FogSailing

Market Veteran

- Reaction score

- 61

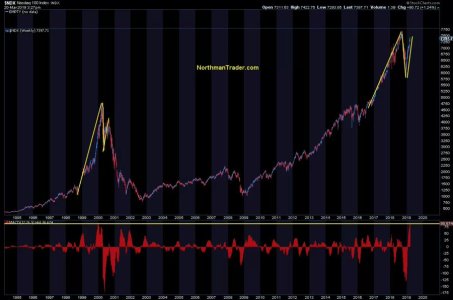

Ok, we just dropped below support at 2752 so 2739 is up on deck. After that 2723 I believe is the next pit stop. Between these points who knows what happens before a return to the downside. But I'm still looking at 2560 before we see a substantial rebound and I still think we see a 4-6% correction before the broader market turns around.