It sure looks like it. After some very choppy trading that saw the broader market gap higher at the open and trade at times with gains in excess of 2%, the market peaked early and then quickly erased the bulk of those gains my mid-morning. It then chopped around in a fairly narrow range for about 2 hours before diving into negative territory in the early afternoon. Just after 3p.m. the market was near its lows of the day, but a late buying surge took the averages higher once again with the S&P 500 posting a respectable 0.85% gain. But not all market averages did so well. The Nasdaq fell 0.43%, but that was well off its lows of the day.

What immediately strikes me is that it appears that the late day buying spree was traders or computer generated buying trying to front run the next rally as today's weakness did bring some of the indexes close to the lower end of their trading range. Will it work yet again? Or will the market finally throw them a curve ball?

Today's strong open was attributed to news that Germany voted in support of expansion of the European Financial Stability Facility, which is yet another attempt to shore up the dire financial problems plaguing the EU.

On the domestic front, another data point was seen as encouraging. The weekly initial jobless claims count fell 37,000 to 391,000. Anything under 400,000 is considered "good" by some pundits.

Another data point, second quarter GDP, showed a growth rate of 1.3%, which bested economists expectations for 1.2% growth.

Tomorrow finishes the 3rd quarter and come Monday, we'll have two new IFTs in our hip pocket.

Here's today's charts:

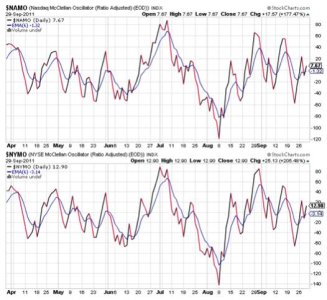

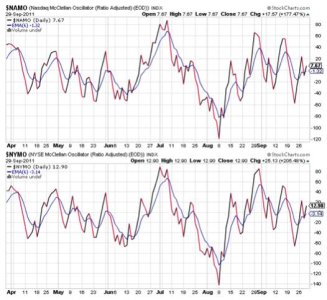

Both NAMO and NYMO flipped back to buy conditions today, but these signals seem to be trending lower since last August. That may be an indication that this market is losing steam. But for the moment they're relatively neutral.

NAHL flipped back to a sell condition, while NYHL came close.

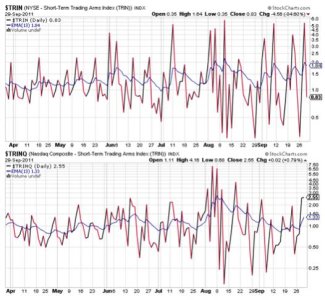

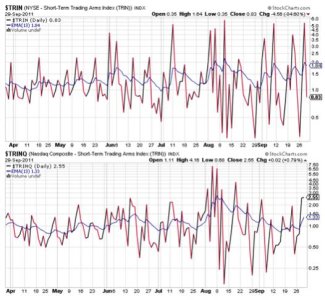

TRIN spiked lower and flipped to a sell condition in the process. TRINQ remained about where it was yesterday. The former is showing a modestly overbought condition, while the latter is showing a modestly oversold condition. I think the biggest thing I see here is that the Nasdaq is showing relative weakness now as opposed to leading the market in strength in past weeks. Is this a clue to market direction moving forward?

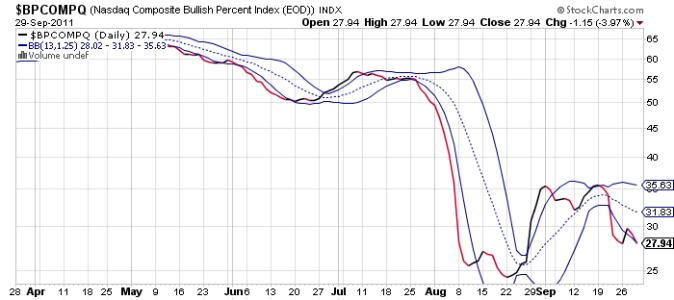

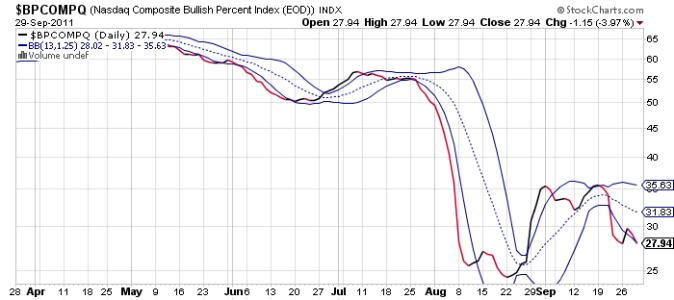

BPCOMPQ fell a bit more and flipped back to a sell condition. The fact that this signal is back below 30 suggests an oversold market (intermediate term).

So the signals remain mixed and the system remains in a sell condition overall.

I continue to be cautiously bearish. I've been looking for some downside action that takes out the August lows, but we've only managed to get close before the bulls step in and launch the market back to the top of the trading channel. The late afternoon rally today may be yet another attempt to repeat that outcome. And I wouldn't bet against it in spite of my bearish sentiment.

What immediately strikes me is that it appears that the late day buying spree was traders or computer generated buying trying to front run the next rally as today's weakness did bring some of the indexes close to the lower end of their trading range. Will it work yet again? Or will the market finally throw them a curve ball?

Today's strong open was attributed to news that Germany voted in support of expansion of the European Financial Stability Facility, which is yet another attempt to shore up the dire financial problems plaguing the EU.

On the domestic front, another data point was seen as encouraging. The weekly initial jobless claims count fell 37,000 to 391,000. Anything under 400,000 is considered "good" by some pundits.

Another data point, second quarter GDP, showed a growth rate of 1.3%, which bested economists expectations for 1.2% growth.

Tomorrow finishes the 3rd quarter and come Monday, we'll have two new IFTs in our hip pocket.

Here's today's charts:

Both NAMO and NYMO flipped back to buy conditions today, but these signals seem to be trending lower since last August. That may be an indication that this market is losing steam. But for the moment they're relatively neutral.

NAHL flipped back to a sell condition, while NYHL came close.

TRIN spiked lower and flipped to a sell condition in the process. TRINQ remained about where it was yesterday. The former is showing a modestly overbought condition, while the latter is showing a modestly oversold condition. I think the biggest thing I see here is that the Nasdaq is showing relative weakness now as opposed to leading the market in strength in past weeks. Is this a clue to market direction moving forward?

BPCOMPQ fell a bit more and flipped back to a sell condition. The fact that this signal is back below 30 suggests an oversold market (intermediate term).

So the signals remain mixed and the system remains in a sell condition overall.

I continue to be cautiously bearish. I've been looking for some downside action that takes out the August lows, but we've only managed to get close before the bulls step in and launch the market back to the top of the trading channel. The late afternoon rally today may be yet another attempt to repeat that outcome. And I wouldn't bet against it in spite of my bearish sentiment.