We're not feeling it. It's not that we've pulled back all that much, but we sure haven't embraced the idea of a Santa Claus rally either. And next week we'll be half way into December.

I guess I'm not only one with my guard up.

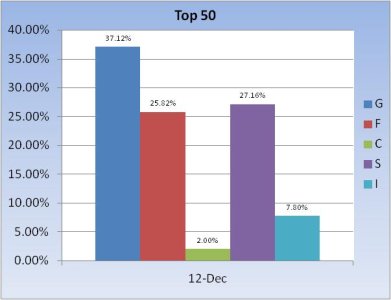

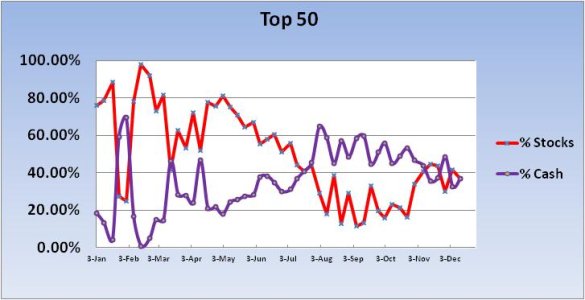

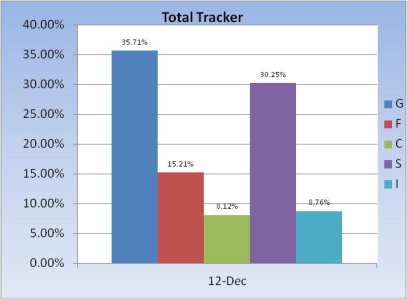

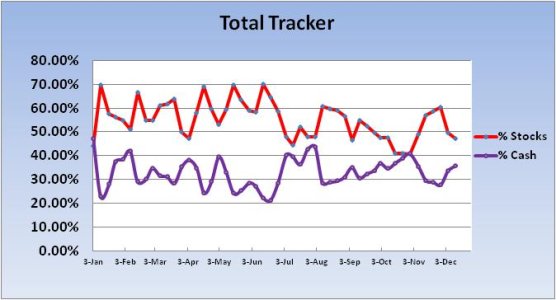

Here's this week's Tracker Charts:

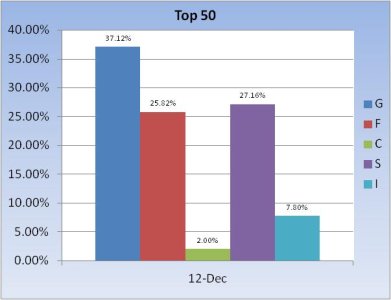

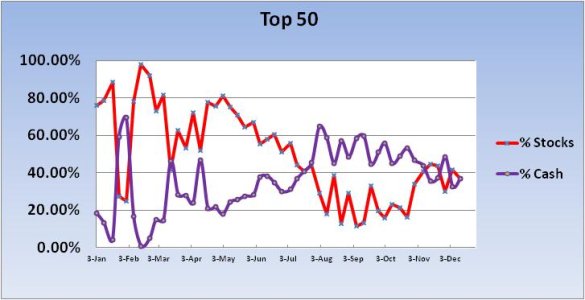

Last week, the Top 50 increased their stock exposure by 11.9% to begin the new week. It paid off with moderate gains if one held that position through the week. This week, they've reduced that exposure by 4.8% to a total stock allocation of 36.96%.

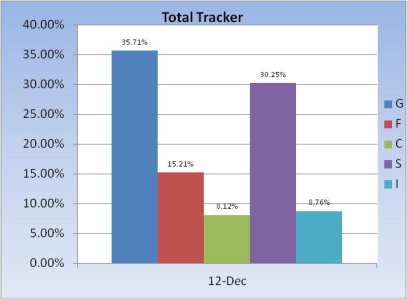

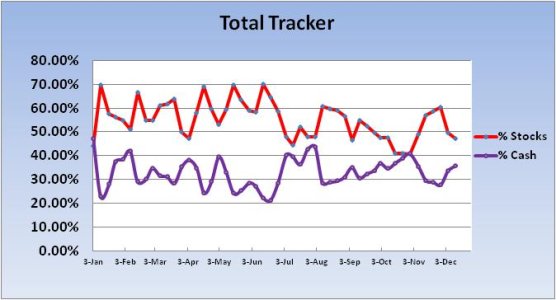

The herd pulled back too. Although they had a higher stock allocation than the Top 50 (49.19%) last week. They pulled back 2.36% to a total stock allocation of 47.13%.

These are defensive positions for both groups given the current technical picture and positive seasonal bias.

My Seven Sentinels charts have been painting a bullish picture of late and in fact have issued 3 unconfirmed buy signals in the past two weeks. That usually means a buy signal is on the way, but this market can be very deceptive and our current collective stock exposure says we're aware of that.

Our sentiment survey also issued yet another sell signal for the new week too. That system has been in a sell or hold (sell) position since the week of 10 October.

So are we overly bearish or simply waiting for the right opportunity?

My own market posture has been quite defensive for some time now. I spend as little time in stocks as possible. I'm more focused on the longer term than the short term, which means I'm bearish longer term, but somewhat bullish shorter term. But that short term is not without risk with the kind of volatility we've become accustomed to seeing. And for me, I'd rather miss out on upside gains right now than be caught on the wrong side of the trade should the bottom fall out of this market. I'll let my ROTH IRAs take that risk, but not my entire portfolio. Perhaps many of us are thinking along those same lines because our stock allocations are not projecting a bullish outlook given seasonality.

I had made a comment in one of my blogs when the market was rallying last month from very low levels that I was concerned the Santa Clause rally was already here. After all, the smart money does love to front run the herd.

And if that turns out to be true, that pot of gold at the end of the rainbow may turn out to be a lump of coal instead.

I guess I'm not only one with my guard up.

Here's this week's Tracker Charts:

Last week, the Top 50 increased their stock exposure by 11.9% to begin the new week. It paid off with moderate gains if one held that position through the week. This week, they've reduced that exposure by 4.8% to a total stock allocation of 36.96%.

The herd pulled back too. Although they had a higher stock allocation than the Top 50 (49.19%) last week. They pulled back 2.36% to a total stock allocation of 47.13%.

These are defensive positions for both groups given the current technical picture and positive seasonal bias.

My Seven Sentinels charts have been painting a bullish picture of late and in fact have issued 3 unconfirmed buy signals in the past two weeks. That usually means a buy signal is on the way, but this market can be very deceptive and our current collective stock exposure says we're aware of that.

Our sentiment survey also issued yet another sell signal for the new week too. That system has been in a sell or hold (sell) position since the week of 10 October.

So are we overly bearish or simply waiting for the right opportunity?

My own market posture has been quite defensive for some time now. I spend as little time in stocks as possible. I'm more focused on the longer term than the short term, which means I'm bearish longer term, but somewhat bullish shorter term. But that short term is not without risk with the kind of volatility we've become accustomed to seeing. And for me, I'd rather miss out on upside gains right now than be caught on the wrong side of the trade should the bottom fall out of this market. I'll let my ROTH IRAs take that risk, but not my entire portfolio. Perhaps many of us are thinking along those same lines because our stock allocations are not projecting a bullish outlook given seasonality.

I had made a comment in one of my blogs when the market was rallying last month from very low levels that I was concerned the Santa Clause rally was already here. After all, the smart money does love to front run the herd.

And if that turns out to be true, that pot of gold at the end of the rainbow may turn out to be a lump of coal instead.