We got the rally I was looking for today. Unfortunately, it was sold before I could lock in any gains. But it wasn't nearly as robust as I'd hoped. I bailed to cash just the same as risk was still high and seems to be ratcheting up.

None of the ecomomic reports carried much weight today, and the market generally shrugged them off. Earnings reports have largely been good, but the market seems to be looking past them. After the close, Yahoo (YHOO) was up +2.9% following Q4 Earnings, which beat estimates by $.04. No reason to expect that news to generate any more interest than other reports have.

There are no economic reports being released tomorrow, but the FOMC annoucement will be released in the afternoon, long after the IFT deadline, and the President's first State of the Union Address will be delivered that evening. Those are both high interest items and there's no telling how the market will react to them. The FOMC annoucement may be anticlimactic as it's been the past few releases, but I wouldn't be surprised if the President's speech sets the tone for Thursday's trading.

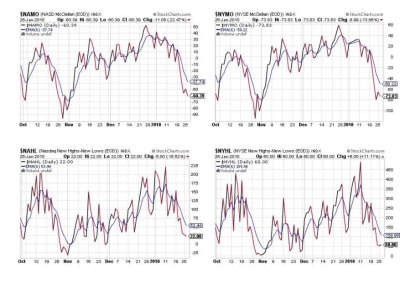

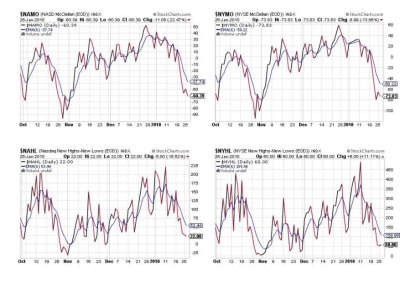

Here's today's charts:

Still flashing sells here.

TRIN is close to a sell, while TRINQ remained on a buy. BPCOMPQ continued to drop, which suggests the trend has changed.

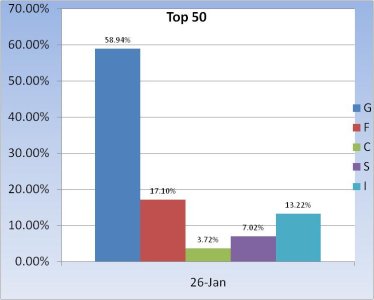

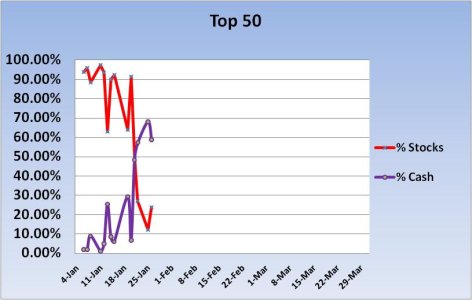

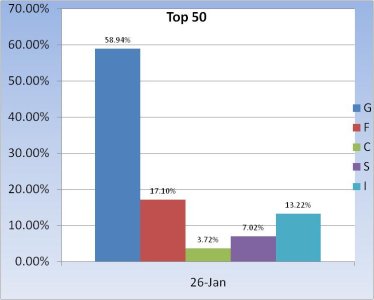

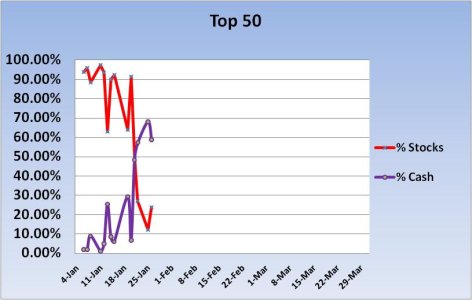

Our Top 15 made only a minor change today, so I'm not going to post those charts, but our Top 50 moved a bit of cash into stocks yesterday for today's trading action. They are still holding a lot of cash though.

So the SS remain in a sell condition going into tomorrow. Bottom pickers are popping up on various message boards and bullish sentiment is rising in some pockets. So far, we haven't seen the kind of carnage we saw last week, but the rally has not been inspiring. I took my best shot at some gains today in a risky end-of-month trade, but the market couldn't hold it's intraday gains into the close. It was worth a try, but I wasn't going to stick around very long in a market that appears poised to deteriorate further. That's it for today. See you tomorrow after the FOMC annoucement.

None of the ecomomic reports carried much weight today, and the market generally shrugged them off. Earnings reports have largely been good, but the market seems to be looking past them. After the close, Yahoo (YHOO) was up +2.9% following Q4 Earnings, which beat estimates by $.04. No reason to expect that news to generate any more interest than other reports have.

There are no economic reports being released tomorrow, but the FOMC annoucement will be released in the afternoon, long after the IFT deadline, and the President's first State of the Union Address will be delivered that evening. Those are both high interest items and there's no telling how the market will react to them. The FOMC annoucement may be anticlimactic as it's been the past few releases, but I wouldn't be surprised if the President's speech sets the tone for Thursday's trading.

Here's today's charts:

Still flashing sells here.

TRIN is close to a sell, while TRINQ remained on a buy. BPCOMPQ continued to drop, which suggests the trend has changed.

Our Top 15 made only a minor change today, so I'm not going to post those charts, but our Top 50 moved a bit of cash into stocks yesterday for today's trading action. They are still holding a lot of cash though.

So the SS remain in a sell condition going into tomorrow. Bottom pickers are popping up on various message boards and bullish sentiment is rising in some pockets. So far, we haven't seen the kind of carnage we saw last week, but the rally has not been inspiring. I took my best shot at some gains today in a risky end-of-month trade, but the market couldn't hold it's intraday gains into the close. It was worth a try, but I wasn't going to stick around very long in a market that appears poised to deteriorate further. That's it for today. See you tomorrow after the FOMC annoucement.