Well, we got the pullback that the Sentinels seemed to indicate we'd get as a result of the toppy readings on NAMO and NYMO, but is the worst over?

Before I get into an analysis let's do a quick review of what led to today's action, and there wasn't much. First, consumer sentiment came in at a 10 month low, which seemed to catch the market by surprise given the depth of selling we saw. Moderate dollar strength also contributed to the downside action. Those seemed to be the two main catalysts, but given the market was overbought it shouldn't come as a surprise that traders found a reason to sell.

The downside action certainly didn't surprise me as I was expecting it, but I was a little surprised not to see much in the way of dip buying later in the day. Futures are green at the moment, but we could see some follow-through to the downside tomorrow morning before we get a reversal, so I'm not expecting a fast move back up, although I don't think it will be long before we resume an upward tack.

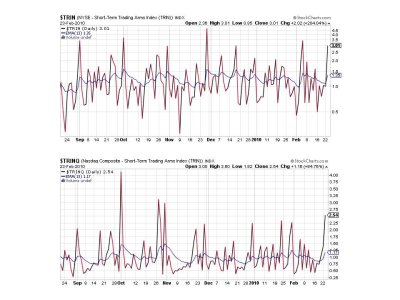

Here's the charts for today:

We got enough selling pressure today to push both NAMO and NYMO under their 6 day EMAs, which flips both to a sell condition. But we aren't too far below the 6 day EMA either, so even if we only chop around for a few days we aren't far from flipping these two signals back to a buy.

Same thing with NAHL and NYHL. They are both on sells now, but can roll back over fairly easy as long as most of the selling is out of the way.

TRIN and TRINQ spiked higher and of course are now on sells. Typically when they reach this extreme reading they reverse within a day or two. This is one of the reason I don't think the selling will last beyond tomorrow, Thursday at the latest.

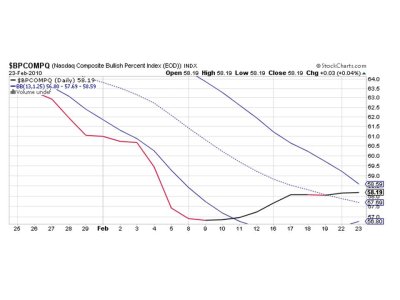

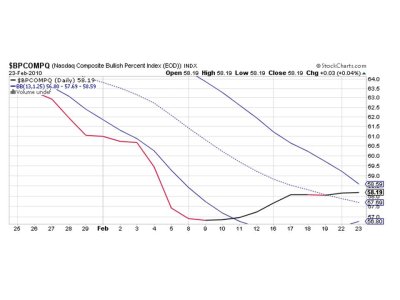

BPCOMPQ actually moved sideways today and remains on a buy. This signal is typically the last one to roll over and it doesn't look like it's about to trigger a sell unless things really fall apart from here. That's not something I'm expecting to see.

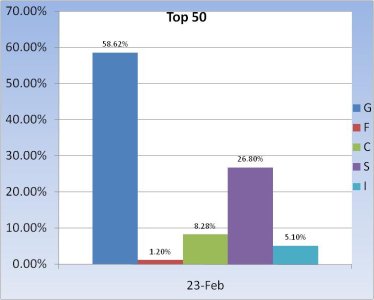

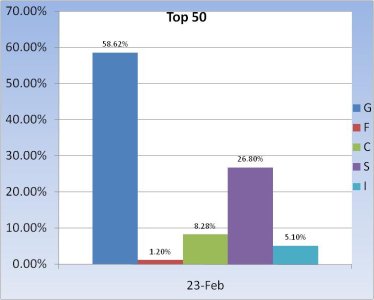

Here is how our Top 50 were positioned for today's action. Obviously it will change after today's bout of selling, so expect to see cash levels rise somewhat.

So 6 of 7 Sentinels are now on a sell, but BPCOMPQ still looks like a robust buy. That can change, but until it does the system remains on a buy. Remember, I'm not expecting to see the system give a sell signal this week given that the several of the SS signals are close to their respective EMAs. But if things do happen to fall apart tomorrow I may have to change my analysis. For today though it's still a buy. See you tomorrow.

Before I get into an analysis let's do a quick review of what led to today's action, and there wasn't much. First, consumer sentiment came in at a 10 month low, which seemed to catch the market by surprise given the depth of selling we saw. Moderate dollar strength also contributed to the downside action. Those seemed to be the two main catalysts, but given the market was overbought it shouldn't come as a surprise that traders found a reason to sell.

The downside action certainly didn't surprise me as I was expecting it, but I was a little surprised not to see much in the way of dip buying later in the day. Futures are green at the moment, but we could see some follow-through to the downside tomorrow morning before we get a reversal, so I'm not expecting a fast move back up, although I don't think it will be long before we resume an upward tack.

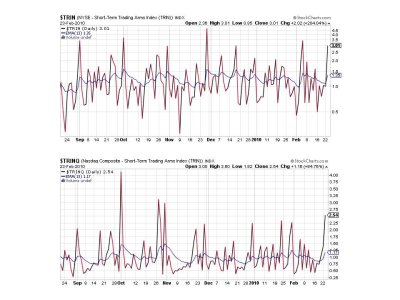

Here's the charts for today:

We got enough selling pressure today to push both NAMO and NYMO under their 6 day EMAs, which flips both to a sell condition. But we aren't too far below the 6 day EMA either, so even if we only chop around for a few days we aren't far from flipping these two signals back to a buy.

Same thing with NAHL and NYHL. They are both on sells now, but can roll back over fairly easy as long as most of the selling is out of the way.

TRIN and TRINQ spiked higher and of course are now on sells. Typically when they reach this extreme reading they reverse within a day or two. This is one of the reason I don't think the selling will last beyond tomorrow, Thursday at the latest.

BPCOMPQ actually moved sideways today and remains on a buy. This signal is typically the last one to roll over and it doesn't look like it's about to trigger a sell unless things really fall apart from here. That's not something I'm expecting to see.

Here is how our Top 50 were positioned for today's action. Obviously it will change after today's bout of selling, so expect to see cash levels rise somewhat.

So 6 of 7 Sentinels are now on a sell, but BPCOMPQ still looks like a robust buy. That can change, but until it does the system remains on a buy. Remember, I'm not expecting to see the system give a sell signal this week given that the several of the SS signals are close to their respective EMAs. But if things do happen to fall apart tomorrow I may have to change my analysis. For today though it's still a buy. See you tomorrow.