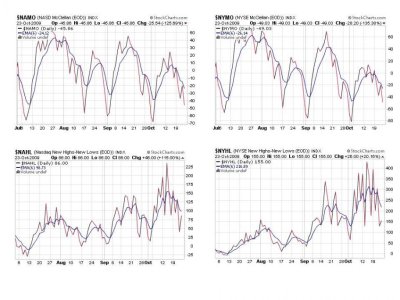

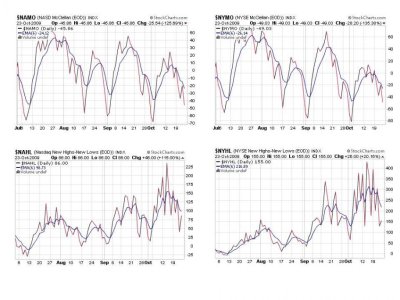

All four of these signals are flashing sells. That's not surprising given Friday's sell-off. But what is surprising is the relative internal strength NAHL and NYHL actually showed in spite of the selling. I did not expect that, which makes me wonder how serious the current bout of weakness really is.

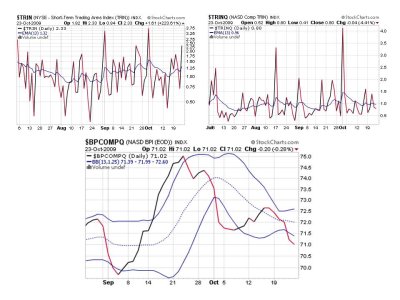

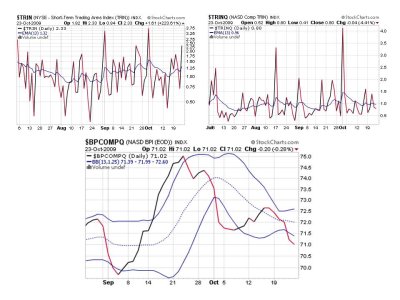

TRIN spiked higher Friday, while TRINQ remained on a buy. Once again I am surprised by this kind of disparity. What is that telling us? I also note that BPCOMPQ, while still on a sell, is not exactly dropping like a lead balloon. It's still giving a reading over 70, which is considered overbought. But in this bull market, that may not be as significant as it appears, as we came from an extremely oversold condition.

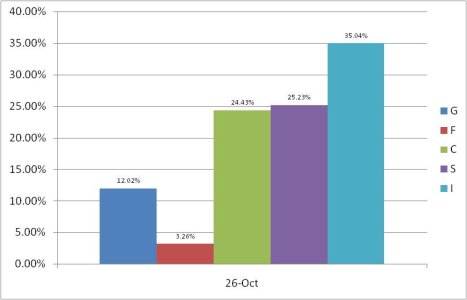

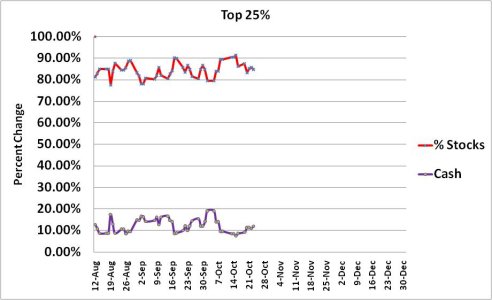

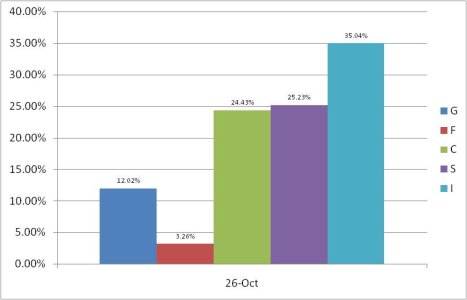

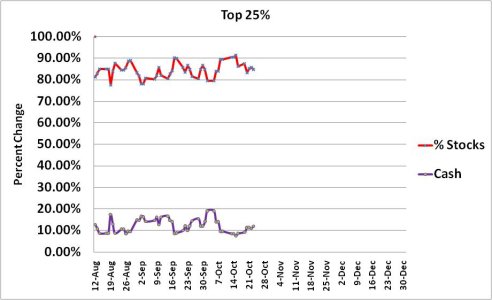

Our top 25% isn't flinching. I'm not sure if they're playing chicken with each other or waiting for someone else to blink, but I'll try not read too much into that other than to state once again what's been obvious for some time; that they're decidedly bullish.

So according to the seven sentinels, we are still in a buy condition, albeit barely. But this is where the market has been whipsawing the system the past few months. What's different though, is how NAHL and NYHL are acting. They actually improved in spite of the selling. The disparity between TRIN and TRINQ was notable too.

Continue to expect volatility. If we are to push higher it will probably be in a nerve wracking manner. Monday's action will be critical as we need to see if we get follow-through after Friday's action. I'm looking for a bounce, but it may come intraday. We'll find out soon enough.

Distribution is evident too. IBD has indicated as much the past couple of days. Buy even IBD was fooled not to long ago when it issued a market in a downtrend decree, only to get whipsawed like the seven sentinels with a blast back to the upside.

I've mentioned that volatility was probably going to increase in the days ahead, and that has certainly been coming to pass. I suspect that the big money is indeed selling into strength, but that doesn't mean they won't use those profits to trick the bears at least one more time. But it's like playing musical chairs at this point. Sooner or later there won't be a chair to sit on and one could find themselves on the wrong side of the market in a big way.

There seems to be more risk right now in maintaining market exposure as we move forward. After all we've come a long way since the March lows and fundamentally I don't see this market continuing to paint a rosy picture of economic health. So timing is everything right now. A more conservative person might take their chips off the table now and not worry about any more upside. They might be more interested in ensuring they've got cash to move back into the market after a large correction has taken place. There's wisdom in that. But one has to be willing to forgo potential gains and not second guess their position.

Then there are those investors who either do not believe this rally is going to end soon, or are willing to take more risk to eke out as much upside as possible.

So think about your investing strategy right now. How much risk are you willing to take? I am not advocating anyone do anything in particular, that's a personal decision. But I can't help but think this market is coming to a crossroad in the next few weeks. I'm feeling the emotion, and I know others are too. Is it the wall of worry? Or is the wall of worry soon to become the slope of hope?

Let's go to the charts:

All four of these signals are flashing sells. That's not surprising given Friday's sell-off. But what is surprising is the relative internal strength NAHL and NYHL actually showed in spite of the selling. I did not expect that, which makes me wonder how serious the current bout of weakness really is.

TRIN spiked higher Friday, while TRINQ remained on a buy. Once again I am surprised by this kind of disparity. What is that telling us? I also note that BPCOMPQ, while still on a sell, is not exactly dropping like a lead balloon. It's still giving a reading over 70, which is considered overbought. But in this bull market, that may not be as significant as it appears, as we came from an extremely oversold condition.

Our top 25% isn't flinching. I'm not sure if they're playing chicken with each other or waiting for someone else to blink, but I'll try not read too much into that other than to state once again what's been obvious for some time; that they're decidedly bullish.

So according to the seven sentinels, we are still in a buy condition, albeit barely. But this is where the market has been whipsawing the system the past few months. What's different though, is how NAHL and NYHL are acting. They actually improved in spite of the selling. The disparity between TRIN and TRINQ was notable too.

Continue to expect volatility. If we are to push higher it will probably be in a nerve wracking manner. Monday's action will be critical as we need to see if we get follow-through after Friday's action. I'm looking for a bounce, but it may come intraday. We'll find out soon enough.