After a fast, short-term up-leg, traders picked up their selling interest again and dealt the major averages hefty losses across the board.

Perhaps we're seeing some front-running of a potential sell-the-news trade centering on any comments the Fed Chair may give regarding monetary policy moving forward, but there were other interesting cross-currents too.

For one, Apple's Steve Jobs announced he was finally stepping down as CEO of one of the market's stellar companies. And Warren Buffet was in the news once again, as he announced he was investing $5B in Bank of America's preferred stock. Up until this point, Bank of America's stock had been reeling for most of August, but today the stock got some relief to the tune of a 9.44% gain.

Overseas, there was speculation that Germany could lose its AAA credit rating, although those rumors were quickly denied by the major rating agencies.

As far as market data, the latest initial jobless claims number came in at 417,000, which was above economist's expectations of 400,000 claims.

And while stocks saw some serious selling pressure in today's action, gold was only able to manage a 0.3% gain at $1762.80 per ounce.

Treasuries bounced back a bit too with the 10-year Note retracing much of yesterday's losses. It's yield is now at 2.23%.

Here's today's charts:

NAMO and NYMO both fell back into negative territory today, but did retain their buy condition status.

NAHL and NYHL also remain in a buy status.

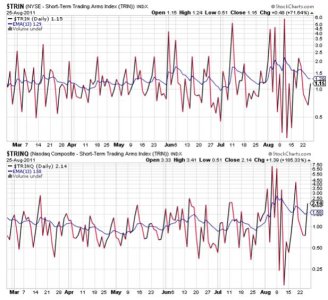

Both TRIN and TRINQ turned up, with the former remain on a buy, while the latter flipped to a sell. Both are relatively neutral now.

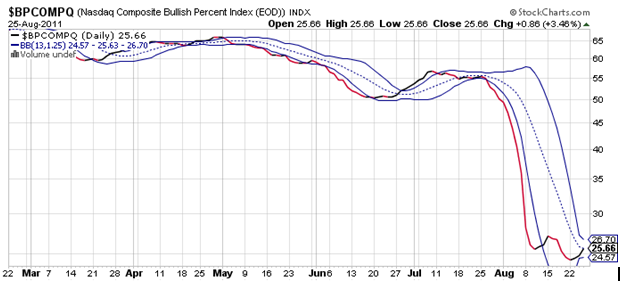

BPCOMPQ managed to ebb a bit higher today and remains in a buy status. Normally, this signal takes more than a day to change direction should the trend itself change, so follow through action to the downside tomorrow could turn this signal back down again. Note too that the lower bollinger band is very close to that signal, so it could flip back to a sell fairly quickly depending on how robust any further selling pressure may be (should we get some).

So nothing has changed just yet as the system retains its unconfirmed buy status, but officially it remains on an intermediate term sell.

This could go either way at this point. I'm leaning bearish myself since we have yet to confirm a buy signal. On top of any Fed commentary tomorrow, we also have a GDP reading on tap at 0830 EST and a Consumer Sentiment reading at 0855 EST. The Fed Chair speaks at 1000 EST.