While I chose to title this evening's blog with news of the coordinated central bank rescue of global money markets, it was not the only news item of the day. Although I think it's probably the biggest reason for today's massive advance.

At the open, the market gapped higher and never looked back as buying pressure was sustained with an end-of-day short covering rally at the close, which easily allowed the major averages to close at or near their highs of the day. And those highs were remarkable, with the DOW, S&P 500, and Nasdaq all higher by well over 4%. The Wilshire 4500 and EAFE (S and I funds) were higher by over 5%.

The rally started with news that China lowered their reserve requirement ratios for the country's banks. Not long after came news that the Fed had coordinated with several major (global) central banks to ease the global money supply.

As if news of goosing the global economy wasn't enough to cheer the market, we also had a very positive ADP Employment Change report, which showed that private payrolls in November had increased by 206,000. That was well above estimates calling for an increase of 125,000. That same data from October was revised upward to an increase of 130,000.

In the afternoon trading session, the Fed's Beige Book for October was released and seemed to contradict those employment numbers with language that indicated hiring was generally subdued.

Also released in the morning session was the Chicago PMI, which spiked to 62.6 for November (from 58.4). Economists were looking for a modest decline to 57.5.

Another report that carries significant weight was October pending home sales. It spiked a whopping 10.4%, which blew away expectations for a paltry 0.1% increase. (I really have to wonder why estimates were off so badly)

So in just three days the market has pretty much retraced it's seven day decline. And volume was convincing too.

Here's today's charts:

NAMO and NYMO spike higher still and remain in buy conditions. As a side note, NYMO will have to reach a reading above 78 within the next four trading days for the Seven Sentinels to have any chance at achieving an official buy signal. After four days the target drops much lower.

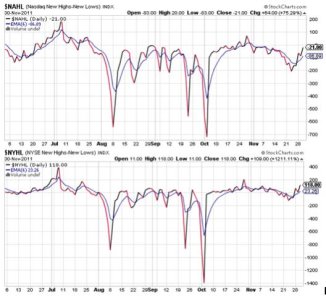

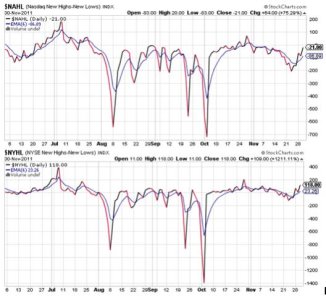

NAHL and NYHL also remain on buys.

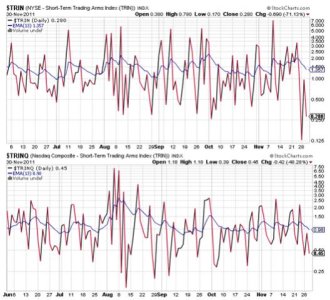

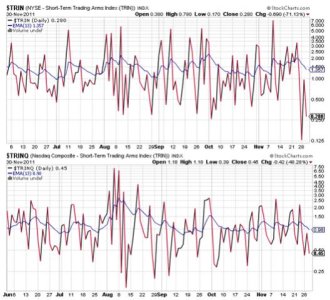

TRIN and TRINQ both moved lower today and together suggest a moderately overbought market.

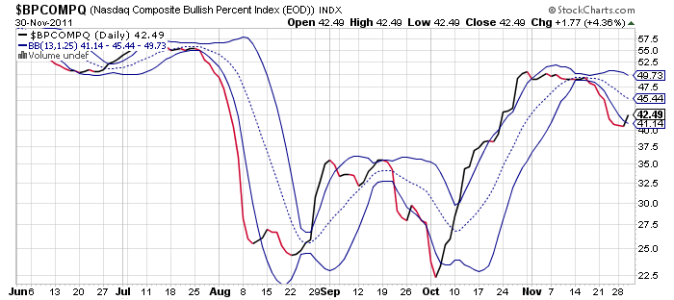

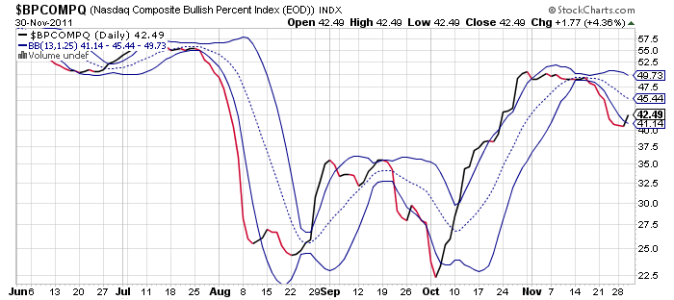

BPCOMPQ turned higher and crossed through the lower bollinger band, which flips it to a buy condition.

