After another bout of Euro debt fear hit the markets yesterday, today saw a Portuguese debt auction draw strong demand. That seemed to be the catalyst to send overseas markets higher.

Here at home the Fed's Beige Book didn't get much reaction, and at the close of trading consumer credit data showed another drop in July of $3.6 billion. So consumer credit has tightened now for 17 of the last 18 months.

Volume remains unimpressive. Today was the fourth trading day in a row where the NYSE didn't reach 1 billion shares traded. This is a trend which now sees the 50-day moving average drop to less than 1.1 billion shares. That's down from two months ago when volume averaged 1.5 billion.

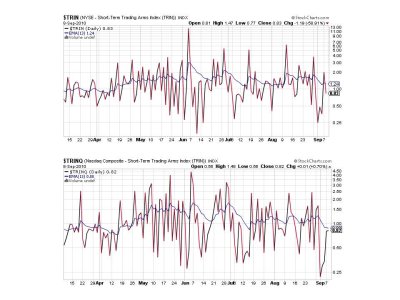

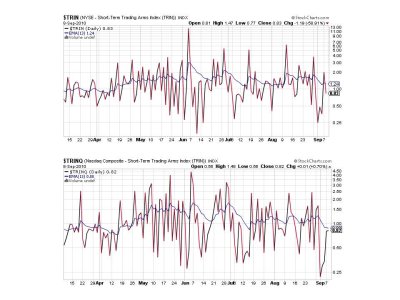

The Seven Sentinels didn't change much today. We may be in a consolidation pattern, but which way will it break? Here's the charts:

Today's rally didn't make up for yesterday's losses and momentum is waning a bit. But that by itself isn't very telling.

NAHL and NYHL moved back up a bit today and remain on buys.

Both TRIN and TRINQ are flashing buys.

BPCOMPQ has not turned back down and did managed to ebb just a bit higher today.

So all signals remain on buys, but NYMO has still not moved above its 28 day trading high so the system remains on a sell.

I am not bullish, but I'm also aware of sentiment remaining fairly beared up, which could keep this market afloat and even provide for some melt up action. But this is also a market that's very vulnerable to news and can make a run in either direction very quickly. This is especially true given the very low volume trading activity. Although I still have a sell signal in force, if we get enough upside pressure we can still trip the sytem back to a buy. But the EMAs are drifting higher while this market plays out, so any major selling pressure could turn these charts bearish in a hurry.

What I'm saying here is the market appears to be at a crossroad, which makes it difficult commit to either side.

Still 100% G fund here.

Here at home the Fed's Beige Book didn't get much reaction, and at the close of trading consumer credit data showed another drop in July of $3.6 billion. So consumer credit has tightened now for 17 of the last 18 months.

Volume remains unimpressive. Today was the fourth trading day in a row where the NYSE didn't reach 1 billion shares traded. This is a trend which now sees the 50-day moving average drop to less than 1.1 billion shares. That's down from two months ago when volume averaged 1.5 billion.

The Seven Sentinels didn't change much today. We may be in a consolidation pattern, but which way will it break? Here's the charts:

Today's rally didn't make up for yesterday's losses and momentum is waning a bit. But that by itself isn't very telling.

NAHL and NYHL moved back up a bit today and remain on buys.

Both TRIN and TRINQ are flashing buys.

BPCOMPQ has not turned back down and did managed to ebb just a bit higher today.

So all signals remain on buys, but NYMO has still not moved above its 28 day trading high so the system remains on a sell.

I am not bullish, but I'm also aware of sentiment remaining fairly beared up, which could keep this market afloat and even provide for some melt up action. But this is also a market that's very vulnerable to news and can make a run in either direction very quickly. This is especially true given the very low volume trading activity. Although I still have a sell signal in force, if we get enough upside pressure we can still trip the sytem back to a buy. But the EMAs are drifting higher while this market plays out, so any major selling pressure could turn these charts bearish in a hurry.

What I'm saying here is the market appears to be at a crossroad, which makes it difficult commit to either side.

Still 100% G fund here.