Evaluating Risk verses Reward

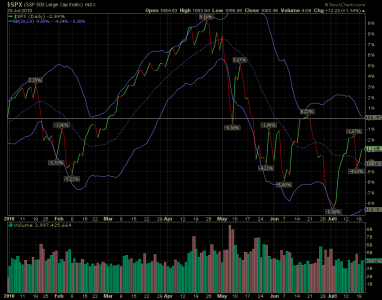

<o>Here is a YTD (Year to Date) Price Performance chart of the S&P 500, with a standard Bollinger Band. We are currently sitting at -2.84%, so if you jumped in now, the upside potential to the .10% top of the Bollinger Band is a gain of 2.94% Meanwhile the downside potential to the -8.58% bottom of the Bollinger band is a loss of -5.74%<o></o>

<o></o>

Using this method, I would determine there is too much risk for too little reward. Besides I'm still waiting for a higher high & low...<o></o>

Take care...Jason</o>