So all signals are now in buy conditions, but because NYMO has yet to tag a new 28-day trading high the system remains in an official intermediate term sell condition. However, today's action has also produced an unofficial buy signal, which "may" be an early warning of higher prices to come.

Yesterday I had said the charts suggested more upside, but that the S&P 500 would have to retake its 50 day moving average to get me to believe this rally. We'll we got more upside. Lot's more upside. And the S&P 500 shot well past its 50 dma in the process.

And it's not hard to understand why this market turned so hard and so fast. Central Banks are injecting liquidity to save the global market. Sound good? Perhaps for the short term, but longer term we just kicked the can down the road yet again. The fact is, for the Central Banks to take this kind of drastic action means the European situation was getting dangerous to all concerned. Obviously, this maneuver buys time, but how much?

Here's my opinion. We could go higher. Maybe much higher on the CB action. It seems like a slam dunk, and sentiment was sufficiently bearish to help things along.

But I sold my 50% S fund position today into the rally. Not because I think this upside run is necessarily over, but I don't think CB intervention is a positive over the longer term. And I don't know if that means days, weeks, or months. But since December 1st is tomorrow and I get two new IFTs, I chose to step aside, lock in my gains, and reassess the market over the coming days. My ROTH IRAs remain in the market however, so either way I'm exposed to whatever the market decides to do.

At the open, the market gapped higher and never looked back as buying pressure was sustained with an end-of-day short covering rally at the close, which easily allowed the major averages to close at or near their highs of the day. And those highs were remarkable, with the DOW, S&P 500, and Nasdaq all higher by well over 4%. The Wilshire 4500 and EAFE (S and I funds) were higher by over 5%.

The rally started with news that China lowered their reserve requirement ratios for the country's banks. Not long after came news that the Fed had coordinated with several major (global) central banks to ease the global money supply.

As if news of goosing the global economy wasn't enough to cheer the market, we also had a very positive ADP Employment Change report, which showed that private payrolls in November had increased by 206,000. That was well above estimates calling for an increase of 125,000. That same data from October was revised upward to an increase of 130,000.

In the afternoon trading session, the Fed's Beige Book for October was released and seemed to contradict those employment numbers with language that indicated hiring was generally subdued.

Also released in the morning session was the Chicago PMI, which spiked to 62.6 for November (from 58.4). Economists were looking for a modest decline to 57.5.

Another report that carries significant weight was October pending home sales. It spiked a whopping 10.4%, which blew away expectations for a paltry 0.1% increase. (I really have to wonder why estimates were off so badly)

So in just three days the market has pretty much retraced it's seven day decline. And volume was convincing too.

Here's today's charts:

NAMO and NYMO spike higher still and remain in buy conditions. As a side note, NYMO will have to reach a reading above 78 within the next four trading days for the Seven Sentinels to have any chance at achieving an official buy signal. After four days the target drops much lower.

NAHL and NYHL also remain on buys.

TRIN and TRINQ both moved lower today and together suggest a moderately overbought market.

BPCOMPQ turned higher and crossed through the lower bollinger band, which flips it to a buy condition.

So all signals are now in buy conditions, but because NYMO has yet to tag a new 28-day trading high the system remains in an official intermediate term sell condition. However, today's action has also produced an unofficial buy signal, which "may" be an early warning of higher prices to come.

Yesterday I had said the charts suggested more upside, but that the S&P 500 would have to retake its 50 day moving average to get me to believe this rally. We'll we got more upside. Lot's more upside. And the S&P 500 shot well past its 50 dma in the process.

And it's not hard to understand why this market turned so hard and so fast. Central Banks are injecting liquidity to save the global market. Sound good? Perhaps for the short term, but longer term we just kicked the can down the road yet again. The fact is, for the Central Banks to take this kind of drastic action means the European situation was getting dangerous to all concerned. Obviously, this maneuver buys time, but how much?

Here's my opinion. We could go higher. Maybe much higher on the CB action. It seems like a slam dunk, and sentiment was sufficiently bearish to help things along.

But I sold my 50% S fund position today into the rally. Not because I think this upside run is necessarily over, but I don't think CB intervention is a positive over the longer term. And I don't know if that means days, weeks, or months. But since December 1st is tomorrow and I get two new IFTs, I chose to step aside, lock in my gains, and reassess the market over the coming days. My ROTH IRAs remain in the market however, so either way I'm exposed to whatever the market decides to do.