I'm running late this evening so I'm going straight to the charts:

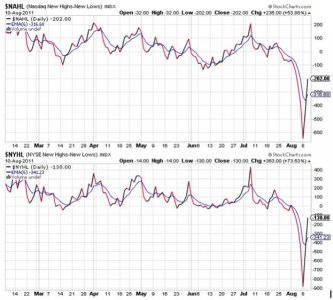

NAMO and NYMO both reversed a bit today, with NAMO flipping back to a sell, while NYMO remained on a buy. This is actually healthy action after yesterday's rally as it's consistent with a bottom "possibly" forming.

NAHL and NYHL actually moved higher today, which I thought was odd, but it could also support the notion that we really are forming a bottom.

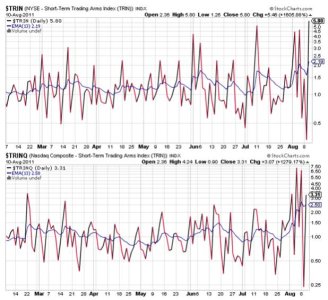

Yesterday I had mentioned that TRIN and TRINQ were highly suggestive of imminent weakness, and we got that today. Now they are back to a very oversold condition and are very suggestive of another rally coming very soon (tomorrow more than likely).

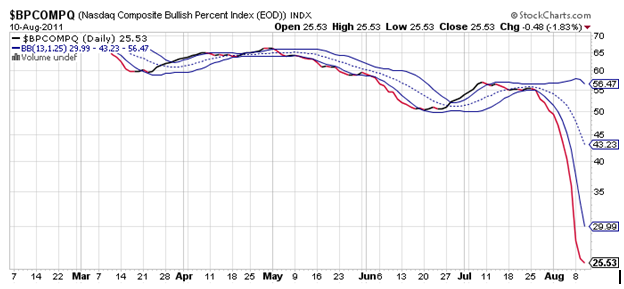

This is where things get a bit interesting. BPCOMPQ looks to be trying to form a bottom as it turned a bit today. It's still very low and is telling me that the market is still oversold in a longer time frame.

So while the system remains in a sell condition, the signals really look to be pointing to a bottoming process in progress. I remain 100% S and I'm still looking to lighten up. The thing to be aware of is that if a bottom is being put in, it's probably only short term (within 2 weeks or so). That's my guess. And the top could be higher than many expect. Perhaps in the mid 1200s for the S&P 500 (1250 or so). But I'm not going to hold a full stock position indefinitley should we begin an up-leg here. If the S&P 500 can get near 1200, I'll begin to raise cash at that point. At least that's my present plan.