It was choppy and it was somewhat volatile, but I'm sure glad to see some measure of follow-through after yesterday's SS buy signal. The S&P still fell short of claiming its 200 dma, but that could be fuel for the shorts to pile in on. Then maybe we can jump the creek.

Today, the nonfarm payrolls report along with the May ADP Employment Change report, showed that private sector payrolls grew by 55,000. But that was under analysts expectations. Still, the market didn't overreact to it.

Initial claims came in at 453,000, which was very close to estimates. Continuing jobless claims moved higher to 4.67 million, which was more than expected. But again, the market didn't overreact.

The ISM Services Index for May came in at 55.4, vice the expected 55.6.

Factory orders for April were up 1.2%; lower than expected.

First quarter nonfarm productivity was up 2.8%, which again was short of the 3.3% projected by analysts. Finally, unit labor costs for the first quarter fell 1.3%, a bit less than expected.

So there wasn't any real big surprises, but the data didn't impress either. So the fact that the market was able to close green a second straight day in spite of lackluster data might be seen as a positive for the bulls.

The market has still left plenty for the bears to worry about as the S&P is still under its 200 dma, volume has been lacking on the upside, and as we saw market data is not inspiring. We could see more chop, but I do feel better about that buy signal yesterday.

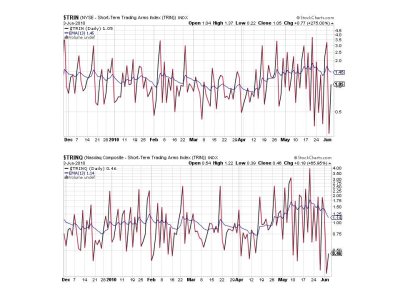

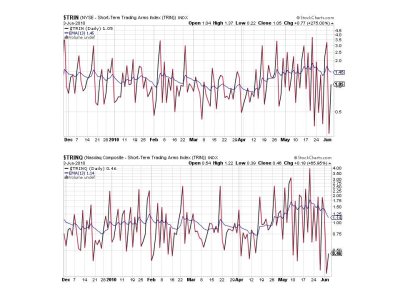

Here's today's charts:

Still on a buy here for both signals and we crossed over into positive territory to boot.

Movement to the upside at last. Two more buys here.

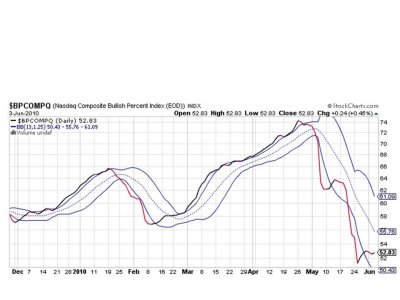

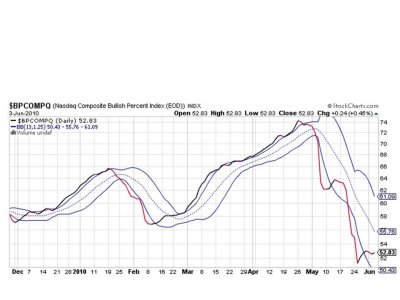

We were able to work off some of yesterday's short term overbought condition, but not enough to push either of these two signals into sell territory.

More upside movement here too. At least now were moving in the right direction. Still on a buy.

So all seven signals remain on a buy, keeping the system on a buy. I feel better about this buy signal after today's action, but I'd like to see the S&P get back above its 200 dma. But if this buy signal continues to prove accurate, it won't be much longer before that happens. See you tomorrow.

Today, the nonfarm payrolls report along with the May ADP Employment Change report, showed that private sector payrolls grew by 55,000. But that was under analysts expectations. Still, the market didn't overreact to it.

Initial claims came in at 453,000, which was very close to estimates. Continuing jobless claims moved higher to 4.67 million, which was more than expected. But again, the market didn't overreact.

The ISM Services Index for May came in at 55.4, vice the expected 55.6.

Factory orders for April were up 1.2%; lower than expected.

First quarter nonfarm productivity was up 2.8%, which again was short of the 3.3% projected by analysts. Finally, unit labor costs for the first quarter fell 1.3%, a bit less than expected.

So there wasn't any real big surprises, but the data didn't impress either. So the fact that the market was able to close green a second straight day in spite of lackluster data might be seen as a positive for the bulls.

The market has still left plenty for the bears to worry about as the S&P is still under its 200 dma, volume has been lacking on the upside, and as we saw market data is not inspiring. We could see more chop, but I do feel better about that buy signal yesterday.

Here's today's charts:

Still on a buy here for both signals and we crossed over into positive territory to boot.

Movement to the upside at last. Two more buys here.

We were able to work off some of yesterday's short term overbought condition, but not enough to push either of these two signals into sell territory.

More upside movement here too. At least now were moving in the right direction. Still on a buy.

So all seven signals remain on a buy, keeping the system on a buy. I feel better about this buy signal after today's action, but I'd like to see the S&P get back above its 200 dma. But if this buy signal continues to prove accurate, it won't be much longer before that happens. See you tomorrow.