It was a choppy trading day to start the new week, but the upward bias was still in evidence as stocks began the session lower and chopped their way modestly higher before some late selling pressure ended the trading day in mixed fashion.

The dollar reversed its recent decline and ended the day down about 0.3%. The pressure was attributed to Fed Chairman Bernanke's weekend interview where he stated the Fed might consider further stimulus if necessary.

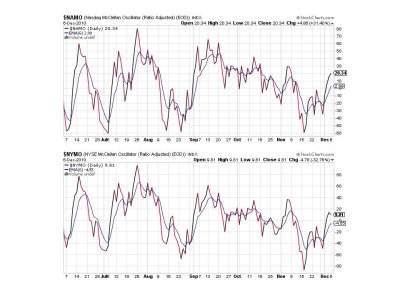

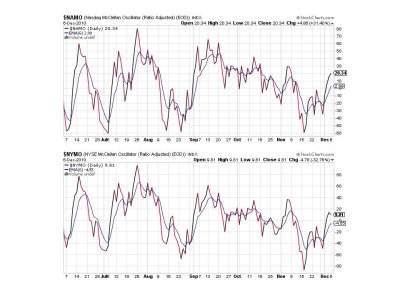

I suppose the big positive here is that the market held on to last week's gains with little trouble. The Seven Sentinels however, fell short of confirming a new Intermediate Term trend. Here's the charts:

NAMO and NYMO remain on buys, but NYMO has still not hit a new 28 day trading high.

NAHL and NYHL also remain on buys.

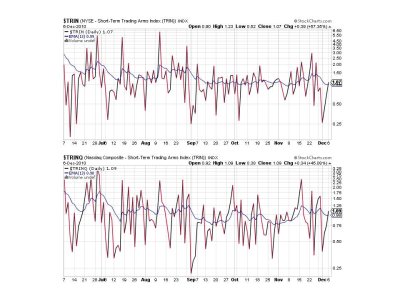

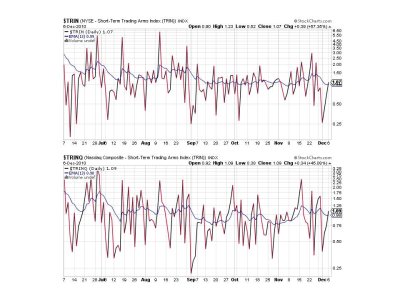

Both TRIN and TRINQ flipped to sells, but they are very close to their respective 6 day EMAs.

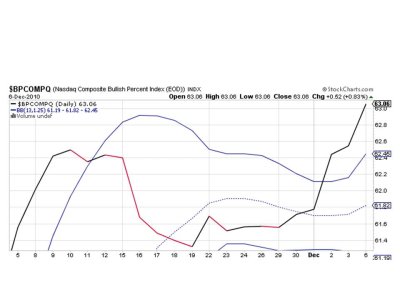

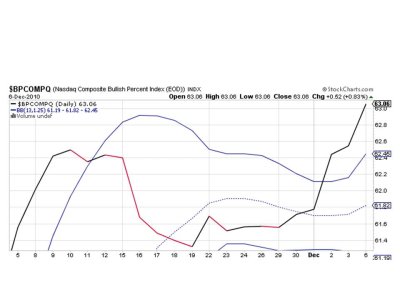

BPCOMPQ continued its bullish trajectory and pulled further away from that upper bollinger band.

So 5 of 7 signals are flashing buys, which keeps the system on a sell.

Seasonality may indeed hold this market together and in fact help it advance, but sentiment is rather bullish, which may be problematic for the market moving forward. The expiring tax cuts are big news right now and it seems our political leaders are getting closer to reaching an agreement. In fact, the President is seeking a one year cut of 2% to the social security tax to sweeten the deal.

http://tinyurl.com/2edf8j4

If this market can propel higher this week, a seven sentinels buy signal will probably occur. But for now it's still a game of wait and see.

The dollar reversed its recent decline and ended the day down about 0.3%. The pressure was attributed to Fed Chairman Bernanke's weekend interview where he stated the Fed might consider further stimulus if necessary.

I suppose the big positive here is that the market held on to last week's gains with little trouble. The Seven Sentinels however, fell short of confirming a new Intermediate Term trend. Here's the charts:

NAMO and NYMO remain on buys, but NYMO has still not hit a new 28 day trading high.

NAHL and NYHL also remain on buys.

Both TRIN and TRINQ flipped to sells, but they are very close to their respective 6 day EMAs.

BPCOMPQ continued its bullish trajectory and pulled further away from that upper bollinger band.

So 5 of 7 signals are flashing buys, which keeps the system on a sell.

Seasonality may indeed hold this market together and in fact help it advance, but sentiment is rather bullish, which may be problematic for the market moving forward. The expiring tax cuts are big news right now and it seems our political leaders are getting closer to reaching an agreement. In fact, the President is seeking a one year cut of 2% to the social security tax to sweeten the deal.

http://tinyurl.com/2edf8j4

If this market can propel higher this week, a seven sentinels buy signal will probably occur. But for now it's still a game of wait and see.