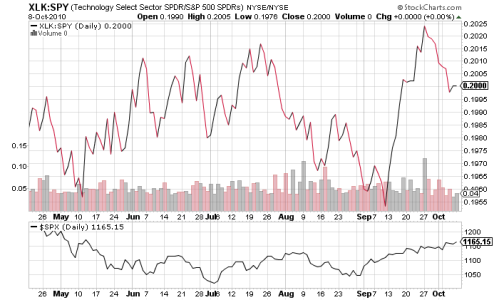

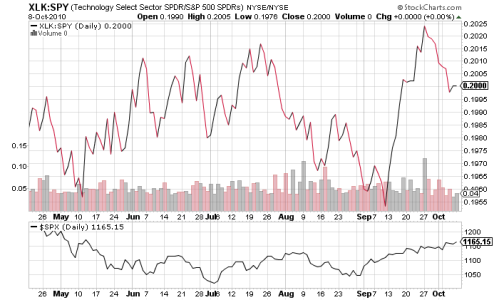

A little fun with charts this morning. Readers of the Banks thread know that I have been banging my fist on the table regarding underperformance by the financial sector for all of 2010 now. According to Standard and Poors, Financials comprise 15.71% of the S&P 500 Index which stands second only to Tech which makes up 18.71%. 3rd place is Health Care at 11.5%. So with this in mind, both Financials and Tech should at least be in line with the index or better as far as performance. A look at the charts. Note the SPX performance during the same time period below.

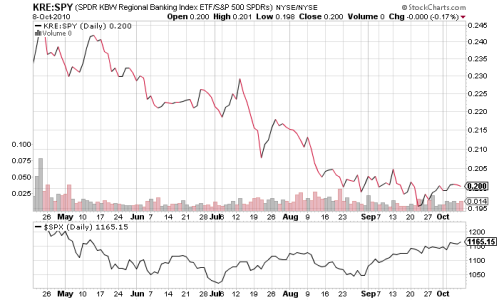

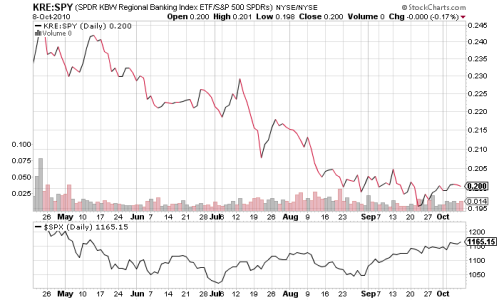

Regional banks, underperforming

Bank Index, underperforming

Financial index, underperforming badly

Why do I continue to beat a dead horse on financials? Well, partially because I am a lone bear right now defending my stance, but the financials need to perform for any rally to be the real deal. And, the fact that the financials make up a large part of the S&P 500 makes their participation all the more important.

Bulls will say, so what the market is going up. Truth is, that as a 'bull' market (or bear market rally) progresses, less sectors play a part in it's move up as investors shuffle their money into the bright spot sectors until there is nothing left worth investing in. Think 2008 with China.

Oh, one more for the bulls since I did mention Technology. A bit of short covering in the past few weeks?

Regional banks, underperforming

Bank Index, underperforming

Financial index, underperforming badly

Why do I continue to beat a dead horse on financials? Well, partially because I am a lone bear right now defending my stance, but the financials need to perform for any rally to be the real deal. And, the fact that the financials make up a large part of the S&P 500 makes their participation all the more important.

Bulls will say, so what the market is going up. Truth is, that as a 'bull' market (or bear market rally) progresses, less sectors play a part in it's move up as investors shuffle their money into the bright spot sectors until there is nothing left worth investing in. Think 2008 with China.

Oh, one more for the bulls since I did mention Technology. A bit of short covering in the past few weeks?