Epic

TSP Pro

- Reaction score

- 365

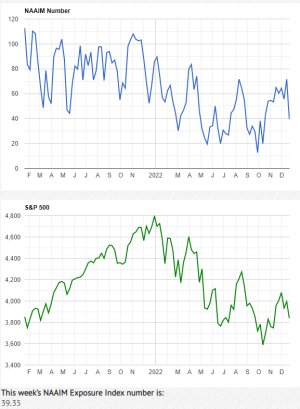

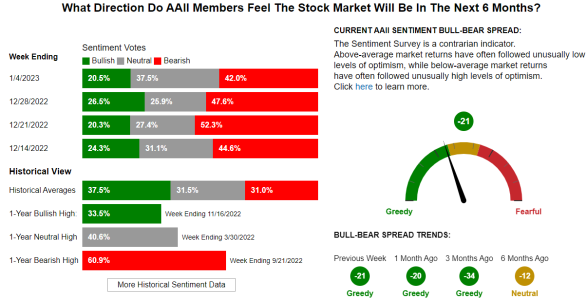

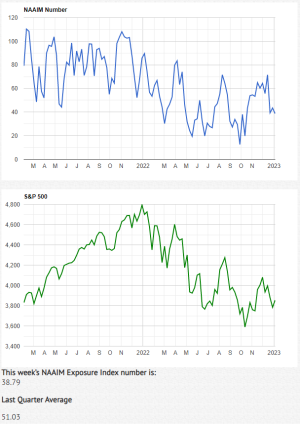

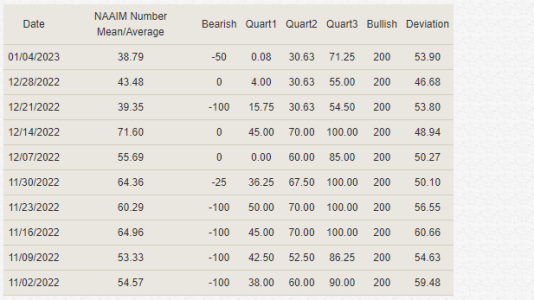

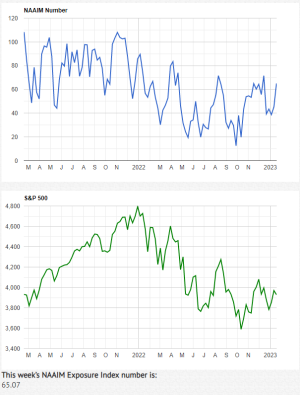

DBA was commenting in her thread that Eddie Ghabour believes market will sell of another 20%*from his point during next several months.

I like to look at Trading View ES1 "Ideas" https://www.tradingview.com/symbols/CME_MINI-ES1!/ideas/ where others have also shared this opinion to one degree or another. I saw a few weeks ago where someone said -30%.

The link below is by far the longest look ahead and the greatest decline prediction that I've seen so far. It's an interesting (less than 2 minute) read with chart that expands.

"The above chart represents within the next 3-6 years PLANET EARTH COULD LOSE HALF ITS GLOBAL NET WORTH...OR MORE."

HERE >>>>> https://www.tradingview.com/chart/ES1!/z3TENZoq-How-is-a-forecast-a-forecast-and-not-a-guess/

...

I like to look at Trading View ES1 "Ideas" https://www.tradingview.com/symbols/CME_MINI-ES1!/ideas/ where others have also shared this opinion to one degree or another. I saw a few weeks ago where someone said -30%.

The link below is by far the longest look ahead and the greatest decline prediction that I've seen so far. It's an interesting (less than 2 minute) read with chart that expands.

"The above chart represents within the next 3-6 years PLANET EARTH COULD LOSE HALF ITS GLOBAL NET WORTH...OR MORE."

HERE >>>>> https://www.tradingview.com/chart/ES1!/z3TENZoq-How-is-a-forecast-a-forecast-and-not-a-guess/

...