After the excitement of the past four days, today was downright dull as the broader market chopped around listlessly all day. There was some selling pressure early on, but it didn't last. Monday is the last day of trading for October, which means if you're out of IFTs, Tuesday will fix that problem.

There wasn't much news today, but we did get some data points. Personal income in September was up 0.1%, but that was under economist's expectations for an increase of 0.3%. Personal spending was also up as it rose by 0.6%. That number of was in-line with estimates.

Here's the charts:

NAMO and NYMO dipped modestly, but remain in buy conditions.

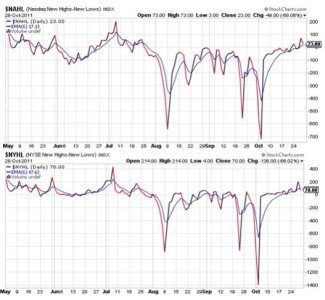

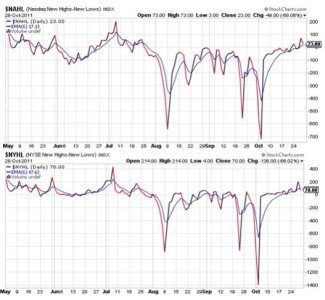

NAHL and NYHL also dipped, but while NAHL remained on a buy, NYHL flipped to a sell.

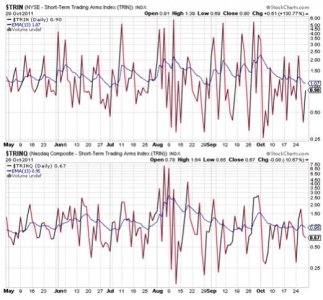

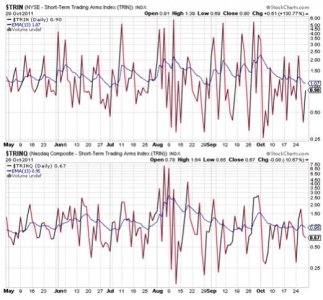

TRIN and TRINQ are also on buys, but are only modestly bullish overall.

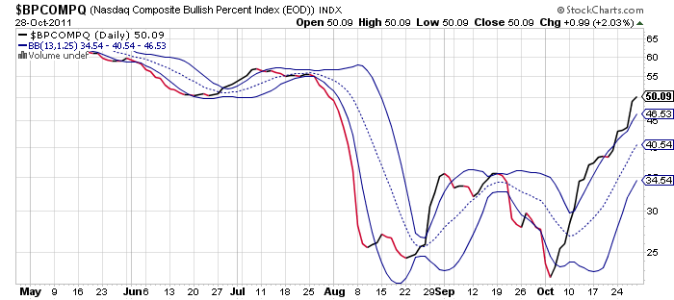

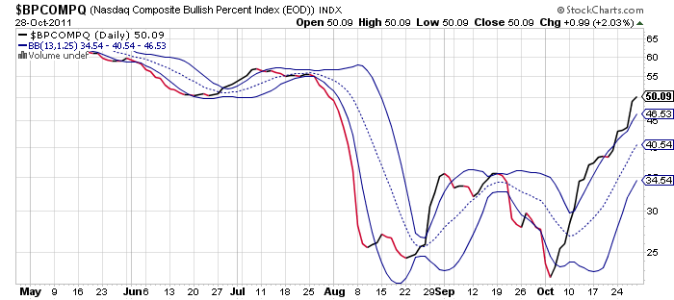

BPCOMPQ keeps stretching to the upside and that keeps in on a buy.

So the signals are mixed, but the Seven Sentinels remain in a buy condition.

Given this October appears to be ending with some of the biggest monthly gains on record, I can't help but wonder what's left for the rest of the year. I'd like to think we'll melt up into the end of year, but I don't think we can do it without seeing some selling pressure soon. I'm out of IFTs at the moment, but I'm not itching to get invested anyway. I do plan to take a different approach to this market in the future, where I'll be making phased buys on weakness and holding through volatility as necessary. As strength presents itself I'll do phased selling as well. But I'm not anticipating making big moves very often, so risk management will still be part of my game plan.

The fact is volatility is difficult to manage in TSP, and it doesn't look like that element of the market will be changing anytime soon.

There wasn't much news today, but we did get some data points. Personal income in September was up 0.1%, but that was under economist's expectations for an increase of 0.3%. Personal spending was also up as it rose by 0.6%. That number of was in-line with estimates.

Here's the charts:

NAMO and NYMO dipped modestly, but remain in buy conditions.

NAHL and NYHL also dipped, but while NAHL remained on a buy, NYHL flipped to a sell.

TRIN and TRINQ are also on buys, but are only modestly bullish overall.

BPCOMPQ keeps stretching to the upside and that keeps in on a buy.

So the signals are mixed, but the Seven Sentinels remain in a buy condition.

Given this October appears to be ending with some of the biggest monthly gains on record, I can't help but wonder what's left for the rest of the year. I'd like to think we'll melt up into the end of year, but I don't think we can do it without seeing some selling pressure soon. I'm out of IFTs at the moment, but I'm not itching to get invested anyway. I do plan to take a different approach to this market in the future, where I'll be making phased buys on weakness and holding through volatility as necessary. As strength presents itself I'll do phased selling as well. But I'm not anticipating making big moves very often, so risk management will still be part of my game plan.

The fact is volatility is difficult to manage in TSP, and it doesn't look like that element of the market will be changing anytime soon.