The market started off with some healthy gains in early trading, but traders seem to be uncertain that this market can significantly add to gains in such an uncertain economic climate. And share volume on the NYSE seems to suggest just that with less than 1 billion shares traded on the day.

Market data was limited, but the July Producer Price Index did see a 0.2% increase, while core prices jumped 0.4%. Both exceeded economist's forecast.

Here's today's charts:

NAMO and NYMO both ticked just a bit higher today and remain in buy conditions.

NAHL dipped a bit lower, while NYHL eked out a slight gain. Both also remain in buy conditions.

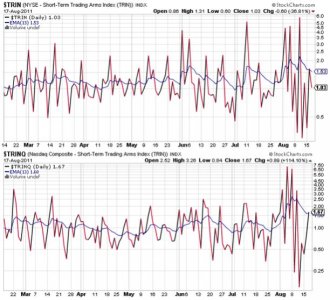

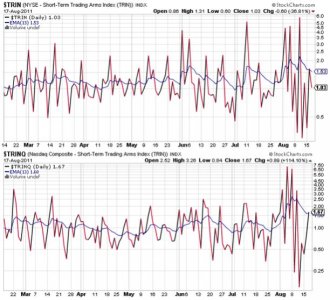

TRIN fell back into a buy condition, while TRINQ just did manage to flip to a sell.

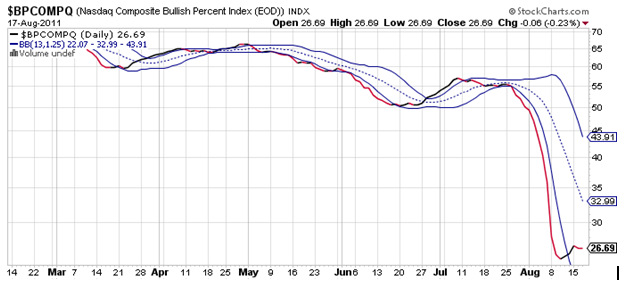

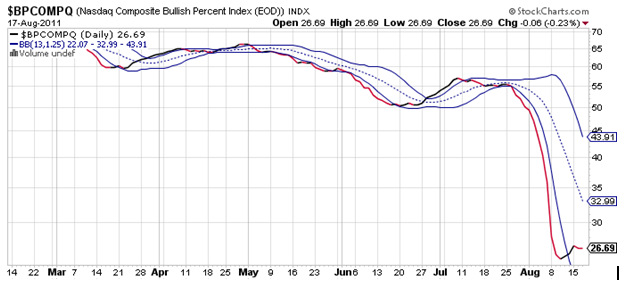

BPCOMPQ tracked sideways and remains in a buy condition.

So not much changed today. The Seven Sentinels remain on an unconfirmed buy, while officially, the system remains in a sell condition.

The market seems to have flattened out, which isn't a surprise. I'm expecting mostly a choppy market for now until some news catalyst propels the market higher or sends it back down to test the lows. So we could find ourselves in a trading range over the days ahead. I have no strong feelings about where this market goes right now, as the signals also seem to be somewhat neutral. BPCOMPQ does suggest we have more upside left, but only because it remains below 30.

I continue to wait this market out in the F fund myself. And I do have one more IFT at my disposal. But I'm in no hurry to use it, if it gets used at all, unless I see a good bullish set-up. Patience is the name of the game for now.

Market data was limited, but the July Producer Price Index did see a 0.2% increase, while core prices jumped 0.4%. Both exceeded economist's forecast.

Here's today's charts:

NAMO and NYMO both ticked just a bit higher today and remain in buy conditions.

NAHL dipped a bit lower, while NYHL eked out a slight gain. Both also remain in buy conditions.

TRIN fell back into a buy condition, while TRINQ just did manage to flip to a sell.

BPCOMPQ tracked sideways and remains in a buy condition.

So not much changed today. The Seven Sentinels remain on an unconfirmed buy, while officially, the system remains in a sell condition.

The market seems to have flattened out, which isn't a surprise. I'm expecting mostly a choppy market for now until some news catalyst propels the market higher or sends it back down to test the lows. So we could find ourselves in a trading range over the days ahead. I have no strong feelings about where this market goes right now, as the signals also seem to be somewhat neutral. BPCOMPQ does suggest we have more upside left, but only because it remains below 30.

I continue to wait this market out in the F fund myself. And I do have one more IFT at my disposal. But I'm in no hurry to use it, if it gets used at all, unless I see a good bullish set-up. Patience is the name of the game for now.