After several wild days of extreme volatility the market broke out to the up-side in choppy fashion, posting its second gain in as many days.

Interestingly, the positive tone seemed to start in the EU, where France, Spain, Italy, and Belgium announced a short-selling ban for a limited time frame. I'm not sure I agree that's relevant to managing downside pressure, but the market seemed to like it just the same.

On the domestic front, July retail sales were up 0.5%, while sales less autos saw a 0.2% increase. That was welcome news to a market that's been getting a fairly steady diet of negative headlines. In addition to the positive July retail sales numbers, June's sales were revised upward as well.

But while retail sails helped the market pick up where yesterday's trading left off, the preliminary Consumer Sentiment Survey for August was released after the first half hour of trade and it came in at 54.9, the worst level since the Carter administration. Economists were looking for something closer to 62.5. Upon receiving that news the market erased all gains in short order, but underlying strength brought the major averages back to begin a recovery to the upside.

So the market seems to have found a short term bottom with today's action, but it should also be noted that treasuries continue to find buyers as well, in spite of yesterday's big sell-off. The benchmark 10-year Note was up almost a point, which brought its yield back down close to 2.25%. So the bond market certainly isn't indicating that the worst is over.

Here's today's charts:

NAMO and NYMO climbed a bit higher today, but are still below the zero line. I expect both to cross up into positive territory before this up-leg is over.

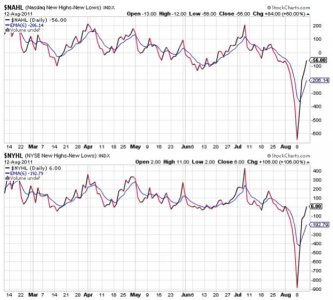

NAHL and NYHL also continued to rise, with NYHL managing to cross over into positive territory.

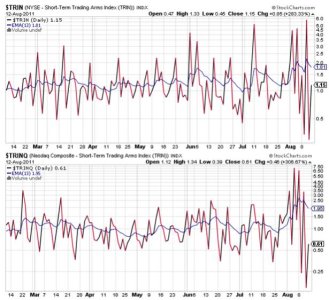

Yesterday TRIN and TRINQ were at extremely low levels, which often results in reversals of direction (as it did earlier in the week). I had said that I was looking for market stability at this point and hoped we'd see enough selling pressure to work off the overbought condition without giving up much of yesterday's gains. The market actually did better than that. We got some selling pressure earlier in the day, but the market didn't go far below the neutral line and ended up at the close with some decent gains. These two signals are still showing an overbought market, but not nearly as much as yesterday. That's a big plus that this market could continue higher in spite of those extreme overbought readings.

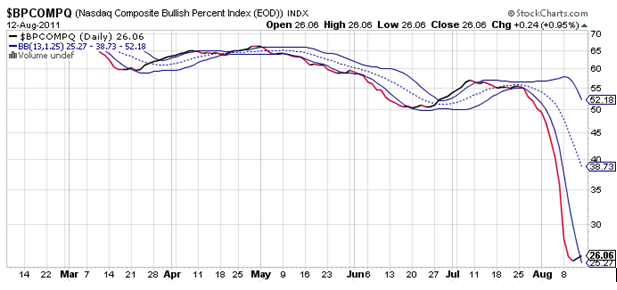

BPCOMPQ ebbed just a bit higher and broke through the lower bollinger band, which technically triggers a buy condition for this signal. But I'm not ready to cheer just yet. I'd prefer to see a solid move higher rather than the tentative buy this signal seems to be showing. But I'm not going to read too much into that for the moment. I suspect the signal will make another move higher early next week.

So if you're counting, all seven sentinels are flashing buys, which puts the system in an "UNCONFIRMED" buy condition. But officially the Seven Sentinels remain in sell mode.

So this market did what I expected and maybe a bit more today. I am fairly confident of higher prices early next week, but that confidence only goes out 2 or 3 days at most. This market still has much to prove as far as I am concerned. But for the moment I'll focus on what's in front of me, and that's a short term bullish market as reflected in the Seven Sentinels.

I am going to be traveling Sunday, so I'll try to post the tracker charts tomorrow instead. See you then.