The new trading week is about to begin and our sentiment survey has issued a rare sell signal. I know it influenced my decision for this week as I sold the balance of my stock position, which means I'm currently 100% G fund. Here's the charts:

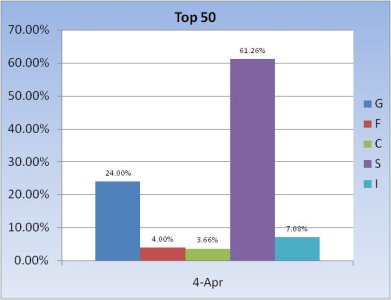

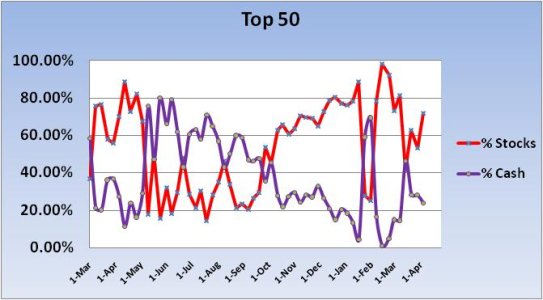

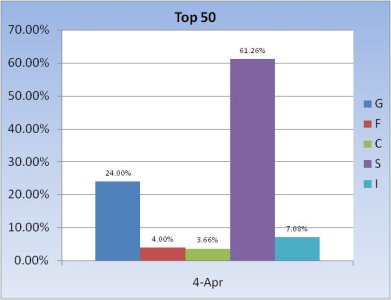

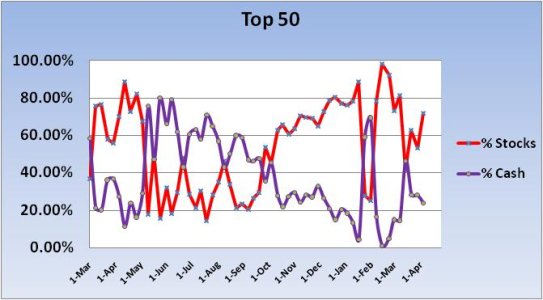

After getting modestly defensive last week, the Top 50 shows much more stock exposure going into the new week. If you remember, last week's charts also showed a very high level of bond market exposure (18.5% in the F fund), which has dropped markedly this week. I suspect this shift is more representative of F fund holders dropping out of the Top 50, while S fund holders moved up. Just when it seemed getting defensive might have been the right short term (one week) strategy, stocks continued to climb anyway.

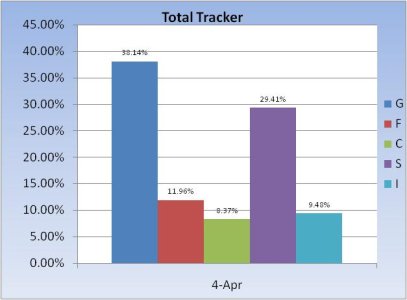

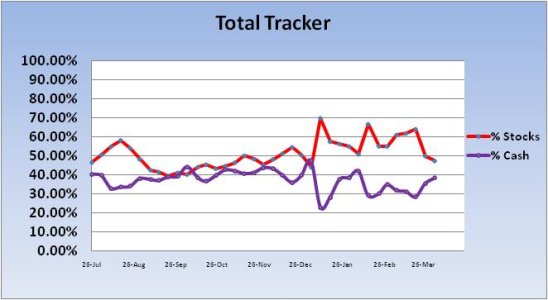

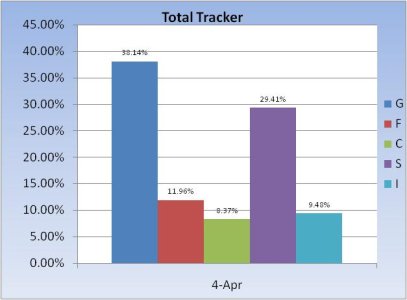

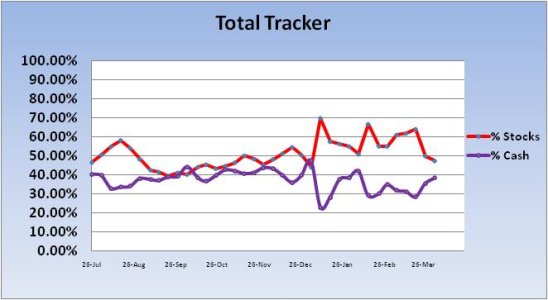

This week the Total Tracker chart shows continued defensive posturing as stock allocations dipped, while the cash level rose. With the sentiment survey sell signal, I would have expected to see a bit more movement to the G fund, but we had a big defensive shift the week prior, so maybe this is about as defensive as we want to get in a longer term bull market.

After getting modestly defensive last week, the Top 50 shows much more stock exposure going into the new week. If you remember, last week's charts also showed a very high level of bond market exposure (18.5% in the F fund), which has dropped markedly this week. I suspect this shift is more representative of F fund holders dropping out of the Top 50, while S fund holders moved up. Just when it seemed getting defensive might have been the right short term (one week) strategy, stocks continued to climb anyway.

This week the Total Tracker chart shows continued defensive posturing as stock allocations dipped, while the cash level rose. With the sentiment survey sell signal, I would have expected to see a bit more movement to the G fund, but we had a big defensive shift the week prior, so maybe this is about as defensive as we want to get in a longer term bull market.