Epic

TSP Pro

- Reaction score

- 365

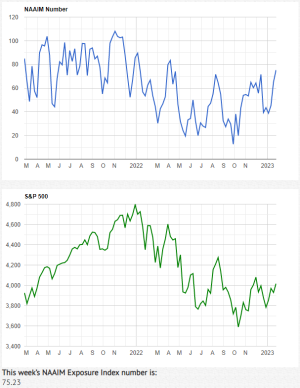

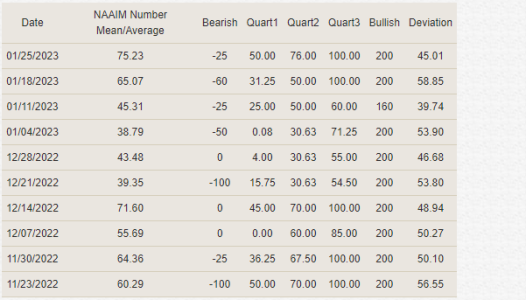

Hey thanks DBA. I know Flawlaw97 and Coolhand both cover NAAIM so I just post up the charts from the site when I can remember to (along with the source link / said for legal purposes.... LOL). I like the eye candy visuals.

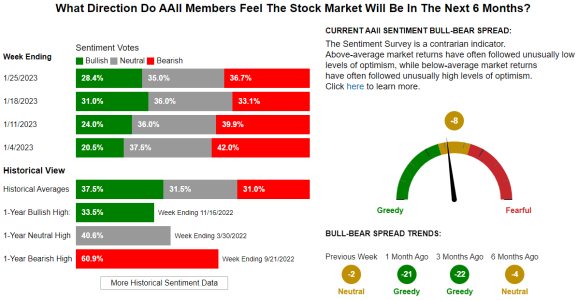

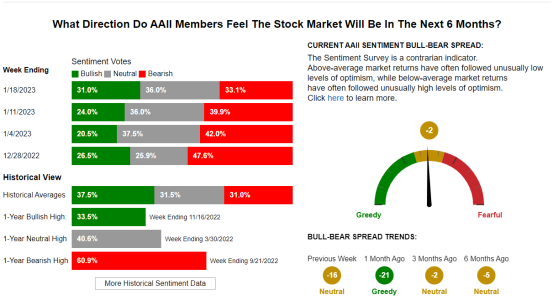

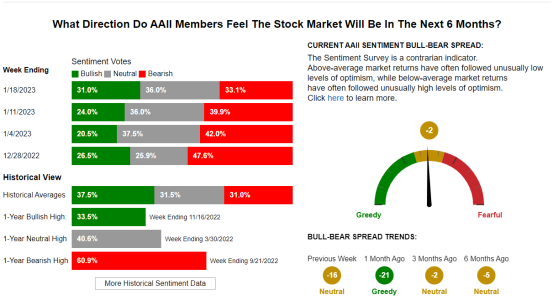

Speaking of which....... I tried to post this yesterday as well, but the AAII site mistook me for a Bot. I tried a few times, but no luck. That's never happened. :dunno:

It's fine today though, so ...........

https://www.aaii.com/sentimentsurvey

..

Speaking of which....... I tried to post this yesterday as well, but the AAII site mistook me for a Bot. I tried a few times, but no luck. That's never happened. :dunno:

It's fine today though, so ...........

https://www.aaii.com/sentimentsurvey

..